Taps Coogan – July 3rd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

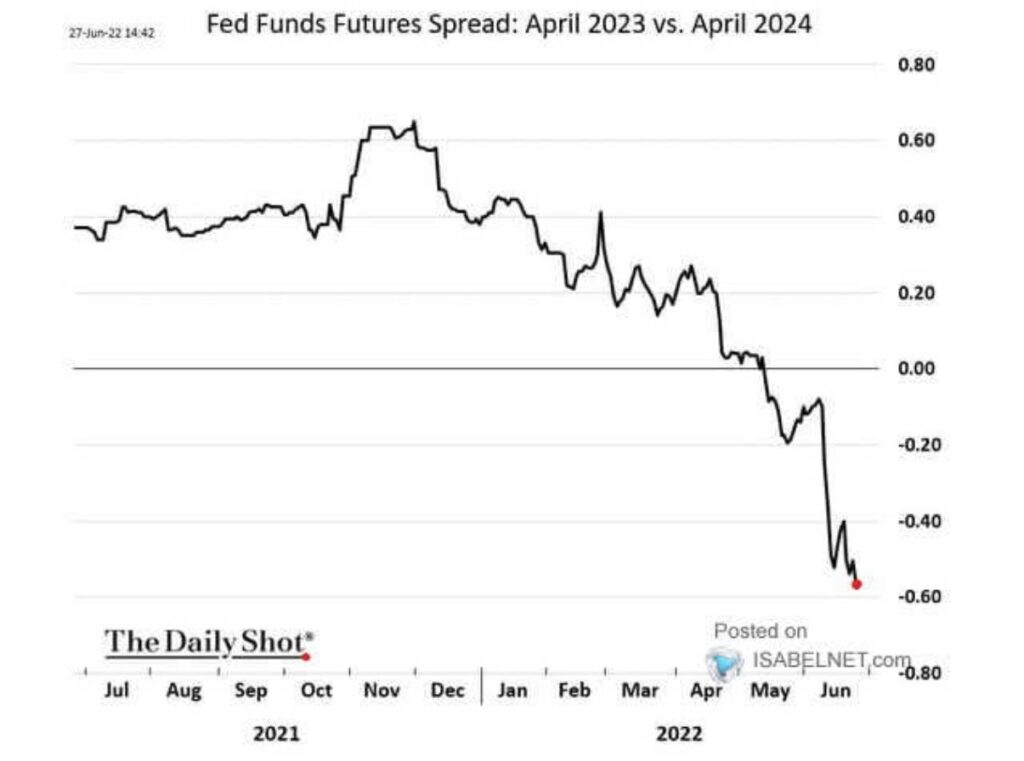

The following chart, from the Daily Shot via Isabelnet, shows that the Fed Funds futures market is now pricing in roughly two rate cuts between April 2023 and April 2024.

The next chart shows the University of Michigan inflation expectations series, which points to inflation remaining above 5% over the next 12 months.

5-Year and 10-Year TIPS breakevens similarly show inflation averaging above the Fed’s 2% target for the next five and ten years respectively, as does the Cleveland Fed’s inflation model.

In other words, the market is starting to price in a scenario where the Fed is forced to pivot to accommodation before bringing inflation under control.

It’s a nightmare scenario and, as we keep warning, given the bad options now available to the Fed, they would be better served by prioritizing the longevity of this tightening cycle, not rushing it. A recession against the backdrop of high inflation and a historic asset bubble caused by low rates is a recipe for ‘fat-tailed’ outcomes. Now is not the time to tighten until something breaks. It’s a time to remember that monetary policy acts with long and variable lags. The impact of the rate hikes that the Fed has already done will not be fully felt for quite some time. By the time they realize they have gone too far, they will have been hiking for months beyond the breaking point.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.