Taps Coogan – February 16th, 2024

Enjoy The Sounding Line? Click here to subscribe for free.

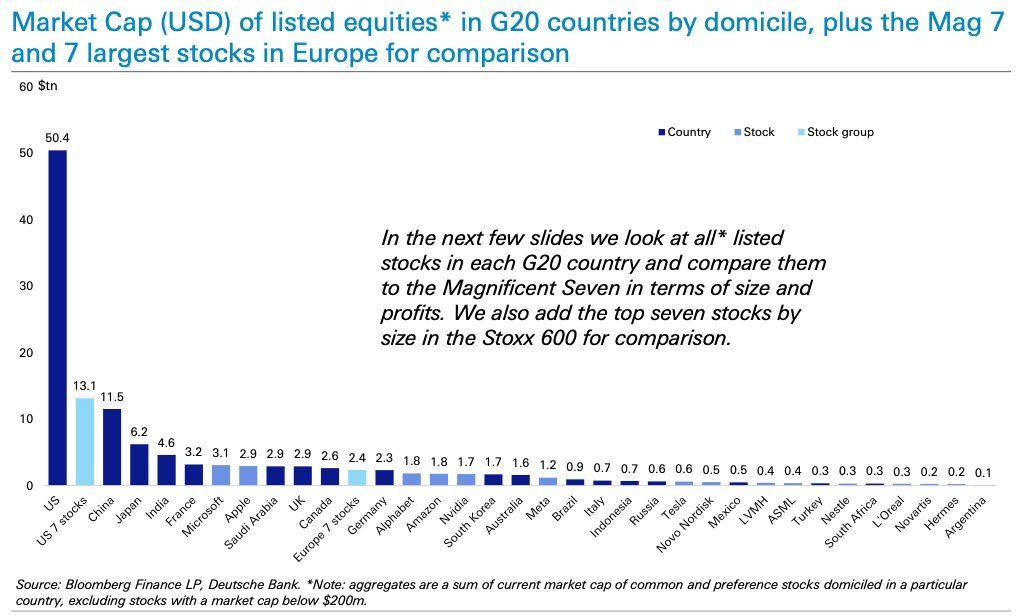

An enormous amount has been written about the soaring market capitalization of the ‘Magnificent Seven’ tech companies (Microsoft, Apple, Amazon, Nvidia, Meta, Tesla, Google) and the following chart, via Michael Arouet, highlights why. Their combined market cap now exceeds that of any other country’s entire stock market.

Chart for future history books, Magnificent 7 market cap compared with rest of the world pic.twitter.com/OvYcNeBkQm

— Michael A. Arouet (@MichaelAArouet) February 16, 2024

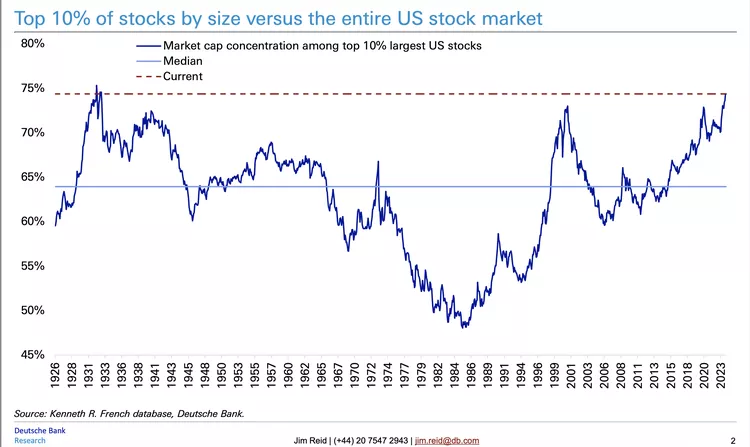

The high degree of market concentration into a small collection of big-tech names is nearing historic levels, at least within a domestic context. As the following chart from Deutsche Bank highlights, this is the most concentrated the market has been since the early 1930s (after, not before, the 1929 bubble and the start of the Great Depression):

Without diminishing the pretty obvious market structure risks associated with such a high degree of concentration, it is nonetheless important to point out that unlike during the Dot-Com bubble, big-tech valuations have risen largely in step with exploding earnings growth. The result is that, while expensive, the Magnificent Seven, are really not that much more expensive than the rest of the market once factoring in their higher earnings and growth. This is even more the case if one excludes Nvidia from the list, whose valuation is extremely extended.

In other words, this period is really not a particularly good parallel to classic stock bubbles like 1929 or 2000 (stocks are only up about 5% over the last 25 months), but instead highlights the ‘winner takes all’ dynamic of our tech-dominated economic era.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.