Submitted by Taps Coogan on the 6th of November 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

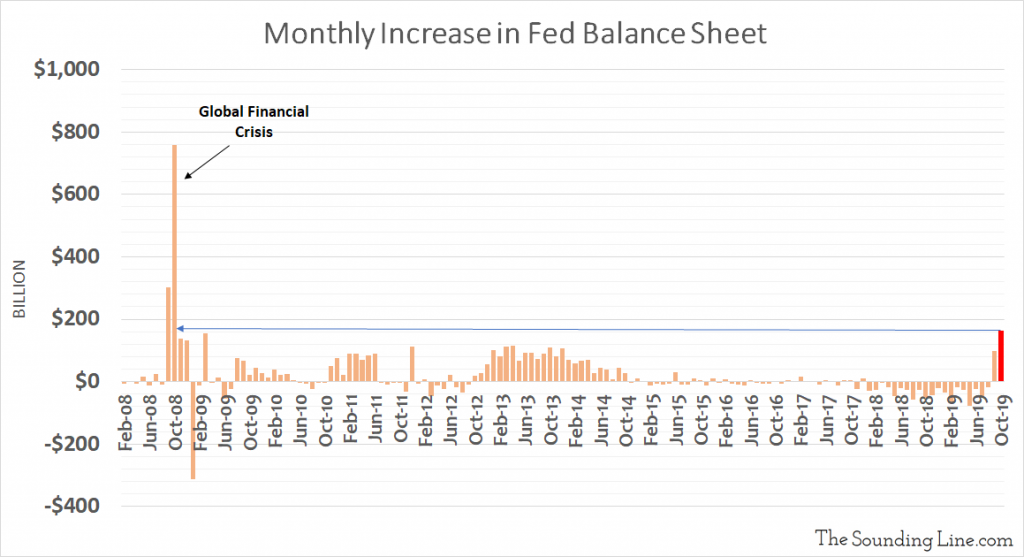

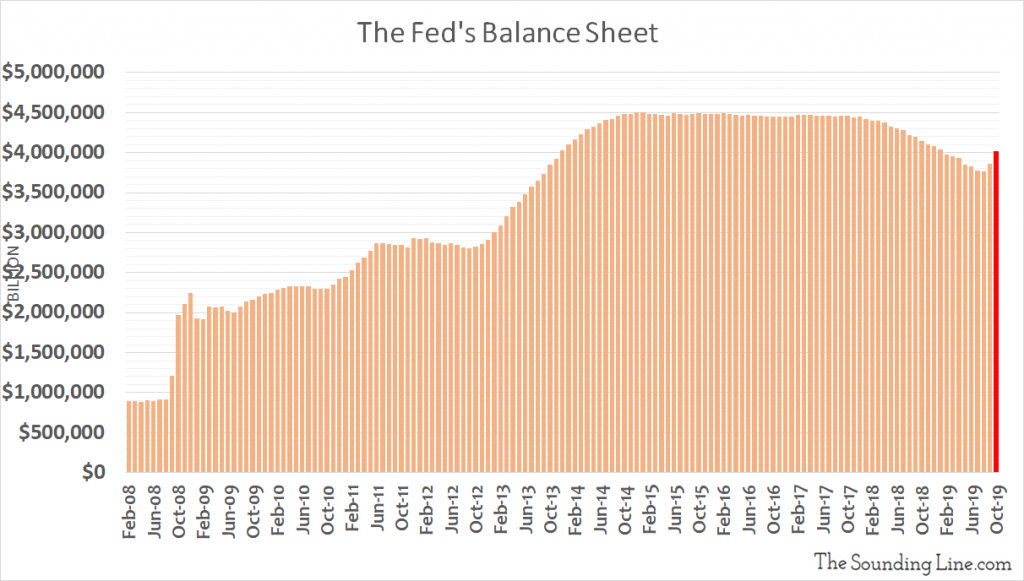

The Fed’s balance sheet grew by over $162 billion in the month of October 2019, the largest monthly increase since October of 2008, the height of the Financial Crisis. In fact, the only two months in the history of the Federal Reserve that have seen a larger increase of its balance sheet were September and October of 2008. Figuratively speaking, the Fed’s printing presses are currently running at crisis-era speeds.

The growth in the Fed’s balance sheet is the result of its recently introduced standing repo facility, with a size of $110 billion, as well as a $60 billion-a-month QE program which the Fed insists is not QE, but which meets any conventional definition of QE.

Indeed, the most striking difference between the Fed’s current balance sheet expansion and its past QE programs is not which part of the yield curve the Fed is targeting, it is that expansions in the past were aimed at bailing the economy out of the worst recession in nearly a century. Today’s QE program is the result of a dollar shortage in overnight lending that is arguably the result of swelling treasury and corporate bond issuance out-competing for existing liquidity. We are not printing money because the economy needs it. We are printing money because the Federal government and Corporate America need it.

The Fed plans to continue its repo facility until at least January 2020 and its QE program into the second quarter of 2020. As we noted here, because any further rate cuts from the Fed will put more pressure on it to do yet more balance sheet expansion, and because the underlying driver of the liquidity crunch in overnight markets is swelling treasury debt issuance, I suspect that the Fed’s balance sheet expansion will become permanent.

A subtle but all important inversion has just occurred. Fiscal policy (aka runaway deficits), and the funding pressure it is creating, is now driving monetary policy, not vice versa. That seems like a very dangerous dynamic in an age of guaranteed fiscal profligacy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.