Taps Coogan – March 16th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Reality check:

In 2019, before Covid and before the lockdowns, total US corporate tax revenue to the federal government amounted to $230 billion. That was after Trump cut the US corporate tax rate from 35%, by far the highest rate in the developed world, to 21%, still higher than in countries like the UK and Germany.

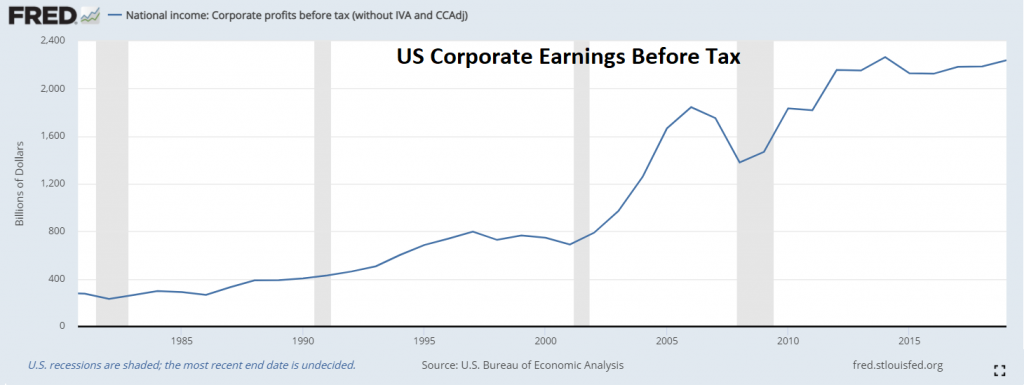

In 2015, when corporate taxes were still 35%, the highest in the developed world, corporate taxes brought in $343 billion to federal coffers. Corporate earnings were higher back then. Despite surging stock prices, corporate earnings have been stagnating for years.

Presumably as part of the plan to finance “extreme competition” with China and other economies, DC is poised to raise the corporate tax rate back to 28%. Meanwhile, countries around the world have been busy cutting corporate taxes as part of their plans to be economically competitive. The average corporate tax rate in the EU was 21.9% in 2020 and will fall further in 2021. France, perhaps the highest taxed country in the world, is cutting its corporate tax rate to 25% by 2022. By the time the US raises its corporate rate back to 28%, it will represent the highest rate in the world when combined with state corporate taxes.

If corporate earnings get back to the level they were at in 2019, raising the corporate tax rate from 21% to 28% would raise $77 billion a year, assuming no tax avoidance strategies, no hit to growth, and no more corporate tax inversions. Corporate tax inversion was a rampant problem back when the US had the highest tax rate in the world, leading companies like Burger King, Medtronic, Johnson Controls, etc… to domicile in other countries like Canada or Ireland in order to pay lower taxes.

If $77 billion in new tax revenue seems like a lot of money, it’s not. The federal government spent $6.65 trillion in 2020 and is on pace to spend a similar amount this year. In other words, the extra money gained from raising the corporate tax rate to the highest rate in the world would fund the federal government for about four days. When you hear members of Congress talk about funding a $4 trillion infrastructure bill by raising corporate taxes, keep that in mind.

Taxing corporate earnings at 100%, assuming one could do the impossible, wouldn’t balance the federal budget deficit, let alone fund new spending like an infrastructure bill.

The bailout for union pensions imbedded within the most recent $1.9 trillion ‘Covid Stimulus’ bill cost taxpayers $185 billion. In other words, just one line of partisan pork in just one ‘stimulus’ bill already blew years of potential tax revenue from raising corporate taxes to the highest rate in the world.

If the US wants to spend trillions upon trillions of dollars on ridiculous partisan pork, bailing out states that don’t need bailouts, sending checks to people making $150,000 a year, and other fantasies, it’s going to have to raise corporate taxes a lot higher than 28%. It’s going to have to raise taxes on just about everything.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.