Taps Coogan – April 13th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

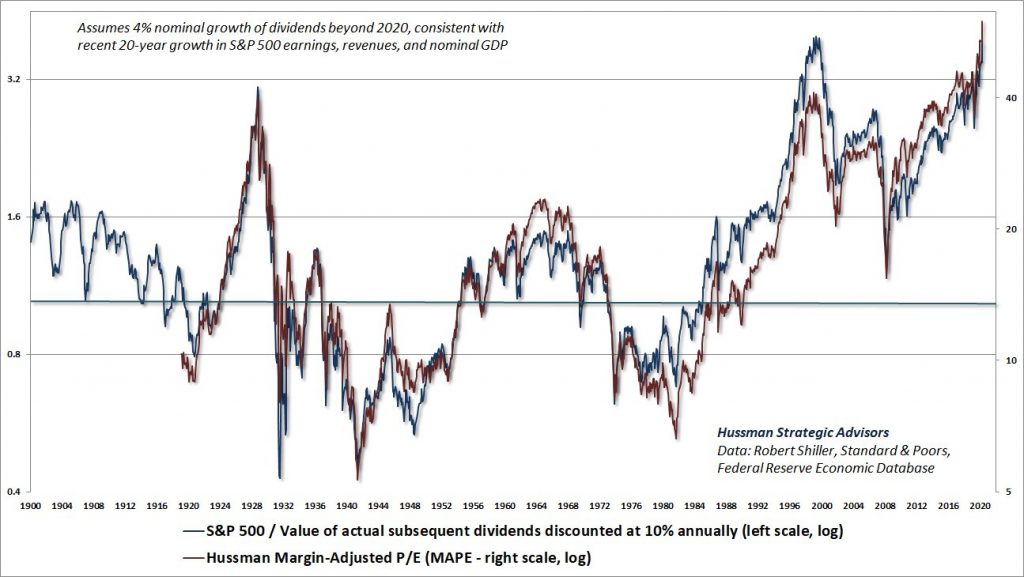

The following chart, from Hussman Investment Trust’s John P. Hussman, shows two measures of the true valuation premium for the S&P 500 going back to 1900. The first looks at the ratio between the S&P 500 and the value of the dividend stream it subsequently paid out. The second shows Hussman’s margin-adjusted price-to-earnings ratio.

It’s worth reading the original article for more detail and context, but the punchline is this: buying a stock is just buying a future cash flow in the form of the dividend stream that a company generates (or could generate based on its earnings). Or, as Mr. Hussman puts it “A good valuation measure is nothing but shorthand for a proper discounted cash flow analysis.”

If you believe that, we are now paying more for the likely dividend flow from US stocks than ever in modern times, as the chart above shows. That has generally not been a good omen for future returns. Of course, the market can always remain irrational longer than any of us can remain sane.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. Also, please consider sharing this article so that we can grow The Sounding Line!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.