Taps Coogan – November 12th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

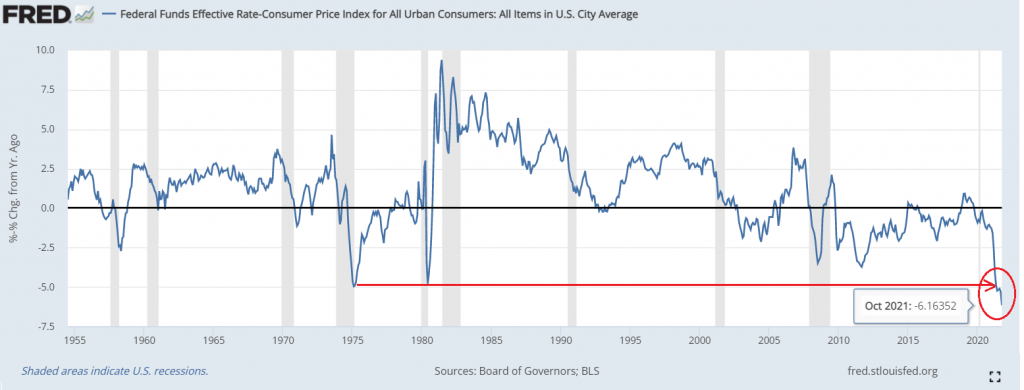

For anyone keeping track, this week’s scorching CPI print of 6.24% has pushed the ‘real’ Fed Funds rate, the Fed Funds rate minus the CPI inflation rate, well below the 1975 low of -5% to a new all time low of -6.16%.

Here is a riddle: if the deeply negative real interest rates during the 1970s are retrospectively considered one of the biggest policy mistakes in the Fed’s history, a mistake that fostered a decade of painful inflation and four recessions within a ten year span, what is today’s policy?

If the Fed believes that their policy is effective at influencing inflation, why do they believe that inflation will be transitory while they maintain the most accommodative monetary policy stance in their history?

Also, for those keeping track, the last time we had a major spike in inflation that didn’t end in the Fed slamming on the brakes and causing a recession was 1951. How long can this go on before the Fed panics? Another three months? Six months?

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.