Taps Coogan – June 19th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

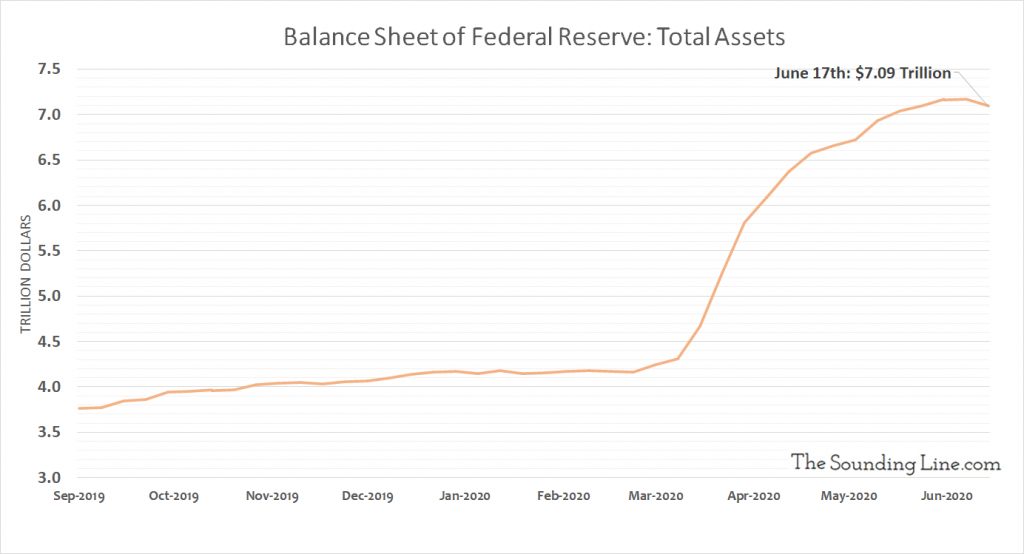

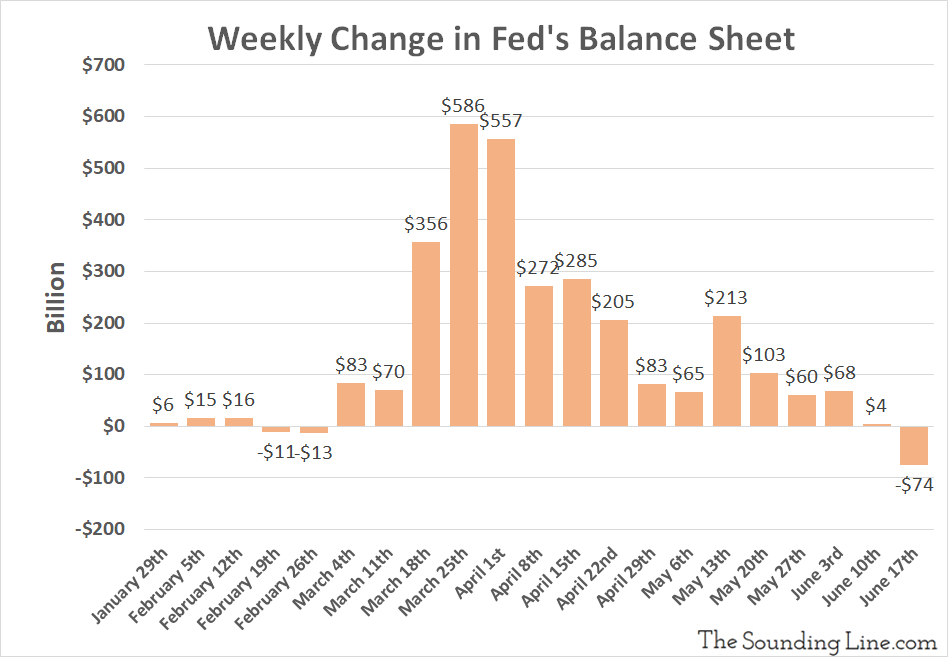

Over the past seven days (ending Wednesday the 17th), the Fed’s balance sheet contracted by a surprisingly large $74 billion, the first such contraction since late February when its Covid stimulus started kicking in. Accordingly, the Fed’s balance sheet has dipped slightly below $7.1 trillion.

