Taps Coogan – June 16th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

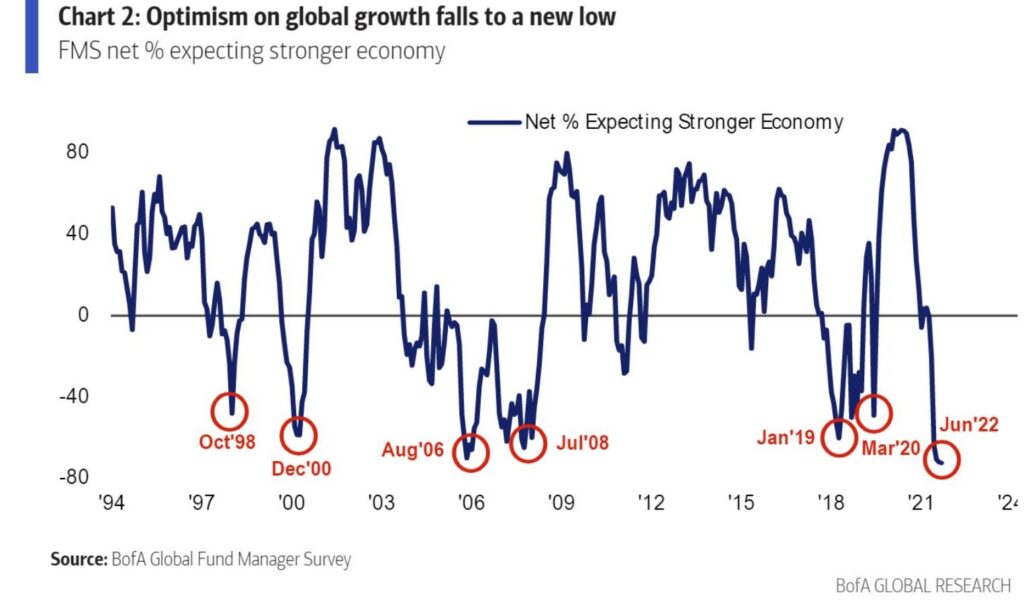

The following chart, from Bank of America via Top Down Charts’ Callum Thomas, shows that fund managers are the most bearish on global growth that they’ve been since at least 1994 and even more bearish than a couple months ago.

To put this in perspective, more fund managers are now bearish on the global growth outlook than they were during the Covid lockdowns, the Global Financial Crisis (GFC), the eve of the GFC, the eve of the Dot-Com Bubble, or the LTCM blowup in 1998.

As we noted last time we pointed out an earlier version of this chart, lest one be too quick to interpret this as a contrarian bullish indicator, the prior low was in August 2006, a year before the GFC started to hit, and the low during the GFC came before the Lehman collapse.

Nonetheless, a global recession is starting looking like a consensus view.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.