Submitted by Taps Coogan on the 5th of May 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

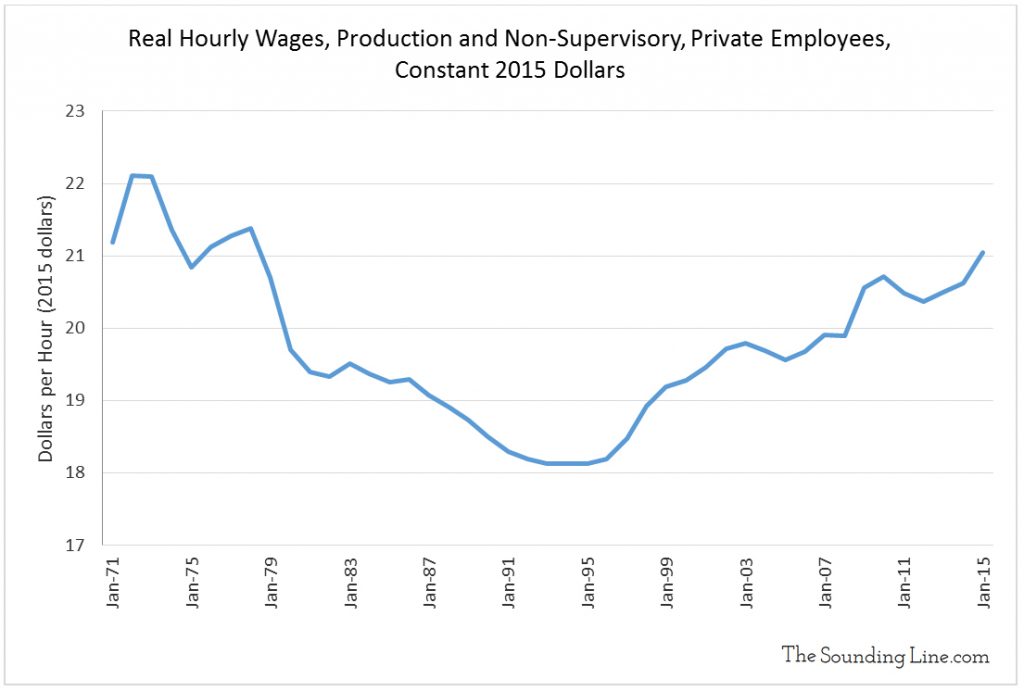

For many, the thought of inflation evokes the idea of a disadvantageous cycle of higher prices, declining real wages, and eroding savings. A brief review of U.S. economic history reveals that for private sector ‘working class’ Americans, hourly wages are lower today than they were in the 1970s, when adjusted for inflation.

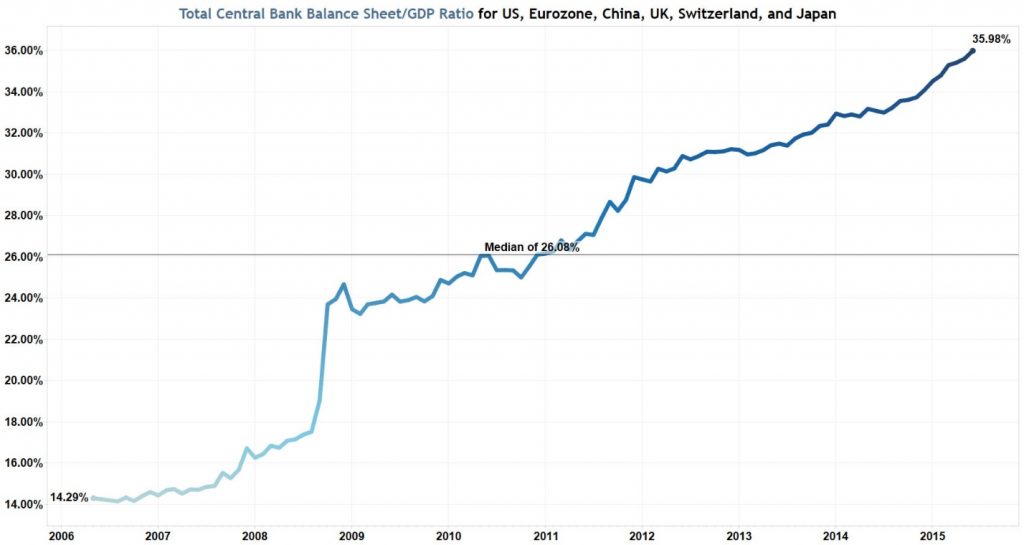

It is peculiar that central banks the world over have become laser focused on increasing inflation as part of a strategy to stimulate their economies. In most developed economies, rates of inflation have fallen from the pre-2008 levels and are now near or even below zero. In ‘Japan – Canary in the Coal Mine’ (link here), we noted that the Bank of Japan (BOJ) has ‘printed’ enough money to purchase assets worth 80% of the entire Japanese GDP. Yet despite this, Japan actually experienced deflation in March. Japan is not alone. Nearly all major central banks have embarked on massive money ‘printing’ and asset buying campaigns known as quantitative easing (QE) in order to keep interest rates low and stimulate inflation.

