Taps Coogan – September 16th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

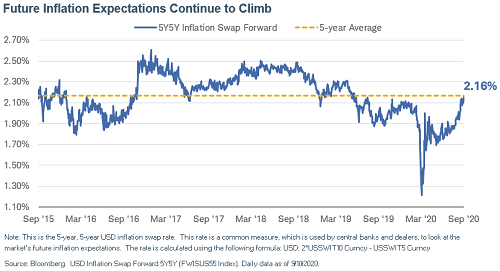

In another indication that the Federal Reserve may be on track to get more than it is bargaining for as it pins interest rates at zero and prints endless amounts of money, the market implied expectation for future inflation has already jumped above 2% and above the pre-Covid level.

With markets already anticipating that inflation will exceed the Fed’s old 2% inflation target, the Fed has already moved the goal post to ‘average 2% inflation’ with the implication being that they will allow inflation to run above 2% for some considerable time to make up for past shortfalls before they would raise rates.

Where Are the Bond Vigilantes?

Just as it promises to hold rates near zero for ‘years,’ the Fed has also signaled a strong unwillingness to lower rates below zero. That means that bond holders are now looking at problems on all fronts. Interest income is extremely low, interest rates can only fall slightly further if the Fed is unwilling to go negative (limiting the capital gains opportunity of falling rates), and future inflation expectations are rising. It is a lose, lose, lose and it appears that major institutional bond holders are finally starting to get wise. The final coup de grâce is that the more bond investors back away from the market, the more the Fed will have to print to keep interest rates pinned near zero, and, presumably, the faster inflation expectations will rise.

If you are wondering who the proverbial ‘bag-holder’ will be at the end of this long period of extreme fiscal and monetary excess, it is looking like the ‘bond investors’ who lent money for years for next to nothing in an environment with rampant money printing are it. Paradoxically, the better the economic outlook gets, the worse it will likely be for those bond holders. Consciously or not, they have made the bet that we will stay in a quasi recession for years with rates at zero and no inflation.

One last thing to remember, the largest holders of those very low interest rate bonds are governments themselves, entitlement programs like social security, pension funds, sovereign wealth funds, insurance companies and banks. In other words, one way or another, you the taxpayer are the real bag-holder.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Many people seem to have forgotten after their nearly four-decade run that bonds have a very ugly side that can yield great pain. The yield curve inverted last week moving many investors to start the countdown to the next recession and causing bond yields to fall as more money shifted in their direction seeking shelter from what investors feel may be a coming storm. Today’s lower yields may be part of a greater conundrum created by the reality of too much freshly printed money floating around and people needing someplace to stash it. The article below delves into why interest… Read more »