Submitted by Taps Coogan on the 13th of March 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Despite constant claims that the U.S. is in the midst of an economic recovery, a number of stubborn facts fail to comply with this narrative. Principal among these is the continuing collapse in the rate of home ownership in the U.S.

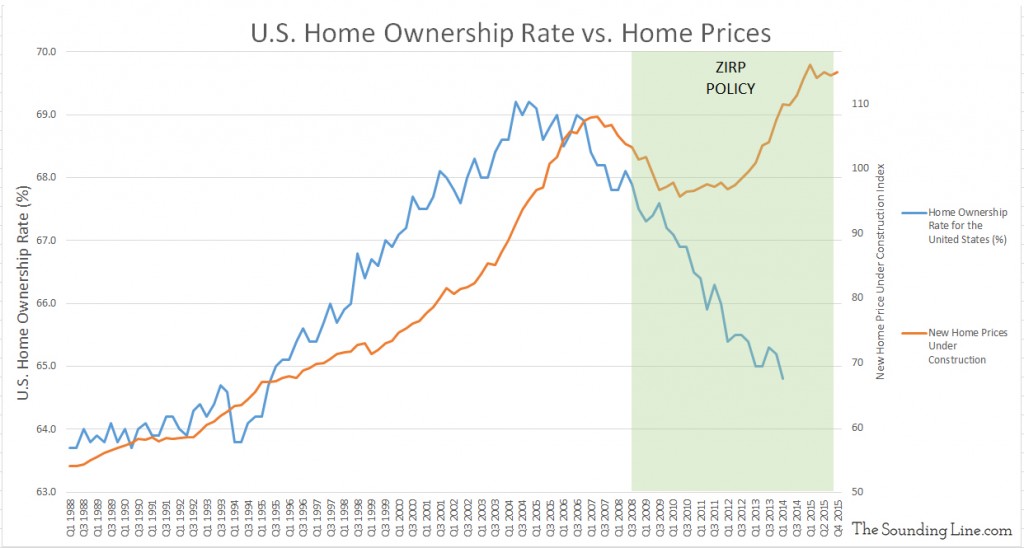

A corner-stone of the American dream, home ownership has been in decline since the housing market peaked in 2006. While seven years of zero interest rate policy (2008 through 2015) managed to raise home prices, it did nothing to reverse the precipitous decline of home ownership, as can be seen in the chart below.

This raises an important question:

Why did home prices climb while the rate of home ownership fell?

Three trends help us understand this phenomenon:

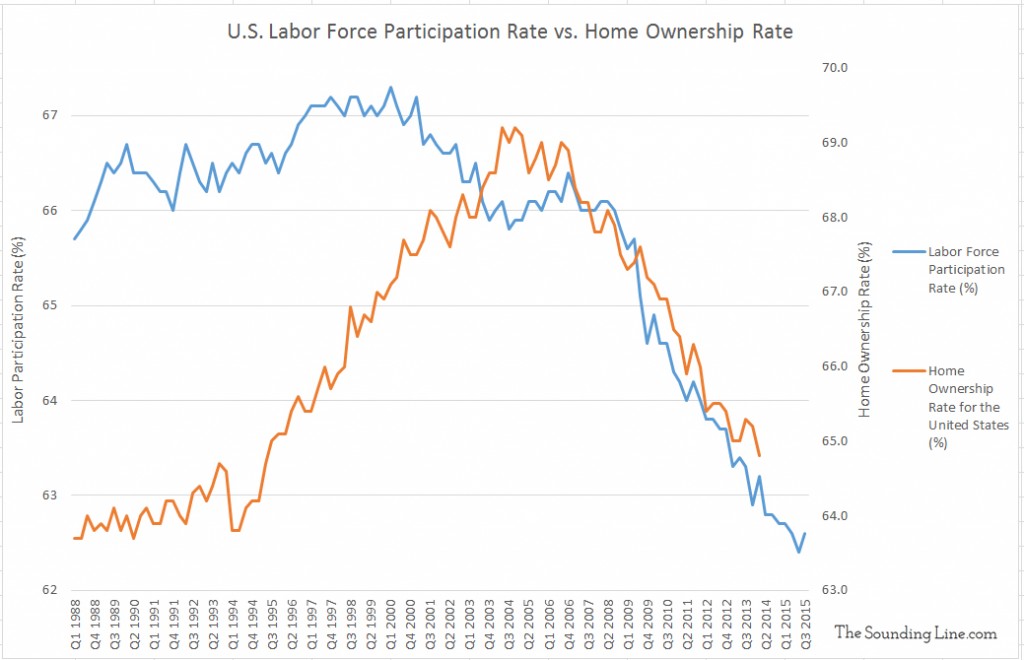

- Despite constant claims to the contrary, labor markets have not recovered from the 2008 recession. As described in detail here, the percentage of people in the labor force continues to decline and, critically, the percentage of people under 55 who are in the labor force remains in decline. The chart below shows that the downward trend home ownership has closely followed the downward trend in labor participation. With employment being a prerequisite to qualify for, and then afford, a mortgage for the overwhelming majority, the relationship between employment and home ownership should not come as a surprise.

