Submitted by Taps Coogan on the 9th of October 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

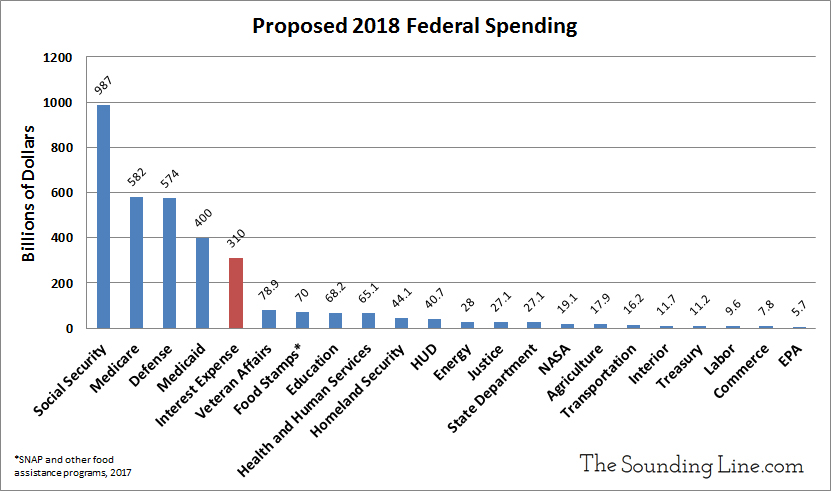

The US federal government is expected to collect roughly $3.422 trillion in taxes in fiscal year 2019 (which began on October 1st, 2018). Mandatory spending, including interest on the national debt, is expected to reach $3.102 trillion and discretionary spending will be at least $1.314 trillion (including $111.4 billion of ’emergency’ funding).

- Discretionary spending is determined by Congressional budget and spending bills every year. It includes all federal departments such as the DoJ, the FBI, the EPA, all federal employees, all defense spending, and the various miscellaneous programs and pet projects that Congress funds.

- Mandatory spending consists of the benefits owed to the people enrolled in entitlement programs such as Medicare, Medicaid, and Social Security. It is determined based on the number of people enrolled in the programs, not based on yearly political budgeting by Congress, hence it is mandatory. The interest on the national debt is also often considered a mandatory spending item, as it is automatically incurred based on the outstanding national debt.

In a sign of just how ridiculously large the US federal budget deficit has become, all federal tax receipts in the current fiscal year will barely be enough to cover mandatory federal spending, including the interest expense. Consequently, less than a quarter (24%) of discretionary spending will be covered by tax revenues this year. In other words, once mandatory spending is fulfilled, the federal government will need to rely on borrowing to pay for nearly all federal employees, federal programs, the military, foreign aid, and Congressional pet projects.

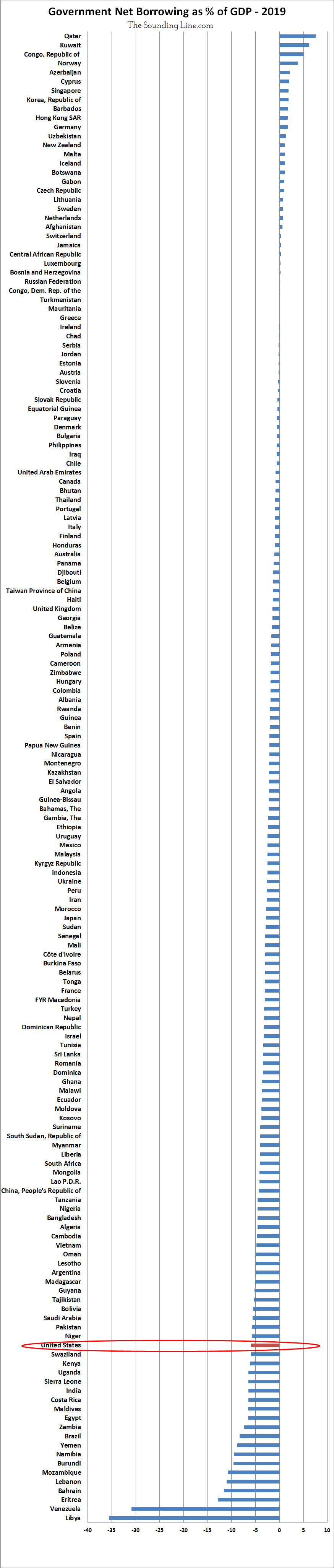

The US federal deficit is expected to be 5.9% of GDP in fiscal year 2019, according to the IMF. Of 166 countries tracked by the IMF (excluding micro-states, Caribbean Islands, etc…) the US will have the 20th highest deficit-to-GDP in the world, trailing countries like: Libya, Venezuela, or Uganda. Relative to its economy, the federal government is on pace to out-borrow the likes of Pakistan, Ukraine, South Africa, Liberia, Haiti, every single developed economy in the world, and every large economy in the world except India and Brazil. (Refer to the chart at the end of the article for the ranking of all 166 countries.)

A decade of historically low interest rates has hidden the true cost of America’s deficit spending. As a result, many Americans have become jaded to the risks such large perennial deficits pose to the long term health of the US economy. While debt incurred in the past years benefited from exceptionally low interest rates, future borrowing will be incurred at higher rates. The interest expense on the national debt is already the fastest growing element of federal spending and is larger than the combined amount spent on Food Stamps plus the departments of: Homeland Security, Housing and Human Development, Energy, Justice, the State Department, NASA, Agriculture, Transportation, the Interior, and the EPA.

Just this year, the government borrowed $8,172 per every person with a job in the country. Next year they will borrow more.

With the economy strong, unemployment low, and tax receipts at record highs, now is the time to cut spending and bring the federal budget into order.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any spam.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.