Taps Coogan – August 4th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Back in May, when the consensus was saying that we were unlikely to get a recession before 2023, we wrote a couple articles in which we argued that the rapidity of the market decline, combined with other factors, implied a recession or recession-scare was coming much sooner, probably by summer.

At the time, that was a contrarian view. Today, it is not.

The technically accepted definition of a recession has long been: two consecutive quarters of declining real GDP. The initial second quarter real GDP estimate was solidly negative and followed a negative reading in the first quarter. Technically speaking, we are in a recession.

Of course, the technical definition of a recession is just as arbitrary as saying a bear market is a 15% decline. Many 15% declines don’t practically represent bear markets.

The ‘official’ designation of recession in the US is determined by the quasi-governmental National Bureau of Economic Research (NBER). NBER makes a ‘holistic assessment’ of the economy to determine the ‘official’ start and end dates to recessions. Outsourcing the designation of recessions to a small collection of ‘non-partisan’ economists using nebulous rules is just as arbitrary, and much more opaque, as using two quarters of real GDP.

So, technically we are in a recession, but officially we are not.

Practically speaking, are we in a recession?

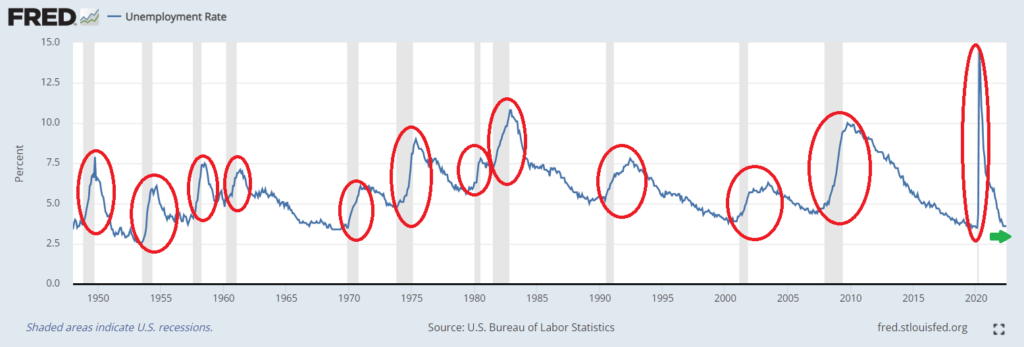

If I hand you a chart of the unemployment rate, you can easily find every recession since World War II without the need for the NBER or GDP figures. You won’t find the current ‘recession.’

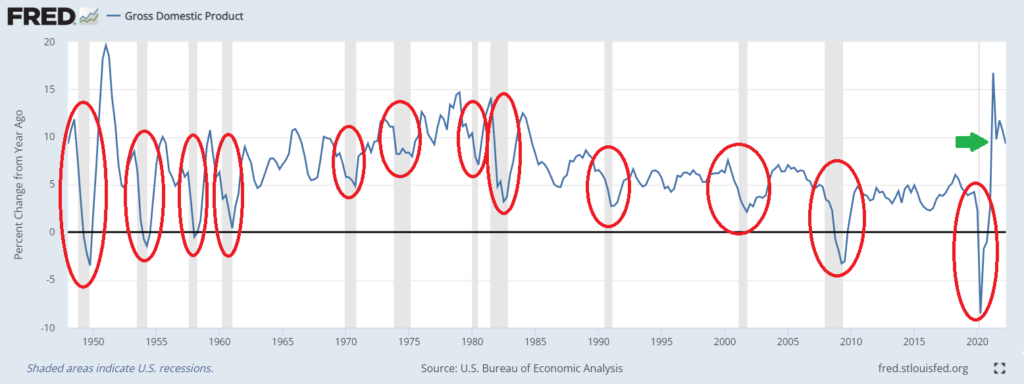

The same goes for nominal GDP:

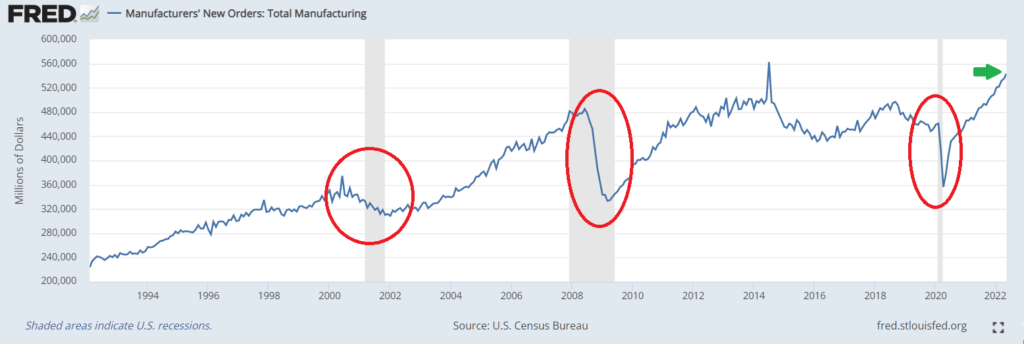

…and manufacturing orders:

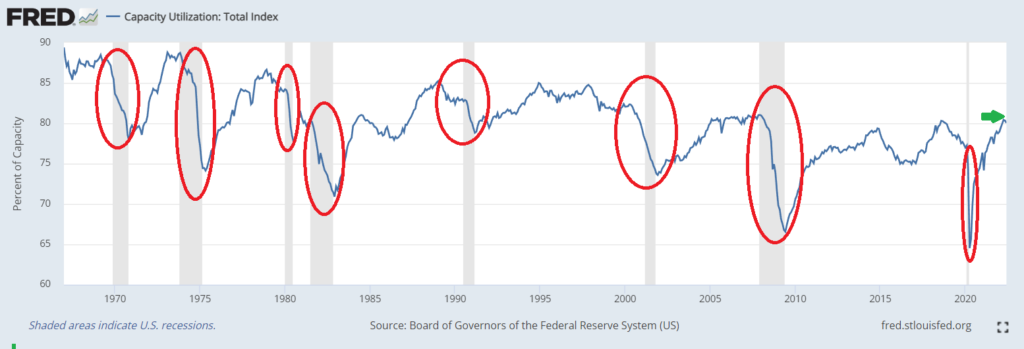

…and capacity utilization:

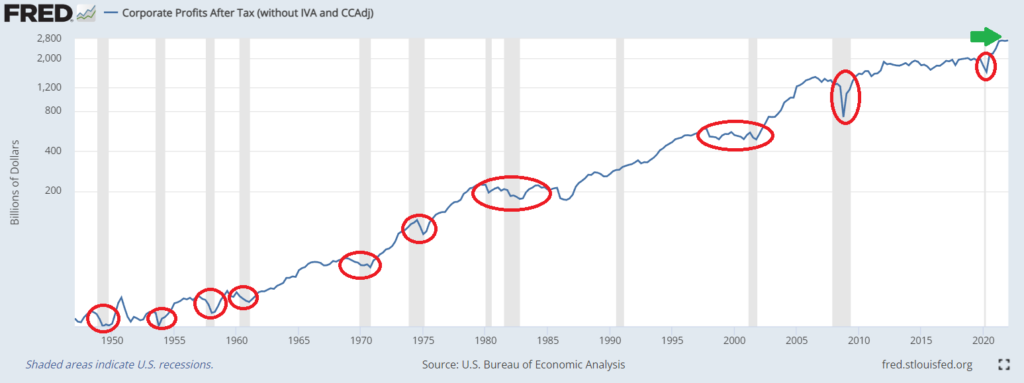

…and corporate earnings:

The same goes for ‘real’ consumer spending, hiring, and many other factors.

Consumers and businesses may be fearing a recession, but they’re not behaving like we are in one yet.

Given the extreme excesses in the economy last year (real year-over-year GDP hit 12% a year ago), let’s not act too surprised that it is now slowing. Many of the factors above, like the labor market or corporate earnings, are going to deteriorate relative to last year. There is room for most of them to deteriorate before they reach particularly terrible levels.

There is not a single example since at least World War II when two consecutive quarters of declining real GDP did not end up being part of an official recession. The odds are high that this period will be retroactively declared a recession when lagging factors like the labor or capacity ulatization shown above start to deteriorate.

While the designation of recession has important social and political implications, it probably doesn’t have much relevance to investors at this point. The current rally not withstanding, we’ve been in a bear market all year. A recession is no longer a contrarian forecast and the market has arguably priced in a mild recession.

What matters is not if we are in a recession, but how severe this recession will be.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

My argument has been the models are undervaluing the inflation. Not the ShadowStats argument, but that they will revise their own models. People are still confusing inflation for demand, as are the models. I expect we’ll get deflation very quickly, maybe negative monthly CPI by October and then all these data sets will start cratering rapidly as the “demand” evaporates along with the inflation.

Directionally I agree though on the severity question I lean towards mild. There is just so much room for year-over-year declines that look scary but bring us to absolute levels that aren’t that bad in the grand scheme of recessions. Main risk is over tightening and China slowdown imo.