Data Source: Labor Participation Rate – BLS; Home Ownership Rate – U.S. Census Bureau

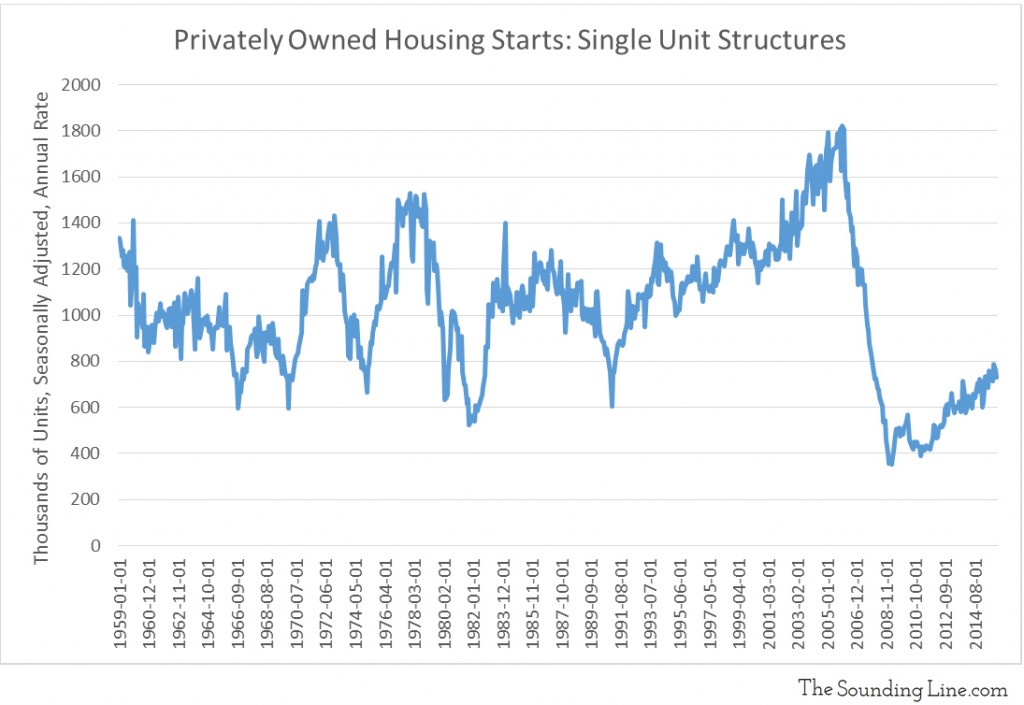

- With fewer people participating in the labor force and thus fewer people able to realize the dream of home ownership, it is natural that fewer homes are being built. The number of single family housing units being built is still far below the historic rate going back to 1959, as shown in the graph below.

