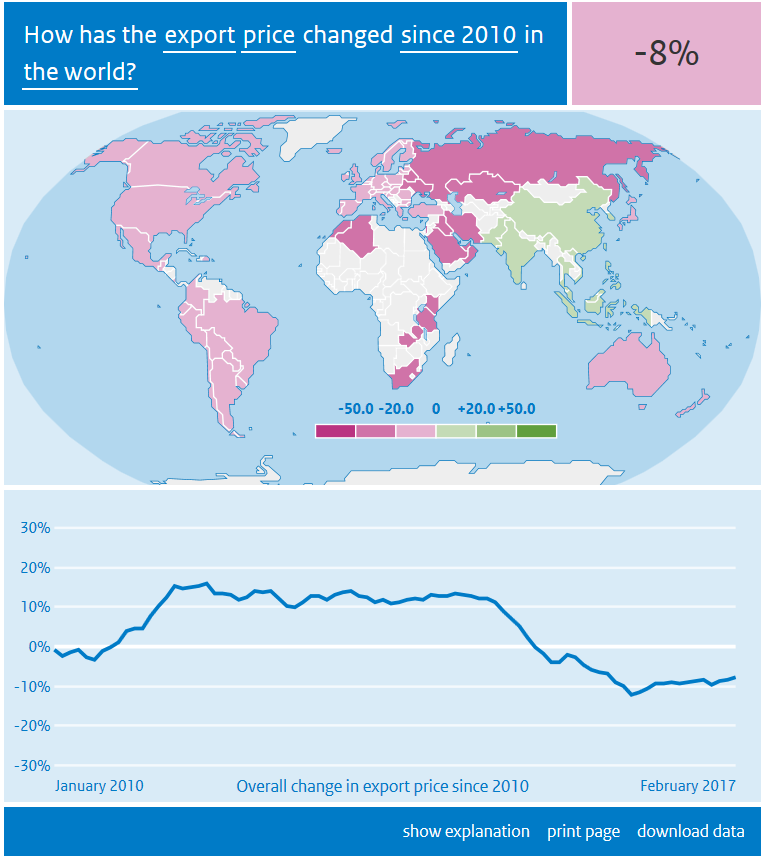

For the last few years, much has been made of the decline in the value of global trade, particularly here at The Sounding Line. While the volume of global trade has continued to climb modestly (the physical quantity of goods traded), the value of that trade has fallen dramatically (the prices in US dollars actually paid for goods traded). The decline in oil prices has been a large contributor to this trend, but as the following graphic from the CPB Netherlands Bureau for Economic Policy Analysis reveals, it is far from a complete explanation. According to the CPB, since 2010, the value of global exports has fallen 8%, and as the map reveals, it is not just oil or resource exporting countries which have suffered the decline. Quite remarkably, every country outside of China, India, and a few smaller Asian neighbors have seen the value of their exports decline. This includes developed economies such as the US, EU, Japan, and Australia.

Enjoy The Sounding Line? Click here to subscribe for free.

The main culprit behind this global trend (and to some extent low oil prices themselves) is likely the strengthening US dollar. Since 2014 the US dollar has strengthened dramatically against all major foreign currencies. The strong dollar is itself largely a product of the divergence in central bank policy between the US Federal Reserve (which ended QE and began talking about rate hikes in 2014) and nearly all other central banks (which have not tightened monetary policy to the same degree or at all). While the dollar has weakened somewhat recently, owing to France’s election of President Macron, and President Trump’s controversies, the central bank policy divergence seems likely to persist for the foreseeable future. This is putting enormous pressure on economies around the world because they receive less value (as measured by the global reserve currency) for their exports. As such, it represents yet another hurdle which may potentially derail the Federal Reserve’s attempt to normalize monetary policy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.