Taps Coogan – February 5th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

The differences in benchmark crude oil prices (WTI, Brent, Dubai, etc…) are quite small when compared to natural gas markets. That ‘flatness’ in oil prices is the result of the ease of transportation of oil and the ubiquity of import/export facilities. Those factors make arbitraging regional price differences fairly easy.

Natural gas, on the other hand, is difficult to transport. Gas pipelines often stretch many thousands of miles, cross multiple judications, take decades to build, and cost tens of billions of dollars. When they are completed, they give a buyer access to just one benchmark price. Pipelines simply can’t be laid between every gas producer and every buyer and thus, pipeline-dominated markets represent quasi-monopolies for exporters. Regional differences in gas prices cannot be easily arbitraged and, at times, gas that costs a few dollars per MMBtu in an exporter’s domestic market can sell to an importer for ten or twenty times the price.

LNG (liquified natural gas), on the other hand, enables oil-like seaborne trade in natural gas. The catch is that LNG must be compressed to higher pressures at lower temperatures than pipeline gas. That uses more energy and thus involves higher costs.

Now, here is the trillion dollar policy mistake that countries like Germany made: They assumed that because LNG costs more to produce, LNG infrastructure investments would make their gas more expensive. Accordingly, countries like Germany blocked LNG infrastructure investments in favor of pipelines.

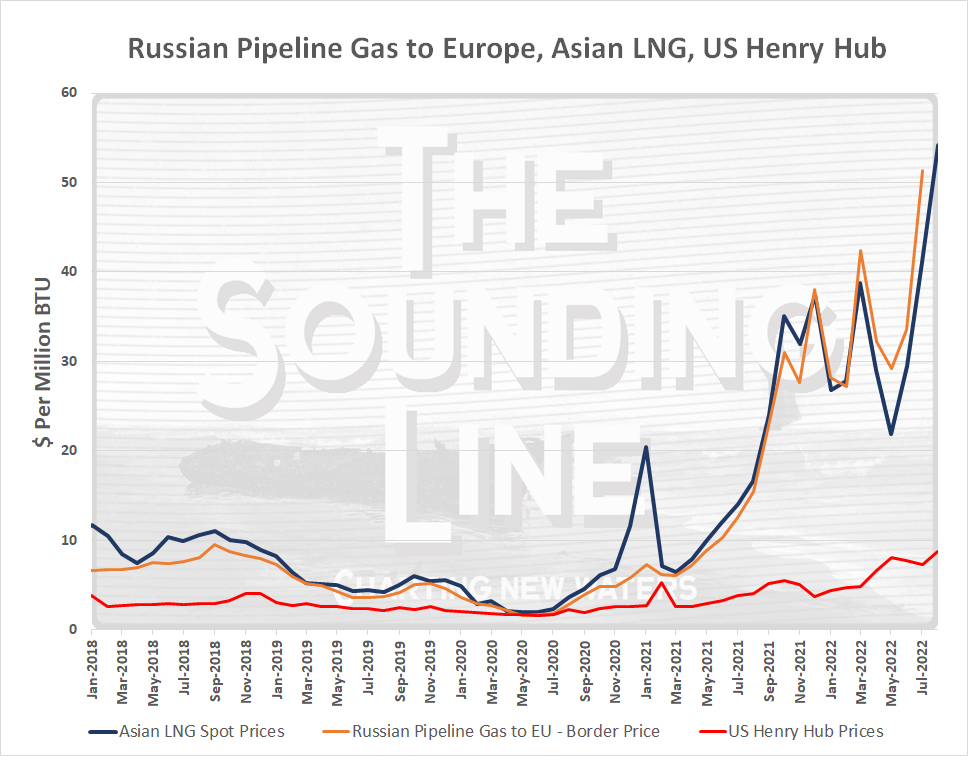

Such decisions were a failure to understand basic market dynamics. For years, Russia has charged the EU nearly the same price as benchmark LNG in Asia. Why? As every business savvy person is supposed to know, prices aren’t determined by cost. They are determined by how much you can charge the customer. When your customer doesn’t have viable alternatives, you can charge them a lot.

Only investments in LNG infrastructure (primarily export infrastructure) would have flattened gas markets and ensured that the EU’s pipeline imports would not be more expensive than the cheap gas in LNG exporter’s domestic markets plus a few bucks of shipping and liquification.

Ironically, Russia’s invasion of Ukraine has finally set into motion the changes that will ‘flatten’ global natural gas markets. The biggest loser will be Russia.

No, the EU still cannot completely replace Russian gas imports, and yes, the EU got quite lucky this winter. A historically warm winter reduced gas demand and Covid lockdowns reduced China’s competing LNG imports. Nonetheless, Russia’s invasion of Ukraine disproved one of the great energy myths: that the EU was severely import capacity constrained. Despite >80% declines in natural gas imports from Russia, as the following chart from Bloomberg highlights, the EU was able to secure sufficient gas supplies for this winter and prices have now fallen to levels lower than when the war started.

From here on out, the main factor that is keeping the EU’s gas prices high (and Asian prices too), is a shortage of LNG export capacity. Yes, the EU needs more LNG import capacity and better connections between import terminals and end consumers, but the pressure on prices is really due to a shortage of LNG export capacity from ‘cheap’ gas markets like the US.

That shortage is likely to ease starting in 2024 as a large amount of LNG export expansions come online in the US, Qatar, Mozambique, Australia, and of course Russia. Thanks to the last year, yet more projects have been greenlit and, eventually the natural gas world will flatten as excess export capacity emerges. As the biggest pipeline exporter in the world, Russia has the most to lose.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I don’t think this person knows anything about the Russian / German arrangement nor how much LNG is costing. Is this site pro Ukraine? I see the yellow / blue flag……

This site is pro-reality. LNG prices are easy to find, look for yourself if you have doubts.

As for the vertically striped yellow/blue flag…

https://en.wikipedia.org/wiki/International_maritime_signal_flags