Submitted by Taps Coogan on the 30th of April 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Yesterday we looked at the asset holdings of the world’s major central banks in the context of responding to the next recession. The conclusion was that performing large amounts of additional QE would face significant restraints: very little room to further suppress long-term interest rates and likely having to appropriate the bulk of the sovereign and corporate debt markets not already held by central banks in many key markets around the world.

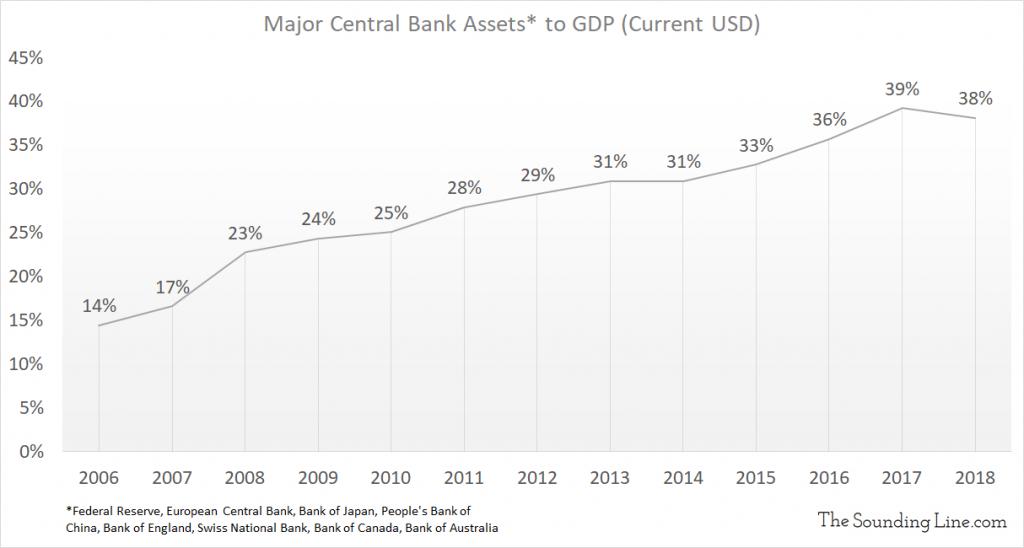

Along similar lines, the following chart shows the size of major central banks’ assets compared to their combined economies. The ratio peaked at a whopping 39% in 2017 and sits at 38% as of the end of 2018, up from 17% in 2007. Central bank asset holdings have grown an average of $1.13 trillion per year since the Financial Crisis, essentially the same as the growth in annual GDP ($1.19 trillion per year).

Relative to their combined economies, central banks have more than doubled the size of their asset holdings since the Financial Crisis. Repeating a similar feat today would imply bringing their holdings to over 80% of GDP. The implications of such large central banks is hard to predict. Simply rolling over the maturing bonds on a portfolio 80% the size of global GDP would constitute trillions of dollars of bond purchases every year.

The explosion in central bank asset holdings since the Financial crisis has made central banks the largest single participants in financial markets and among the largest participants in the overall economy. It has transformed the role and behavior of markets in ways investors are reluctant to seriously confront.

Central banks’ obsession with delaying the next recession at any cost, as opposed to preparing for it, is deeply unhealthy. As we have frequently discussed, there have been as many as 42 recessions and five depressions in the US since the 1780s. The US economy recovered from every single one, returning to growth within an average of roughly one and a half years. That includes the 39 recessions and depressions that proceeded the establishment of the Federal Reserve in 1913, and 20 that occurred when the US had no central bank at all.

Free market economies recover from recessions. The US economy would have recovered from the Financial Crisis, Fed stimulus or not. That is not to say that central bank actions during the recession did not have positive effects. It is to say that perpetually delaying policy normalization after the recession had passed, leaves us extremely vulnerable to the next recession and is transforming the way our economy works.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I wonder whether they are intentionally delaying the next recession because they know that the euro would not survive another financial crisis. And the dollar with that.

It’s possible