Submitted by Taps Coogan on the 29th of May 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

We have discussed the weak economic conditions and high debt levels in Italy on numerous occasions here at The Sounding Line. Italy has experienced the 5th slowest economic growth since 2000 among a list of 181 countries around the world and has not seen net new job creation for a decade. Meanwhile, its national debt has surged from 102% of GDP in 2008 to over 132% today.

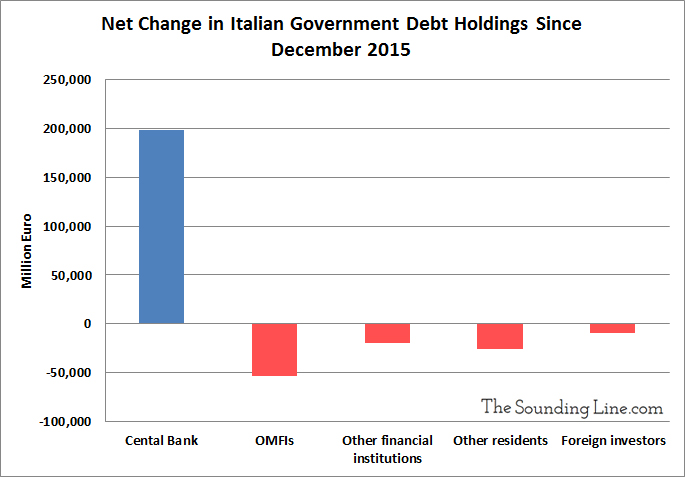

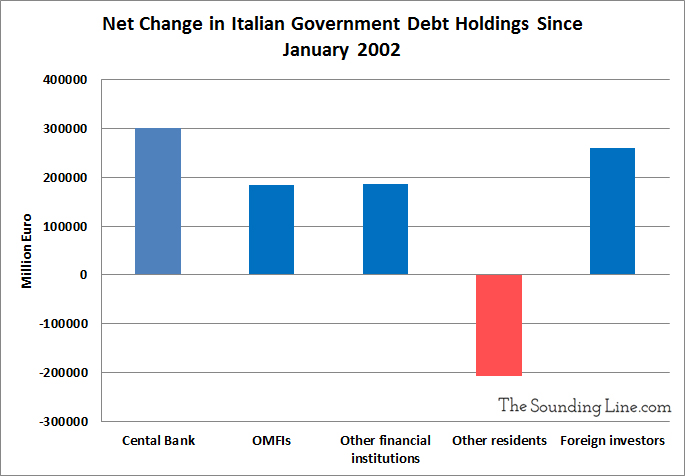

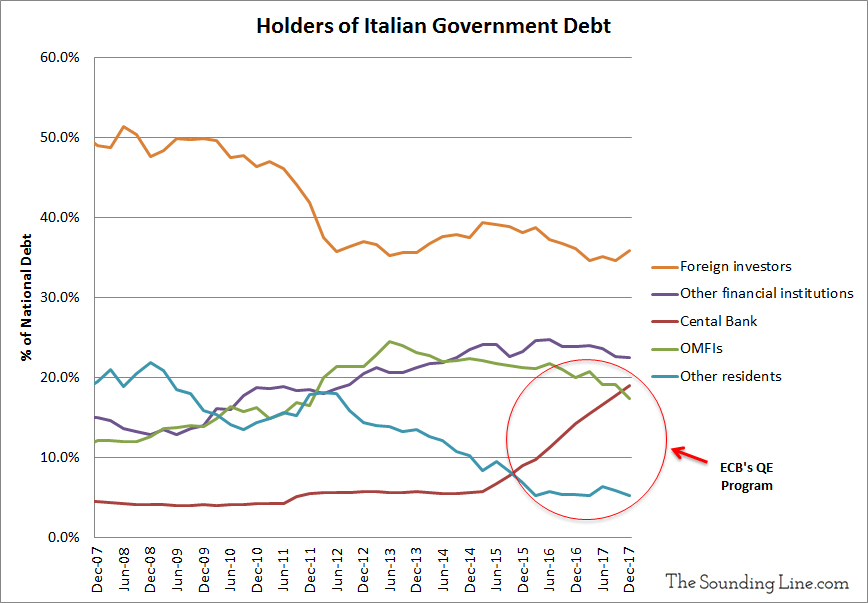

Despite Italy’s increasing indebtedness and weak economic fundamentals, interest rates on Italian government bonds have remained remarkably low, until very recently, as a result of the ECB’s continuing QE program. As the following charts show, since the end of 2015, the Italian Central Bank (part of the ECB’s Eurosystem) has been the only net buyer of Italian debt. It has bought an amount of Italian debt greater than 100% of all Italian debt issued since the end of 2015. In fact, the Italian central bank is now the largest net buyer of Italian government debt since the Euro was implemented in January 2002.

The ECB has long insisted that it will end its QE program by the end of this year. However, the private sector has been unwilling to lend to Italy at ultra-low interest rates. Considering that the newly elected Italian government plans to dramatically increase deficit spending, investors are doubly unlikely to start lending to the Italian government at ultra-low rates just as the ECB stops propping up the Italian bond market. In fact, investors are already dumping Italian bonds, interest rates are spiking, and fear of another debt crisis is rising.

Given Italy’s already very high debt levels, even a modest increase in borrowing costs could reach havoc on the country’s finances and end its almost non-existent economic recovery. Unless the ECB is willing to allow for an uncontrolled debt crisis in Italy, it is very hard to imagine them ending their QE program anytime soon.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Excellent article that deserves a large audience. This is the core of central banking in the EU – bailout and rule over all the member countries. Italy is our last parlamentary chance to break up the ECB and the euro – if not – we are enslaved and death will not be scary anymore.