Submitted by Taps Coogan on the 27th of April 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The word ‘depression’ is getting thrown around a lot these days to describe the current economic outlook, not just by long-time market skeptics, but by mainstream economists, investors, and journalists.

There is good cause for concern. We are likely witnessing the fastest and largest rise in unemployment on record. The S&P 500 has witnessed its fastest 35% crash in history. Most of the global economy has been shutdown. Corporate balance sheets have been destroyed by a decade of debt-fueled buybacks and stagnant earnings. Demographics are poor: baby-boomers are retiring and population growth is stagnating. Monetary and fiscal stimulus have been badly, badly overused during the prior decade. Undoubtedly, this is a bad moment in economic time.

Accordingly, a number of people are warning of an unfolding depression or severe recession. More-or-less every analyst who I read has warned of a ‘U’ shaped, “W” shaped, or “L” shaped recovery for the economy and markets.

A Reality Check

Part of what makes severe recessions and depressions drag on for as long as they do is their lack a clear terminus. They are typically driven by self-reinforcing endogenous economic forces. The economy keeps getting worse largely because it is expected to keep getting worse.

The current economic recession, however, has an exogenous cause and, at least theoretically, a logical terminus. Regardless of what happens with the Coronavirus pandemic, the economic shutdowns will not last forever. Most will not last another two months. Some are already easing.

To a much greater extent than during a typical severe recession or depression, today’s rising unemployment rate reflects furloughed workers, not permanently fired workers. Some workers will find that their jobs are permanently gone. Some business will go under. However, the majority will likely be back at work within a few months.

In the meantime, the largest fiscal stimulus in history means that people on unemployment are receiving expanded benefits. The recent stimulus bill included a $600-a-week boost to unemployment that will, on average, bring overall unemployment compensation to at least 100% of income for the bottom half of the labor force. The federal government has also delivered roughly three-quarters of a trillion dollars of loans to small and medium sized business. Those loans are forgivable if used towards payroll expenses, making them essentially grants. The federal government is also sending most Americans a $1,200 check. The federal government has also executed a series of direct corporate bailouts of industries like the airlines.

The largest monetary stimulus in history has already erased half of the decline in stocks, backstopped the bond market, bailed out the commercial paper market, bailed out the mortgage market, backstopped the money markets, and backstopped the municipal bond market. It has also already monetized most of the fiscal stimulus.

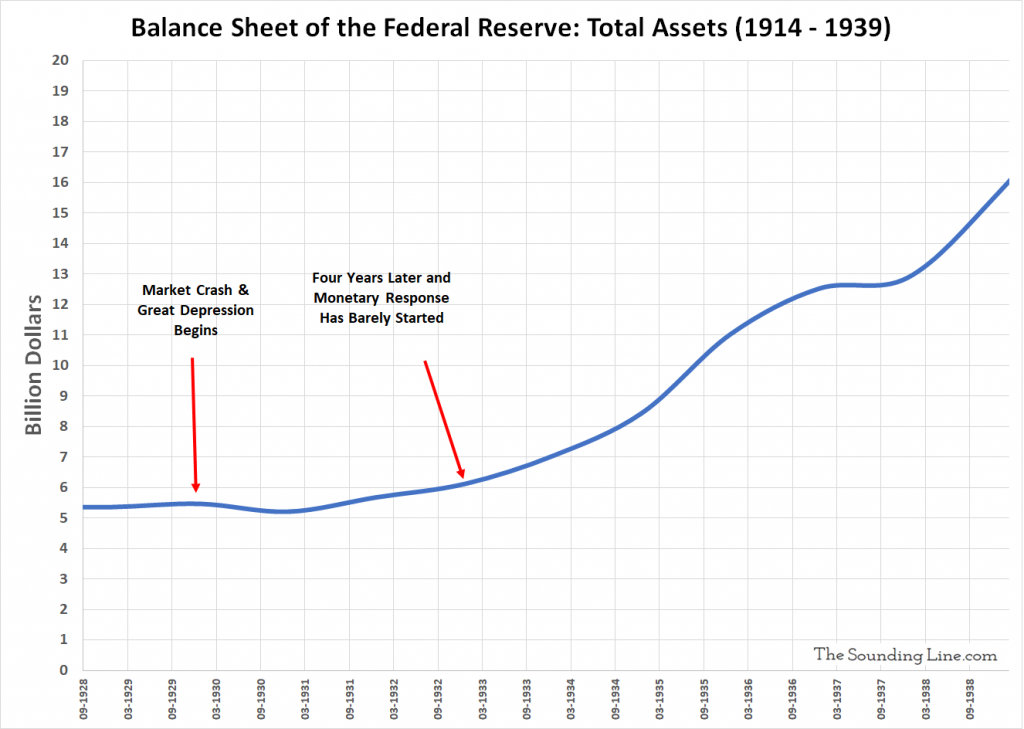

By comparison, for the first four years of the Great Depression, there was no monetary response at all. The concept of monetary stimulus hadn’t even solidified in the public conscience. In fact, the Fed’s balance sheet actually constricted during 1930 and didn’t start to meaningfully grow until 1933.

Federal unemployment insurance wasn’t ‘invented’ until 1935, nearly six years into the Great Depression. ‘Helicopter Money,’ checks in the mail, hundreds of billions of dollars of grants to small businesses, and massive corporate bailouts weren’t even a pipe-dream. To the contrary, many banks failed outright during the Great Depression, permanently destroying the savings of the recently unemployed. FDIC deposit insurance also did not exist.

Even during the Global Financial Crisis, the Fed didn’t unveil QE-1 until nearly a year into that recession, and only did so when the failure of the entire banking system was imminent.

We are barely a month into this economic crisis and the Fed’s balance sheet has already swelled by roughly 75% and the federal government is hemorrhaging money as fast as it possibly can.

It is possible that the economic pain caused by the shutdowns will collide with over-indebtedness and other negative factors to take on a life of their own and create a self-sustaining economic recession or depression. This is a real risk.

What worries me more, however, is the real possibility that the Fed and the federal government will find delivering stimulus to be a very hard habit to kick when this temporary crisis passes.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The promise of help from the poorly crafted Paycheck Protection Program delayed mass firings from the 54 million Americans employed by small businesses. After putting the program out there, the government has failed to come through with its promises. The carnage is about to begin as unemployment begins to surge. More details in the article below.

https://brucewilds.blogspot.com/2020/04/unemployment-to-soar-as-small-business.html