Taps Coogan – February 16th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

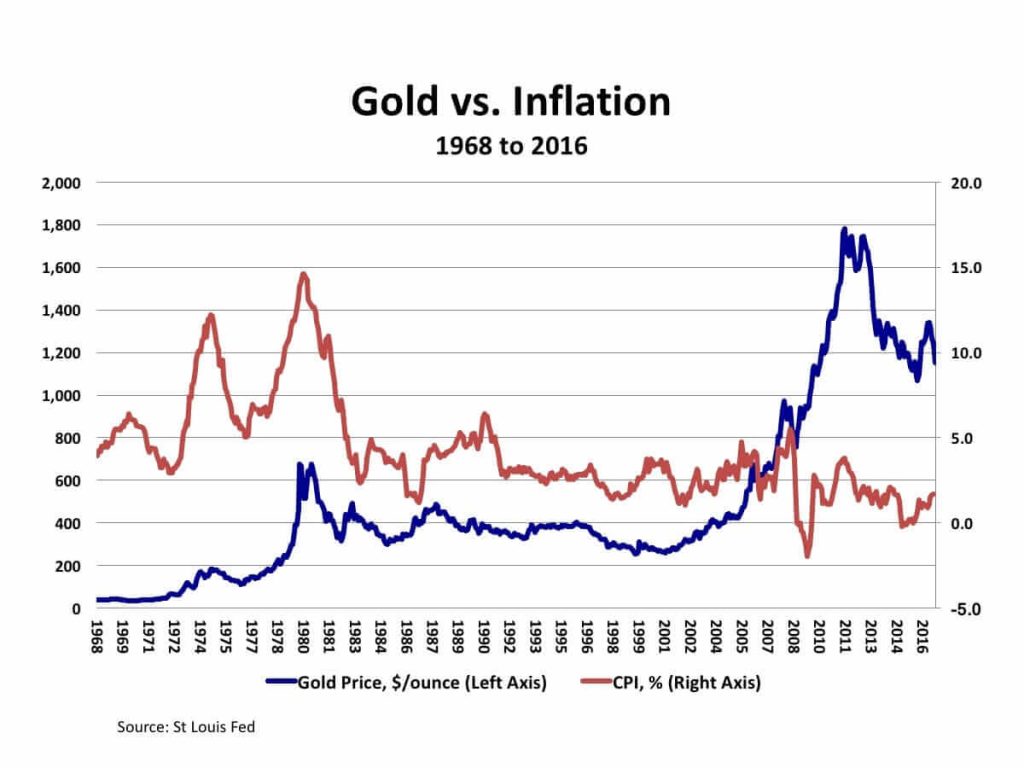

Despite popular narratives, Gold is not very well correlated to inflation.

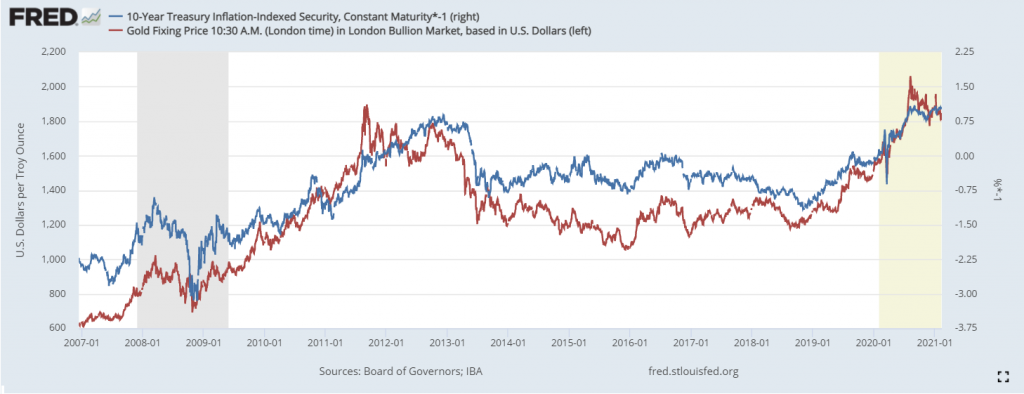

On the other hand, since 2007, gold has been strongly correlated to inflation adjusted long-term rates such as the 10-Year TIPS. The correlation was weaker before 2007, a reminder that gold’s correlations are always transient.

Gold vs the 10-Year TIPS (Inverse)

To the extent that the above relationship above holds up, more inflation is not necessarily bullish for gold. What would be bullish for gold is if the gap between long term yields and inflation expectations widens (inflation breakevens to be precise).

For the last six months, both long term yields and inflation expectations have risen in rough unison. Hence, the 10-Year TIPS has been holding steady at around –1% for six months and gold has been treading water.

As we’ve noted before, the Fed isn’t doing anywhere near enough QE to keep nominal long term yields flat. While still historically low, the yield on the 10-Year has doubled since August.

People often say that the Fed doesn’t control the long end of the treasury curve. That is true in the sense that they don’t have an explicit fix like they do for overnight rates.

Practically however, the Fed is the largest treasury holder and buyer in the world by a country mile. More than half of its $7.4 trillion balance sheet is comprised of Treasury securities and just the Fed’s treasury holdings with a maturity of over ten years exceed China’s entire treasury portfolio. The Fed may not fix the long end of the treasury curve but they are the single largest influencer of it, by far.

So that begs the question, is the rise in long term rates since last August an oversight on the part of the Fed or does it have their benediction?

The bull case for gold is that the Fed will get uncomfortable with further increases in long term yields and begin to cap them as inflation keeps rising, pushing real yields even more negative. That will take much more QE from the Fed, perhaps an implausibly large amount.

The bear case for gold is that the Fed realizes how wildly reckless ever deeper negative real yields and accelerating QE would be in the face of rising inflation, so they pivot to fixing negative real yields at some level near here. Of course, holding the line on such a policy would take intestinal fortitude once markets realized that it meant rising nominal yields. In other words, it would be completely out of character for this Fed.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.