Submitted by Taps Coogan on the 10th of June 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

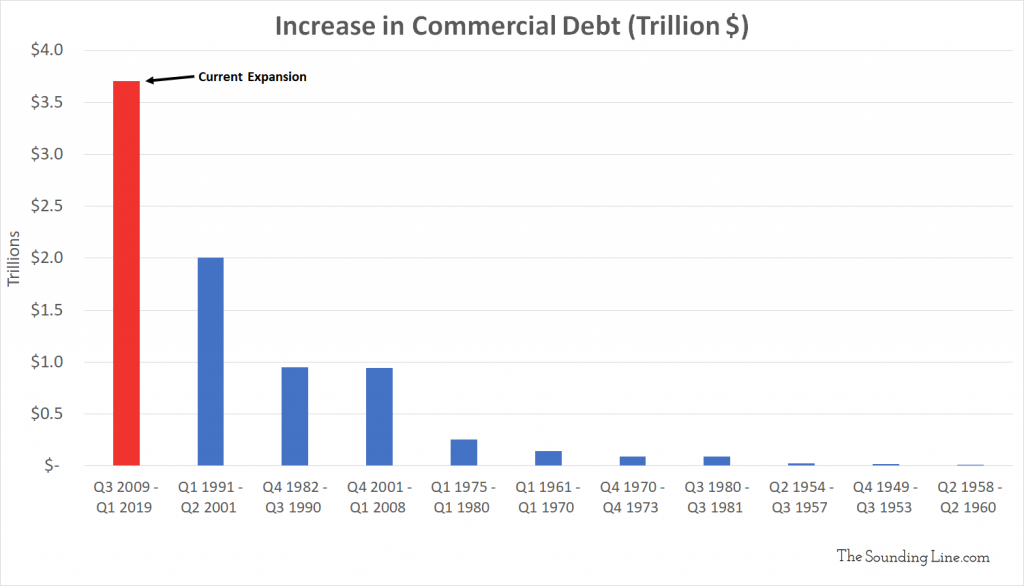

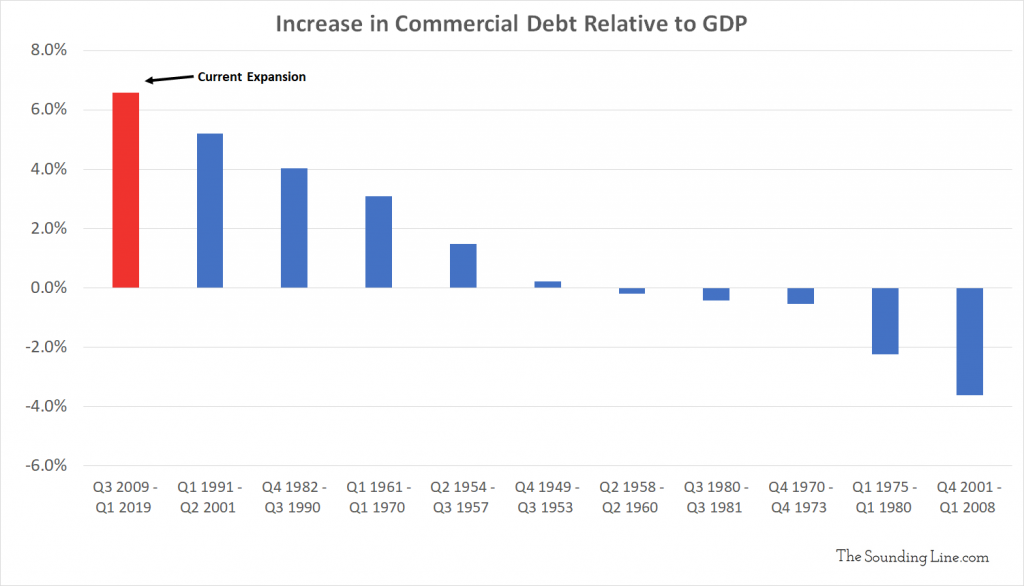

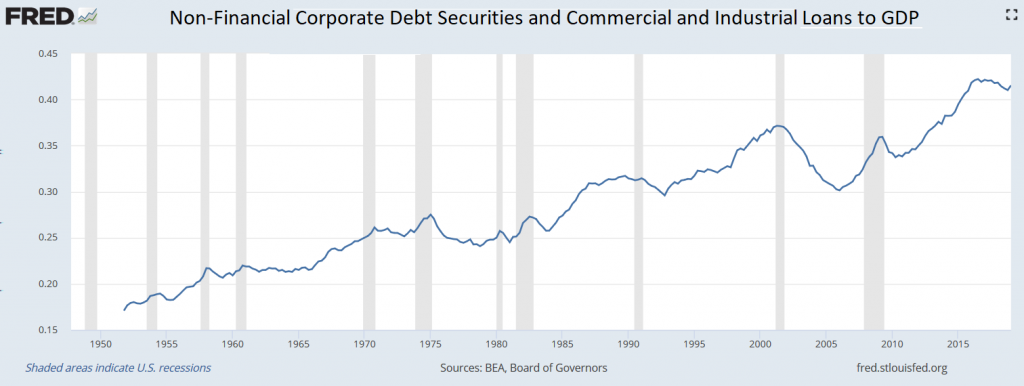

US commercial debt has increased by over $3.7 trillion since the Financial Crisis (corporate debt securities plus commercial and industrial loans), growing from roughly 35% of GDP in 2009 to 42% of GDP today. The increase in commercial debt post 2009 is the largest since at least World War II, both in nominal terms and in relation to GDP. Commercial debt hit its highest level relative to GDP in 2018 and remains near those record high levels today. With debts of roughly $6.7 trillion, American companies currently have nearly $20,000 of debt per person in the country and over $800 of debt for every person on Earth.

To a large extent, the Financial Crisis was caused by artificially easy borrowing conditions that led to too much debt in the hands of people that had little hope of repaying it in an economic slowdown. In response to the resulting crisis, the Federal Reserve and other central banks have kept interest rates at or near historic lows, not just during the crisis but for over a decade after the last crisis had faded. The result has been a massive increase in indebtedness by entities that have had access to the lowest interest rates, such as corporations.

With the economy currently cooling, central banks around the world are contemplating lowering interest rates yet again. The truth is that the increased indebtedness caused by their past overly accomodative policy means that a recession now could be catastrophic. It’s a logical ‘doom-loop:’ overly accommodative policy incentivizes uneconomical borrowing, which compounds systemic risks, which leads central banks to avoid recessions at all costs, which leads to yet more accomodative policy. All the while, the need for structural pro-growth economic reform is masked, investor discipline is degraded, and zombie companies stay in business.

Presumably, a coming deluge of fresh central bank stimulus will delay the inevitable yet again, but there are limits to easy policy. Someday the piper will have to be paid.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.