Taps Coogan – January 14th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

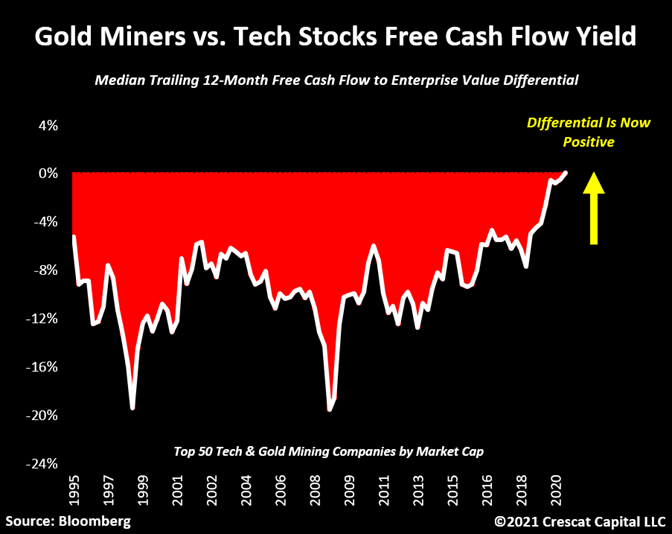

According to Crescat Capital’s most recent letter to investors, gold mining shares are now trading with a favorable free cash flow yield versus the top 50 tech companies for the first time in at least 25 years. They define free cash flow (FCF) yield as the ratio of the trailing 12-months of FCF to enterprise value.

While it’s not clear what basket of mining stocks they are using for the comparison, it points to the intersection of a couple of interesting trends. The market cap of money-losing tech companies surged in 2020, eclipsing the Dot-Com bubble. Meanwhile, gold miners have seen FCF jump this year amid rising gold prices. They’ve used much of that cash to pay down debt, which factors favorably into the enterprise valuation calculation.

Given the prospect for trillions of dollars of additional stimulus, debt, and monetization in 2021, a lot of attention has been focused on gold and inflation. In reality, gold is not very well correlated to inflation. The stronger (inverse) correlation is to real yields.

While negative real rates seem to be the Fed’s objective, if the federal deficit ends up being dramatically bigger than expected this year, and the Fed doesn’t accelerate QE to match it, real long term rates could actually rise, which isn’t good news for gold or miners. However unlikely that sequence of events may seem, it is possible.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.