Submitted by Taps Coogan on the 11th of March 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Based on daily closing values, the gold-to-silver price ratio hit 98.7 during the market turmoil of Monday, March 9th, its highest level since March 1991 and nearly the highest level since the gold window was closed in 1971.

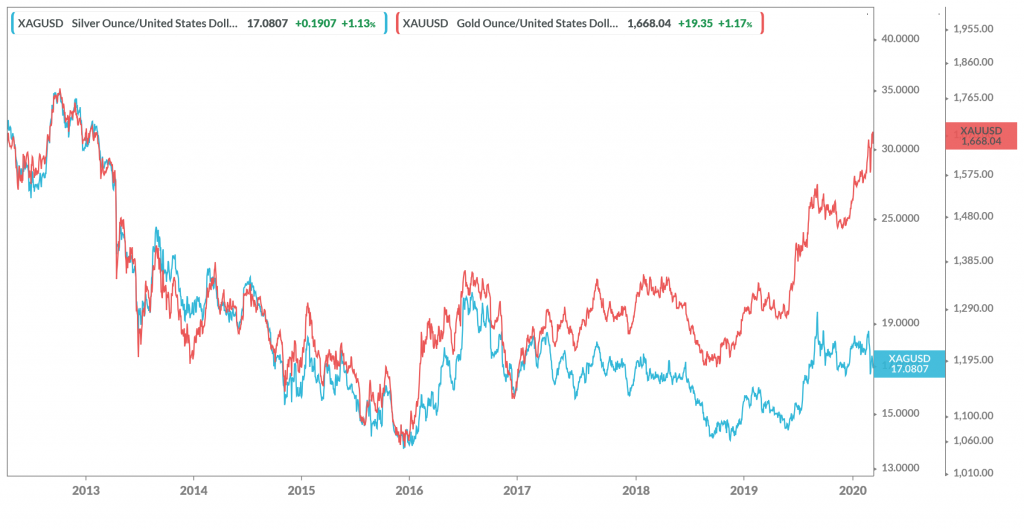

The widening divergence between gold and silver has occurred against the backdrop of a much stronger rise in gold than silver over the past year, opening up the largest differential between the two in nearly 30 years. Silver, which has more of an industrial demand profile, has under-performed gold as industrial production around the world as weakened and expectations of monetary stimulus have risen.

Gold and Silver Prices Since 2012

The gold-to-silver ratio also spiked during the 2008 Financial Crisis, peaking at 89 the during the week of October 12th, 2008. That turned out to be the height of the Financial Crisis, when the sharpest market declines were witnessed and when the US announced the bailouts of its four largest banks.

Today’s near record gold-to-silver ratio ratio is just one of a raft of financial metrics that have reached historic levels in recent days. As we recently discussed, the gold-to-oil ratio just hit a record high, long term treasury yields are at an all-time record low, and market volatility is at its highest level since the Global Financial Crisis.

With the Coronavirus outbreak still not showing any clear signs of slowing, it is conceivable that many of these metrics will become even more extreme, potentially risking structural damage to the financial system itself. However, whenever this fever eventually peaks, investors are likely to be staring at a raft of once in a lifetime divergences and distortions in markets.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.