The chart below from the National Inflation Association (link here) shows that the major central banks’ QE buying sprees exceed 35% of the GDPs of the US, Eurozone, China, UK, Switzerland, and Japan combined!

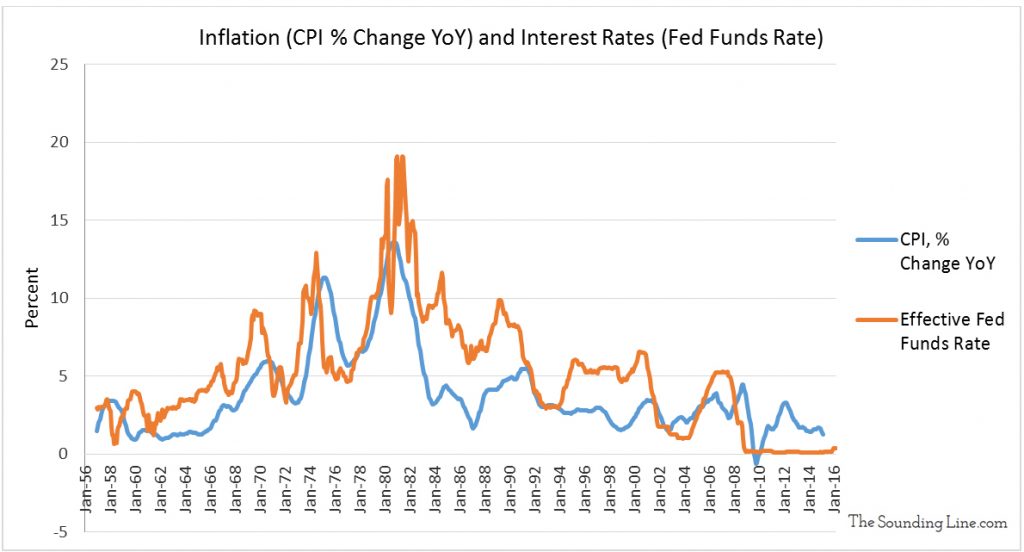

The mantra of easy monetary policy has been repeated so loudly and for so long by central banks and their advocates that it’s all too easy to hear their siren song of ‘low interest rates causing higher inflation’ and to believe that lowering rates will in fact increase inflation in today’s economic environment.

Another review of history shows that interest rates and inflation are highly correlated. When interest rates go lower, so does inflation. That is the first clue that this strategy isn’t likely to work. It is simply confusing the symptoms with the disease.

As we discussed here:

Interest rates follow the same underlying supply and demand dynamics as other prices. Speaking in general terms:

When interest rates are falling it is a sign that demand for credit has fallen in relation to its supply. Falling rates mean that lenders are competing to lend to a shrinking pool of eligible borrowers. As the pool of eligible borrowers shrinks, lending slows, and so does credit creation. As credit creation slows so does the money supply and in turn inflation. Eventually interest rates become so low the lenders’ overhead costs exceed market interest rates. Below this point it is no longer profitable for lenders to lend. That reduces credit growth further and the negative cycle continues. All the while lenders’ (read banks) profits and revenues are reduced, threatening their stability and compounding problems further.

This is where the Fed steps in. To break the cycle of declining lending and declining inflation the Fed lowers its Fed Funds Rate. The Fed Funds Rate is one of the costs of lending for banks. By lowering this cost, the Fed enables banks to resume profitably lending at lower rates than they otherwise would be able to do. Hopefully more borrowers will be credit worthy and more business plans viable at these artificially lower rates and credit growth will restart, ending the negative cycle.

