Submitted by Taps Coogan on the 28th of February 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

In ‘The Velocity of Money – A Cautionary Tale’ (link here), we looked at the velocity of money as an important indication of the health of the U.S. economy. In a similar way, the robustness of global trade can help us understand the health of the global economy.

What is global trade telling us about the health of the global economy?

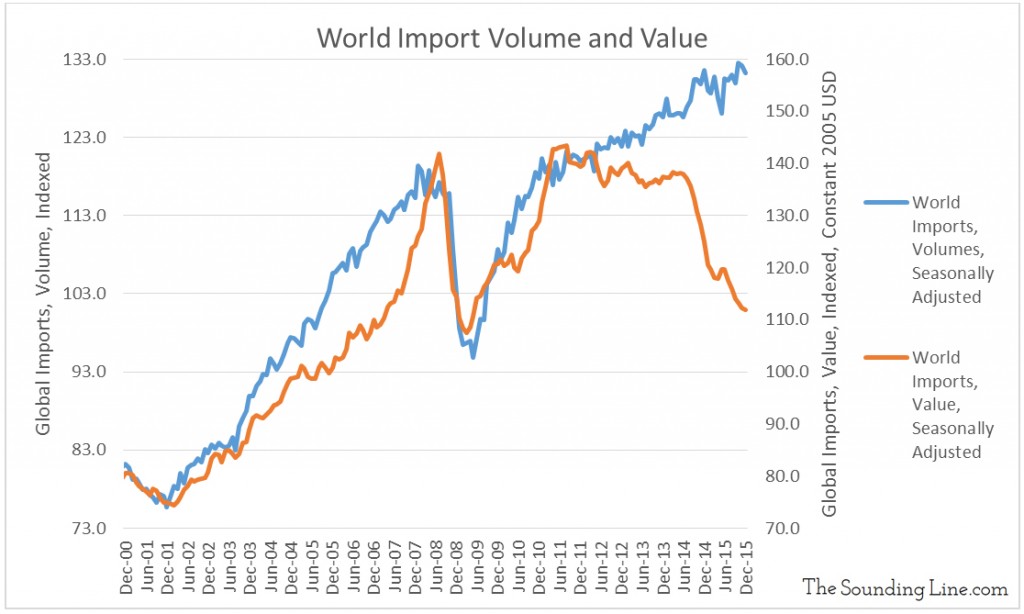

As the chart below shows, while the volume of global imports is still building, albeit at a moderated pace, the value of these imports has declined precipitously.

This raises an important question. Why haven’t trade volumes declined with trade values as they did in 2008?

