Submitted by Taps Coogan on the 24th of July 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

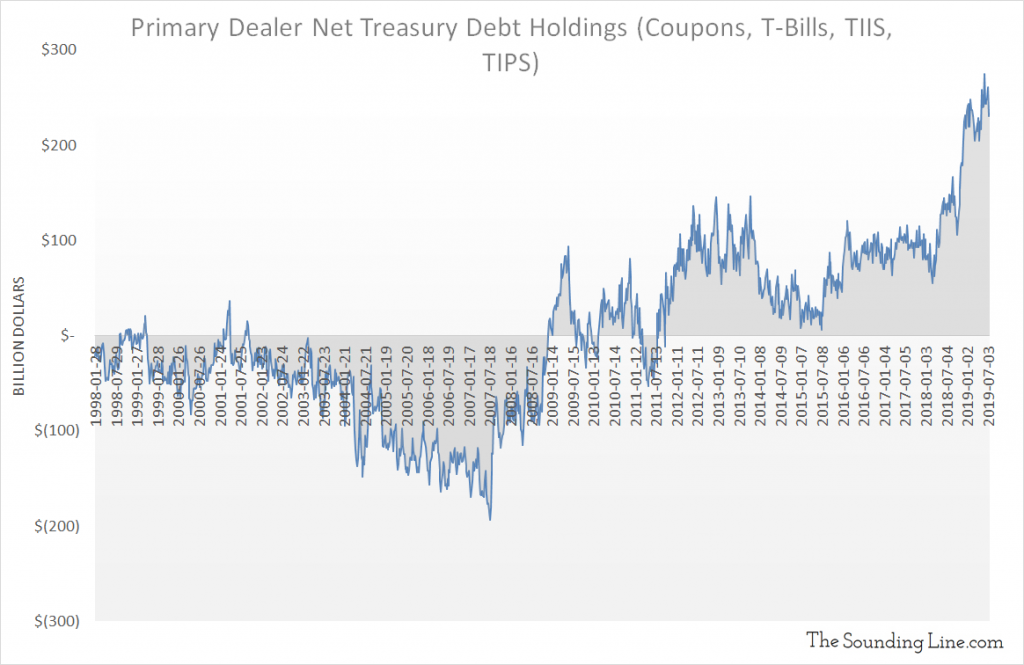

Primary dealer net treasury holdings have been surging since mid 2018. As of July 10th, 2019 net holdings stand at over $230 billion, modestly below the all time high set in May 2019 at $274 billion. These are the highest levels since at least 1998.

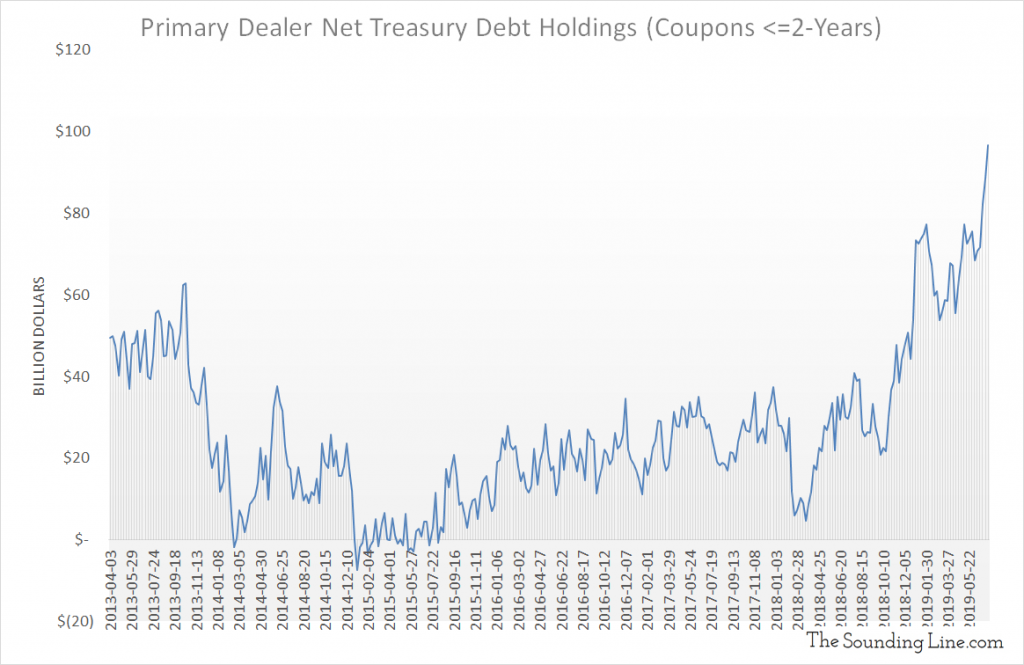

The exact reason behind the recent surge in primary dealer net treasury exposure is not clear. It could mean that primary dealers are having trouble passing along treasury debt to end buyers. However, treasury rates fell strongly during the same period, so that is not necessarily the case. Most of the growth has been in coupons with a duration of two years and less, which means it could be an attempt to capture increasingly attractive short term treasury yields, a recession hedge, or something else entirely.

What Happens If It Reverses?

Whatever is causing the increase in primary dealer treasury holdings, if it were to reverse back to historically normal levels, secondary markets would have to absorb nearly $200 billion of additional treasury debt at a time when issuance is poised to surge and foreign demand is tepid.

Meanwhile, the recently resolved federal debt-ceiling impasse had been limiting the Treasury’s issuance of new debt and forcing them to draw down cash reserves. Doing so acts as sort of mini-QE for markets: less treasury debt to absorb and a ‘fresh’ liquidity injection from the Treasury’s cash balance. With the impasse now resolved and borrowing set to re-accelerate even faster than before, the same mechanism will work in reverse as the Treasury borrows and rebuilds its cash reserves.

The Fed Funds rate has also been trading above the interest on excess reserves (IOER) rate from several months now. That implies some degree of tightness in excess bank reserves or insufficient dollar liquidity to simultaneously fund both the short term debt markets and the overnight market to the extent previously possible.

Put it all together and there is an increasing possibility that markets are finally approaching their limit to fund rapidly expanding corporate and treasury debt markets without fresh stimulus and monetization from the Fed.

Right on time, the Fed is very likely to deliver the first installment of that stimulus in barely a week. What a coincidence.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.