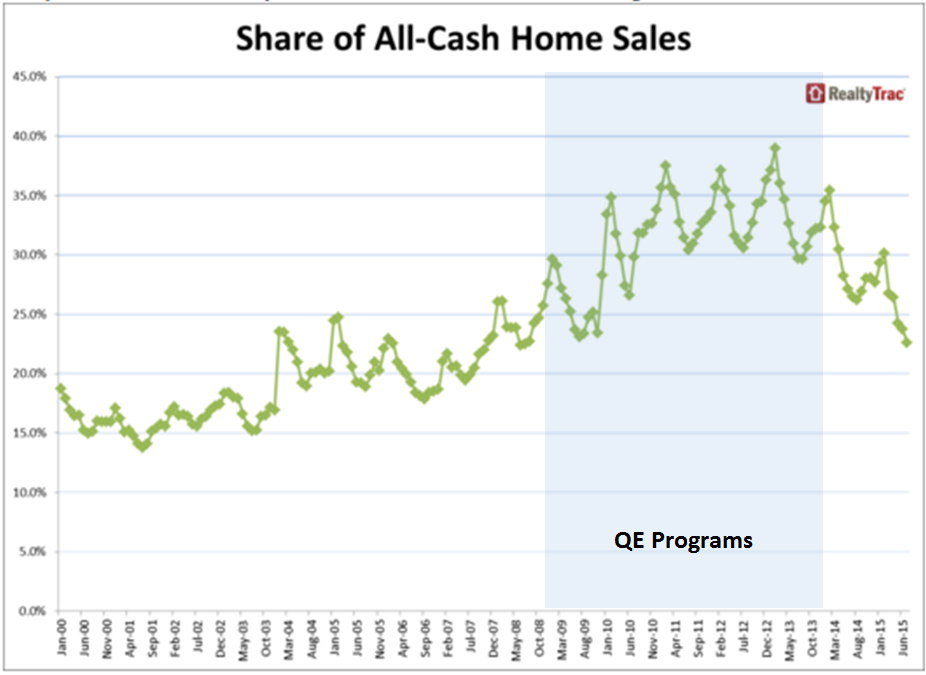

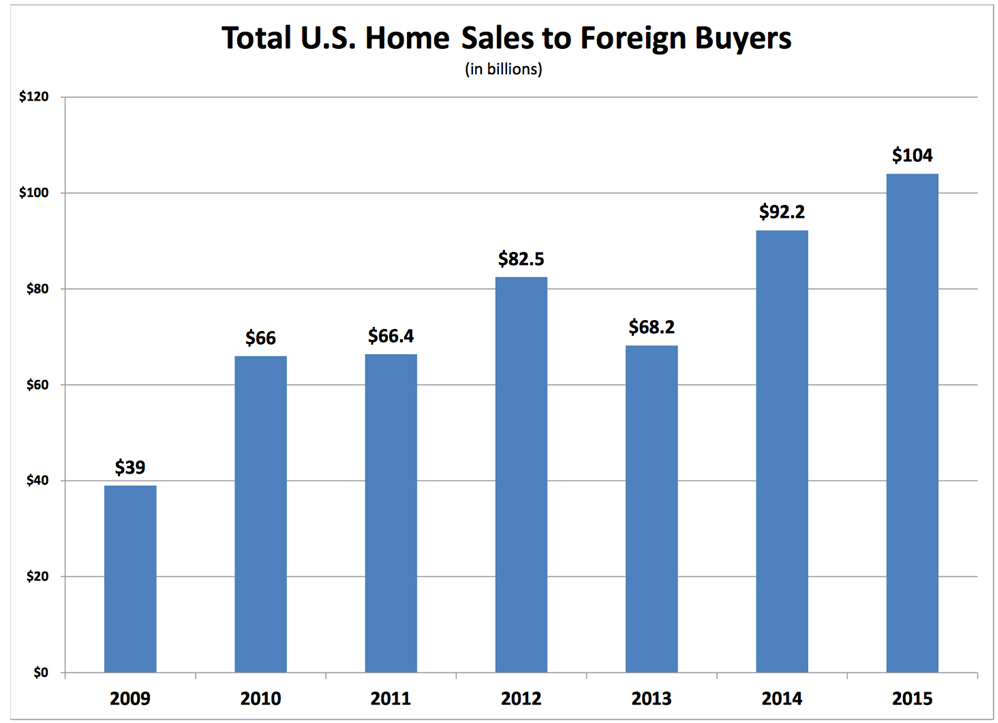

Data Source: Federal Reserve - With ever more Americans unable to afford home ownership, where has the demand come from to drive the prices of homes higher? As the charts below show, all-cash purchases of homes, made by investors and banks not individuals, accelerated during the period of quantitative easing (QE) from the Fed. Of equal importance, foreigners buying high end homes throughout the U.S. has nearly tripled since 2009.

Putting the three pieces together a clear explanation emerges. The Fed’s zero interest-rate policy and QE programs enabled investors and banks to purchase more and more of a dwindling supply of homes which has driven up prices. As the Fed’s programs did nothing to reverse the decline in employment or the welfare of average Americans, but did drive up home prices, home ownership, and the numerous benefits it provides to families, has slipped farther out of reach for millions of Americans.

For the investors who have participated in the housing market ‘recovery’, caution is warranted as the Fed attempts to unwind its extremely accommodative policies. With labor participation still falling, it seems highly unlikely that American families will be able to step into the breach and make up for the artificial demand which is now in jeopardy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

… [Trackback]

[…] Find More Informations here: thesoundingline.com/home-ownership-and-home-prices-the-concerning-disconnect/ […]

… [Trackback]

[…] Informations on that Topic: thesoundingline.com/home-ownership-and-home-prices-the-concerning-disconnect/ […]

… [Trackback]

[…] Informations on that Topic: thesoundingline.com/home-ownership-and-home-prices-the-concerning-disconnect/ […]

… [Trackback]

[…] Find More here|Find More|Read More Informations here|Here you can find 28682 more Informations|Informations to that Topic: thesoundingline.com/home-ownership-and-home-prices-the-concerning-disconnect/ […]