That’s the theory. Here is why it hasn’t worked:

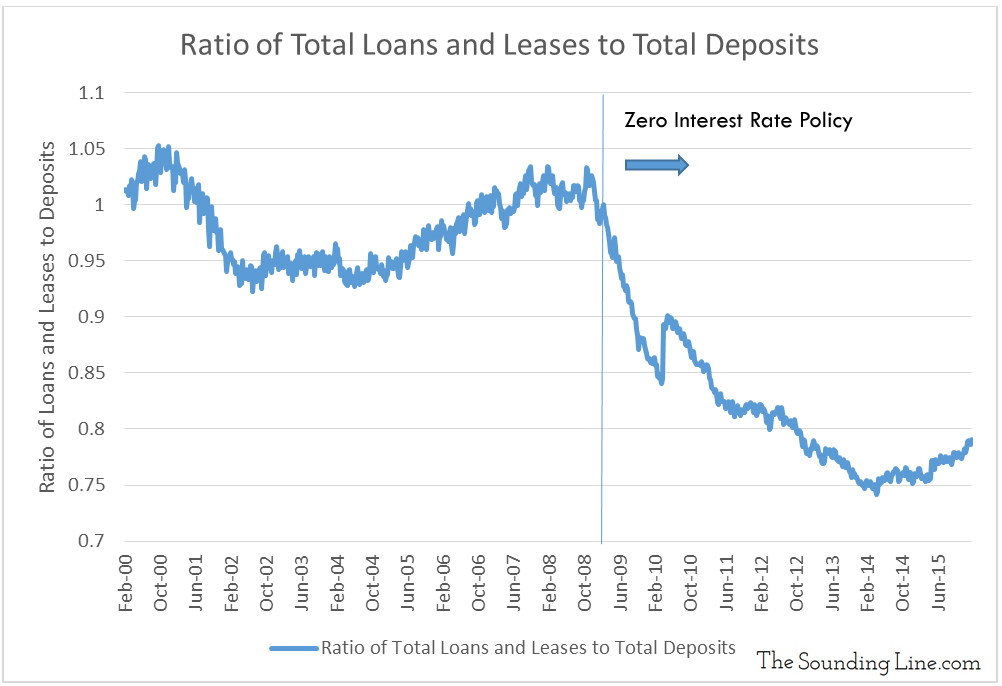

It is important to separate the root cause driving the cycle of weakening demand for credit from the symptoms. Declining interest rates and inflation are the symptoms not the cause of the current economic slowdown. The Fed has attempted to treat the symptoms not the disease. Accordingly they have had little success. Credit worthy borrowers did not become seldom because interest rates rose too high, borrowers became seldom because the financial crisis exposed, and compounded, growing structural problems accumulating in the US economy. These problems have only worsened since the crisis. Fewer people are creditworthy and fewer opportunities for economically viable loans exist as result of these problems, even at lower rates, and so credit growth has remained slow despite low interest rates. The chart below shows that the ratio of loans and leases to bank deposits plummeted following the recession and remains very low today. Banks can’t lend if eligible borrowers don’t exist.

That brings us to the underlying problem: Practically speaking, the US has the highest corporate taxes IN THE ENTIRE WORLD (here). Large multinational companies don’t pay these rates, but small and medium sized companies do. These same small and medium sized companies have also been extremely disadvantaged by the increased cost of compliance associated with geometrically increasing quantities of regulations (here). Once again it is large companies who can afford the cost of compliance and thus gain a competitive advantage in increasingly regulated industries. As a result of over taxation and over regulation, the startup rate of new companies is the lowest on record and has fallen below the rate at which companies are closing. Disadvantaging small and medium sized companies undermines the US economy. They are the largest employers in country (here) and it is new companies, less than 5 years old, which account for all of the net job creation since 1992 (here).

Objectively, we can see in the chart below that lower interest rates have happen with a decreasing ratio of bank lending.

As to the argument that Central banks want inflation because they believe it will discourage saving and thus lead to more consumption and spending, that is the equivalent of wanting people to be concerned that they cannot make a decent return on their savings as the means of convincing them that they should spend those savings. It should be fairly obvious that spending created by people burning through their savings isn’t obtainable and, if it was, certainly would not be sustainable. In reality, people who can afford to do so will move their savings into an investment instrument that has inflation resistance rather than spend it. Equities would be one such instrument, but nearly half of Americans don’t have enough savings to make investing in stocks feasible and they will thus suffer the ill-effects of inflation.

All of this goes to highlight the impact that a few unelected academics bureaucratically managing a highly complex global economy by using a handful of archaic tools and massively oversimplified metrics have had on the world around us. Not only does it undermine the principles of a free market, but it doesn’t work.

Instead of central banks admitting that their policies of simultaneously targeting low interest rates and higher inflation have demonstrably failed to produce higher inflation or increased real economic activity, the central banks are increasingly talking about ‘helicopter money’.

Central banks are starting to recognize that printing money and giving it to banks via QE hasn’t done anything except greatly enrich banks and inflate risk asset valuations. So, they now want to print money and give it directly to people, aka ‘helicopter money’. That plan is almost certain to succeed in creating more inflation than desired. What will central banks do then? You guessed it, raise interest rates. And what will that do? As it always has, higher interest rates will increase inflation further. It’s no wonder that trends in interest rates last decades.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.