Taps Coogan – January 23rd, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

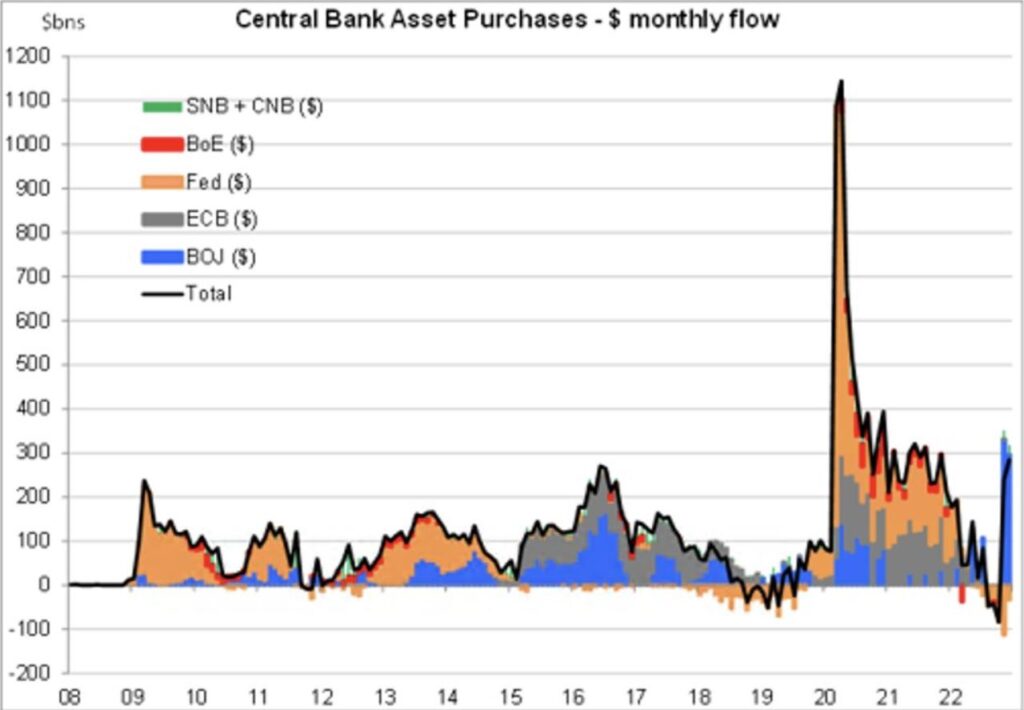

Rick Santelli once quipped, back when he was allowed to speak his mind, that all stimulus is fungible. It’s what we like to call Santelli’s Law: what matters is not how much QE or QT one central bank is doing but the net flow from all of them.

Along those lines, the following chart from Wellington Management’s Trevor Noren shows that, thanks to the Bank of Japan’s (BoJ) quixotic attempts to maintain yield curve control, the world’s major central banks are doing what would have been a record amount of net QE prior to Covid.

While the BoJ had allowed its balance sheet to shrink at the end of last year by slashing its holdings of Covid related loans, it has gone on a truly massive buying spree this year in order to defend its yield curve control program. Within that context, it becomes less surprising that markets have found their footing. Indeed, while the BoJ’s stimulus may exacerbate Japan’s still rising inflation, it is effectively offsetting the Fed’s crusade to see how tight they can get policy before causing a recession.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

When a central bank allows its government to overspend and abuse its currency, something has to give. This is one of the unwritten laws of fiat currencies. When the value of a currency falls, a country and its central bank cannot save both its currency and its bonds. https://brucewilds.blogspot.com/2023/01/a-country-cant-save-both-its-currency.html

I really like this post. It explains alot. You can bet that untold numbers of institutional and bank trading desks around the world are likely borrowing Japanese Yen at the 0.5% rate and then buying government bonds in the US at 4.6%, pocketing a very, very hefty profit in a “carry trade.” This carry trade is also helping to manipulate the price of US bonds higher and interest rates are falling—outside of the shortest rates. US rates are essentially being manipulated lower. JPow might not like that “easing of financial conditions.” We’re seeing rampant speculation re-appear in various markets and… Read more »

For what little it’s worth, I dont think that people borrowing in Yen so that they can buy USD denominated assets should be dollar bearish and yen bullish. You are creating yen units while increasing demand for USD.

yes, I admit that I dont get it. The yen is strengthening. but only from a depressed level. The USD doesn’t look so good for the moment.