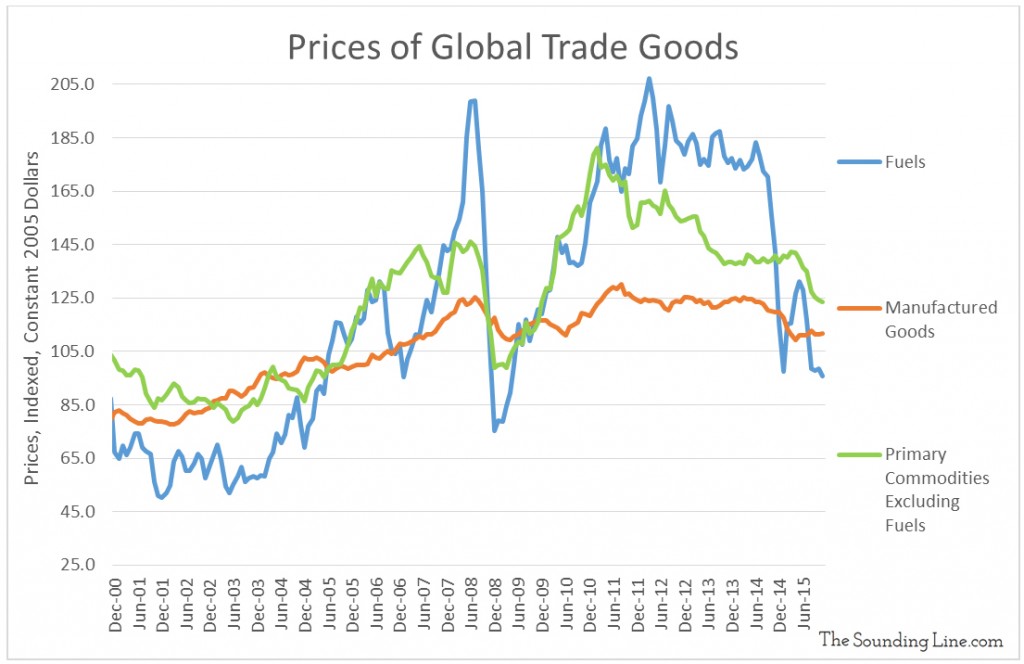

One possible explanation of this widening divergence between trade volumes and trade values is that it is a result of declining oil prices. The chart below shows the indexed trade prices of manufactured goods, fuels, and primary commodities. We can see that the decline in fuel prices is likely the largest contributor to the recent dramatic decline in trade values. However, the prices of manufactured goods and primary commodities, excluding fuel, have been declining since 2011, years before oil prices started declining. Thus the divergence between trade value and volume, which has also been building since 2011, is a result of more than just the recent decline in oil prices.

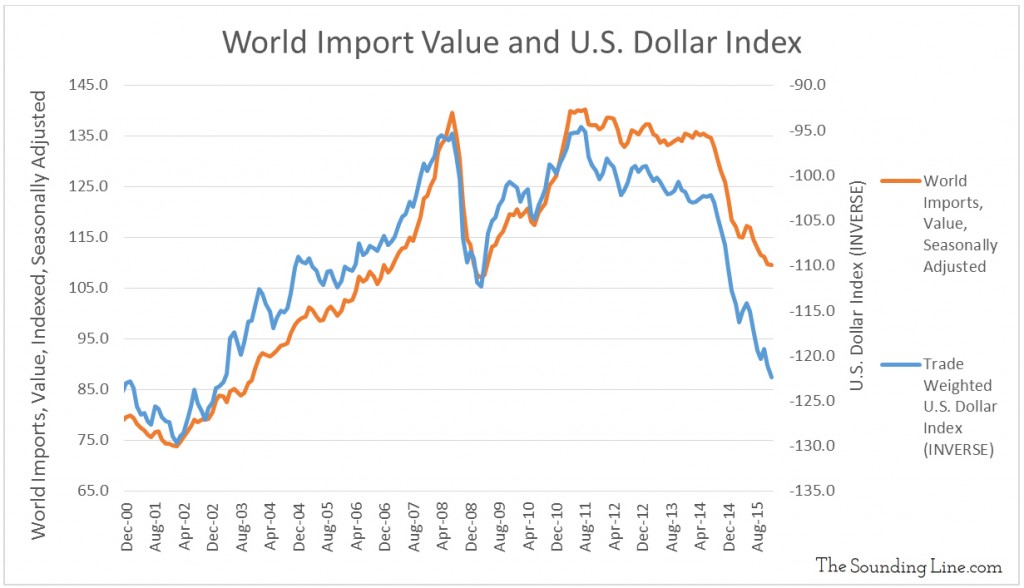

Another possibility is that the decline in the ‘value’ of traded goods is really only a decline in the price of traded goods as measured by the strength of the dollar against other currencies. Much like we explained in ‘Oil Prices and Dollar Strength’ (link here), if the value of the dollar increases, all other things being constant, you can buy more with the same number of dollars and thus prices decrease.

Perhaps the reason for the divergence between trade values and trade volumes is that the dollar has strengthened against nearly all other currencies. This has resulted in prices declining, as reported in USD. The absence of an acute rapidly progressing global recession like in 2008, and lower prices for American consumers has so far enabled continued consumption.

We can see from the chart below that global trade ‘value’ is closely correlated to the strength of the USD compared to a broad spectrum of other currencies.

Three important observations can be made from these findings:

- For export driven economies, allowing the devaluation of their currencies may help them capture export market share. However, the overall effect is to fight over pieces of a rapidly shrinking pie.

- How much longer will global trade be able to maintain its current volume if prices continue to decline? Certainly investment in new capacity will suffer, and at some point, production itself will become uneconomical. Declining volume of trade will be much more damaging to employment and investment than just declining value of trade.

- If this divergence is in fact being driven by the surge in the U.S. dollar’s strength, and if that surging strength is primarily a result of the Federal Reserve signaling tightening monetary policy, how sustainable is that Fed policy? This question becomes paramount as a continuation of Fed tightening could have serious negative side effects for the global economy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

[…] the international trade data that we analyzed in ‘Global Trade – Value vs. Volume’ (link here), also monitors global industrial production. They define industrial production as the value added […]