The shrinkage in the Fed’s balance sheet has occurred despite ‘standard’ weekly increases in its largest holdings. Namely, the Fed bought an additional $18.9 billion of treasury securities and $83 billion of mortgage backed securities. It also made minor changes to its alphabet soup of special purpose vehicles, slightly reducing outstanding loan balances (-$3 billion) to the group that consists of: Primary Dealer Credit Facility, Money Market Mutual Fund Liquidity Facility, Paycheck Protection Program Liquidity Facility, and other credit extensions. Meanwhile, it slightly increased funding (+$1.5 billion) to the Corporate Credit Facility, which has made headlines for buying corporate bonds.

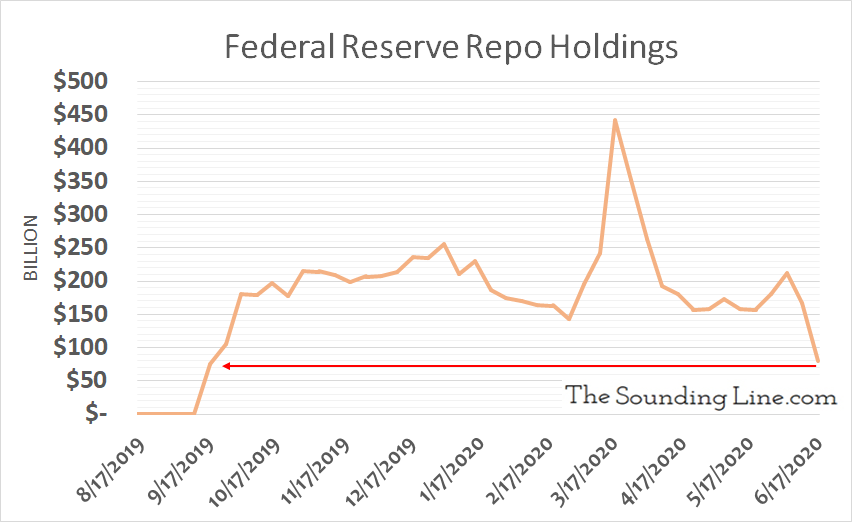

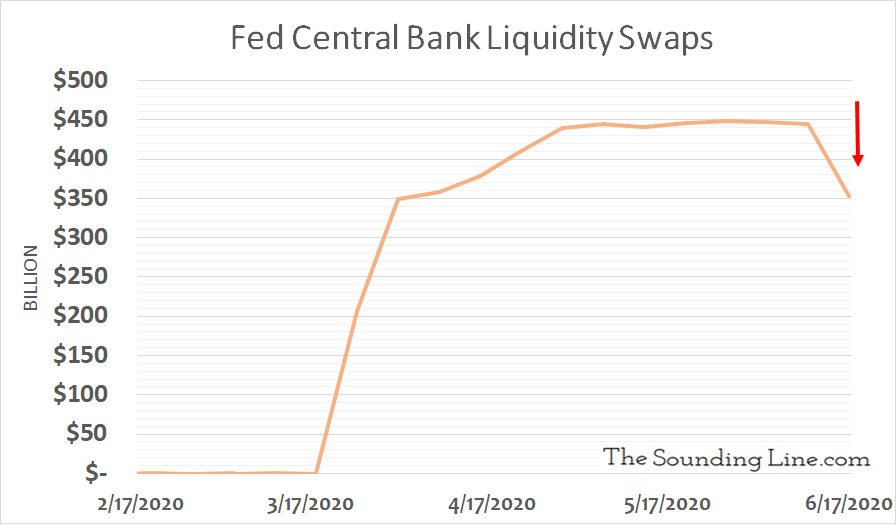

So, despite purchasing/loaning roughly $100 billion of the aforementioned assets, how did the Fed’s balance sheet end up shrinking for the week? The answer is that the Fed shed a whopping $88 billion of repos and $92 billion of central bank liquidity swaps.

The Fed’s repo holdings are now the smallest since the ‘Repo Crisis’ started in mid-September 2019.

The Fed’s central bank liquidity swaps also shrunk for the first time since the Covid crisis started.

The shrinkage of the Fed’s balance sheet may continue for a while. However, this is unlikely to be the start of a major trend. Repos and liquidity swaps are increasingly unneeded as markets resume ‘normal functioning’ (if you can call it that) and bank excess reserves rocket higher due to the Fed’s treasury and mortgage backed security purchases. The assets that the Fed is shedding are the shortest term, most fickle assets on their balance sheet. Assuming markets continue to behave nicely, these assets will continue to dwindle, and soon enough the continued purchases of Treasuries and mortgage backed securities should restart growth in the Fed’s balance sheet.

If markets don’t behave nicely, everything on the Fed’s balance sheet will presumably surge again.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.