Taps Coogan – June 27th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

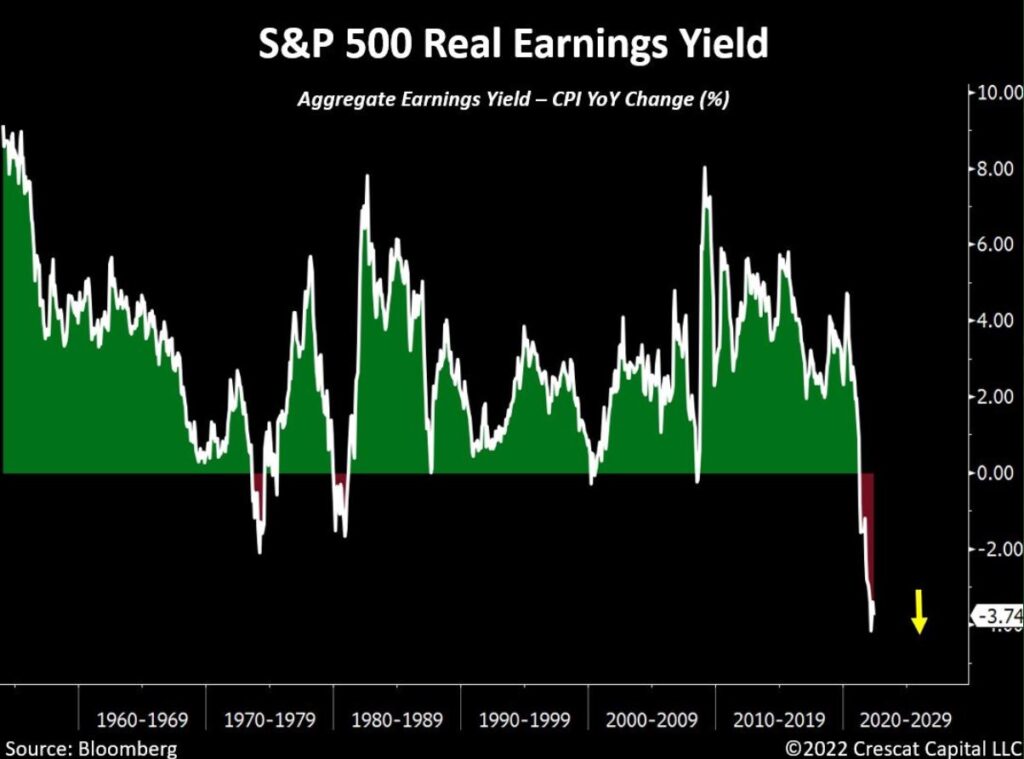

The real earnings yield on the S&P 500 has dipped to its most negative level since at least the 1950s, as the following chart from Crescat Capital’s Tavi Costa highlights.

A negative real earnings yield doesn’t mean that companies are losing money, it means that the earnings yield on companies’ shares is less than the inflation rate.

Put differently, a basket of consumer goods and services held for the last year would have had a better nominal return than the earnings on a basket of S&P 500 shares.

When we first noted this trend about a year ago, here’s what we said:

The prior times when this occurred were: right before the 1987 market crash, right before the Dot Com Bubble popped, and right before the Housing Bubble popped. That’s it for the last 40 years.

Warnings like this are going off left and right, but all that matters to markets is the Federal Reverse and its $120 billion of QE a month. Fortunately for markets, the Fed is promising to ignore all incoming data for the foreseeable future, such as record job openings and break-neck inflation, which is now at 5.4%, and to keep the peddle to the metal. But they will change their mind eventually, at least for a while, and when the market sniffs that out, watch out.

The Fed has been promising to ignore all incoming economic data showing a precipitous slowdown in the economy, including their own models, but they will eventually cry ‘uncle.’ Until the market sniffs out that out, watch out.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Federal ‘Reverse’… not a misprint!

Anything could happen

Yikes. Oops. I guess I’ll leave the mistake 🙂