Submitted by Taps Coogan on the 28th of March 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

“History doesn’t repeat itself, but it does rhyme.” – Mark Twain

Every financial crisis and recession is different. Yet throughout history, they have more often than not been driven by similar underlying forces: an unsustainable appreciation in a financial asset class driven by the extension of too much credit to a group or entity with a diminishing prospect of paying the credit back. At the epicenter of the 2001 ‘tech-bubble’ was unsustainable growth in equity prices and too much credit extended to tech companies that didn’t have real earnings. At the epicenter of the 2008-2009 housing crisis, was unsustainable growth in real-estate prices and credit extended to homeowners who had no real prospect of paying it back.

The next financial crisis will be neither a verbatim repeat of the housing nor dot-com bubbles but will be driven by similar underlying forces.

As one surveys the financial world today, one sector above all others possesses the telltale characteristics of a bubble: government debt (aka sovereign debt). As we discussed most recently in Charting the Looming Sovereign Debt Crisis- Part I, the combined government debt of the 50 largest countries in the world is 90% of their combined GDPs.

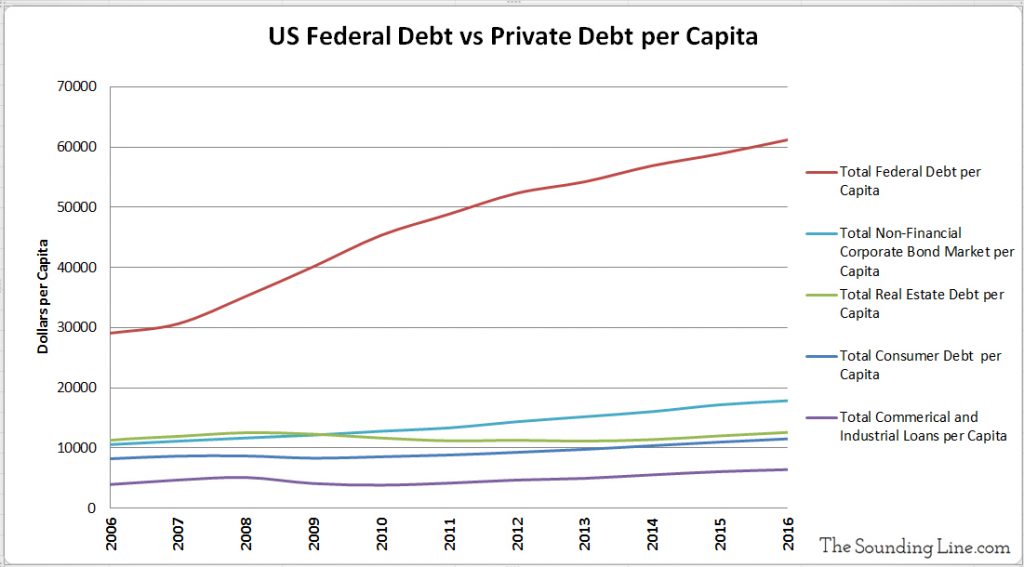

The US government is now the largest debtor in the world. As the following chart shows, the US federal government has now borrowed more than the entire non-financial private sector economy combined. It has borrowed an amount more than all corporate and industrial loans, mortgages, student debt, consumer debt, and the entire US corporate bond market combined.

Not only has the US federal debt become the largest debt in the country and world, but its debt has been growing much faster than private sector debts. As the chart below shows, the federal debt has more than doubled from less than $30,000 per person to over $60,000 per person in the last ten years. In comparison, the non-financial corporate bond market, the next largest debt, grew from $10,585 per person to just $17,874 per person over the same ten years.

While extraordinarily low interest rates have kept the cost of servicing enormous government debt relatively low in the US and many other countries, even a modest rise in interest rates could cause the cost of government debt to rise dramatically. As we first discussed here, the US will need to repay nearly $10 trillion dollars of debt in the next five years. To do this, the US will undoubtedly borrow more money instead of balancing its budget. This will only add to the cost of servicing the debt, necessitating yet more debt.

Eventually a point will be reached due to rising interest rates, stagnating economic growth, and/or continued acceleration in borrowing where sufficient credit cannot be obtained at sufficiently low rates to avoid some form of default. This may happen in the US or any one of a dozen countries in a similar or worse position (Ireland, Italy, Greece, and Japan being prime examples).

Most astounding of all is the fact that, since World War ll, the cost of servicing the US federal debt is actually larger than all of the budget deficits combined (here). Over the long run, all the money that the US has borrowed has gone to nothing but paying its own interest.

P.S. Follow us on Twitter at The Sounding Line @TapsCoogan!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.