Taps Coogan – November 6th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

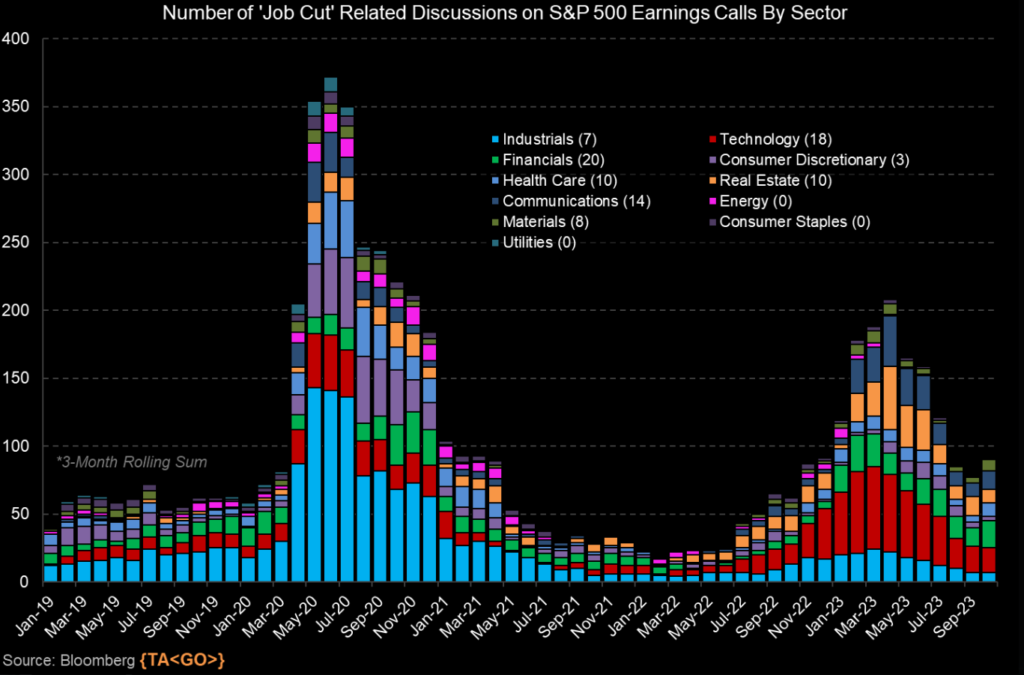

The following chart, via Bloomberg’s Michael McDonough, highlights the number of mentions of ‘job cuts’ on S&P 500 earnings calls:

An analysis of S&P 500 earnings calls reveals the number of discussions related to 'job cuts' across different sectors. Financials and Technology are leading the conversations: {TA<Go>} pic.twitter.com/VLWcZTvTSs

— Michael McDonough (@M_McDonough) November 6, 2023

The punchline is that, while ‘job cut’ talk is up since last quarter thanks largely to financials and materials, the overall trend has been improving since the second quarter of this year with big improvements seen in the tech sector.

Labor stats are lagging, so one should really never make forward looking statements based off of them. What we can say though is that things having been trending relatively well.

P.S. – The lack of articles and updates over the last couple weeks was for personal reasons (all good news). I’ll be trying to slowly scale back up but the pace is going to be slow for a while. My apologies.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The downturn starts in earnest 11 months AFTER the last rate cut so it looks like most of 2024 will hang on but I don’t see how this ends any differently than 2000 and 20007.

(all good news)

Here’s hoping you won the lottery ~!~

“The downturn starts in earnest 11 months AFTER” Indeed. People forgot just how long these things tend to take.

No lottery, no. But if I did win the lotto I’d keep doing the site