Submitted to The Sounding Line by Taps Coogan on 23 of January, 2016

Enjoy The Sounding Line? Click here to subscribe for free.

Of the 28 countries in the European Union (E.U.), 19 have elected to adopt the Euro currency (€). These countries are referred to as the Eurozone.

Recently in the Eurozone:

- French President Francois Hollande declares an ‘economic emergency’ as unemployment in France hits 10.6% (link here)

- Estimates of non-performing loans at Italian banks now surpass €200 billion (link here)

- Four Italian banks and the Portuguese Bank Novo Banco recently employed ‘bail-ins’ of bond holders (links here and here)

- Greek government is confronted with €20 billion in loan payments in 2016 (€6B in June & July alone) (link here)

As a gloomy global economic backdrop sets in, the Eurozone debt crisis continues in 2016. With persistent concerns about the viability of debt in the Eurozone, one might ask; “ Has the adoption of the Euro benefited members of the Eurozone economically?”

This discussion focuses on a few basic but important economic indicators for Germany, France, and Italy, the three largest economies in the Eurozone. It will also cover developments in Greece as it may be the Eurozone’s ‘canary in the coal mine.’

Our four Eurozone countries comprise about 2/3 of the population and Gross National Income of the Eurozone and all began adopting the euro in 1999.

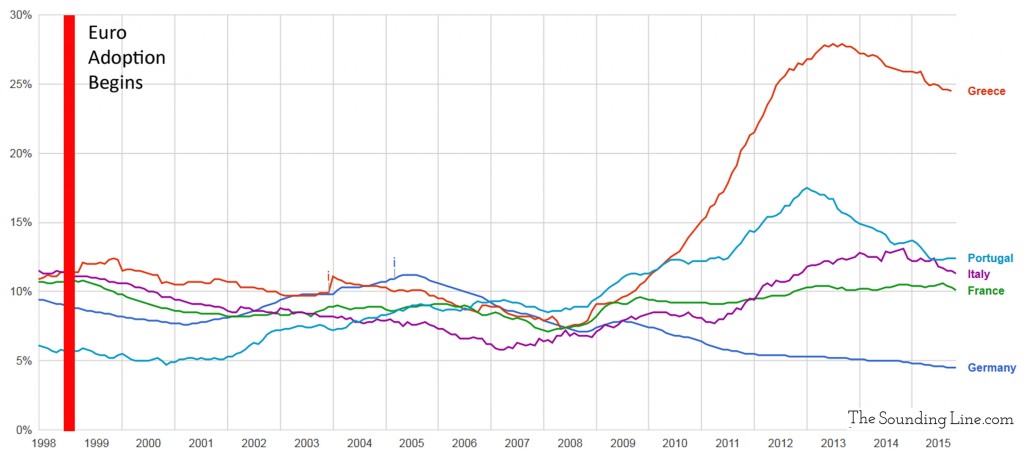

Unemployment:

Of the selected countries, Germany is the only member whose unemployment rate has trended notably downward since joining the Euro. Each other country has an unemployment rate which frequently trends above 10%. Portugal has been added to the chart above to point out that, perhaps surprisingly, it enjoyed an unemployment rate lower than Germany’s at the launch of the Euro in 1999. As the unemployment rate is important in describing the health of labor markets and the economic opportunity afforded to people, judging by these results, Eurozone membership has not clearly benefited the labor markets of France, Italy, Greece, or Portugal. It has however benefited Germany.

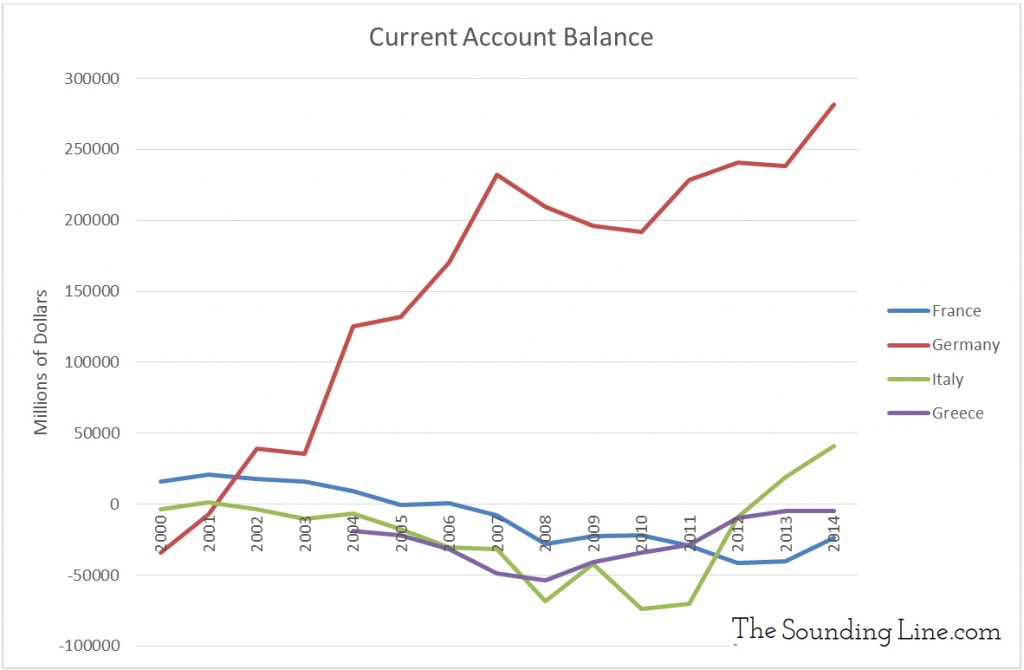

Current Account Balance

When the Euro was implemented, France was a net exporter with a positive current account balance and Germany was a net importer with a negative account balance. As shown in the chart below that is no longer the case. The current account balance is a measure of a country’s balance of trade and an important indicator of the competitiveness of their productive industries. Germany has witnessed dramatic improvement in its current account balance. By comparison, France, Italy, and Greece have experienced little to no improvement.

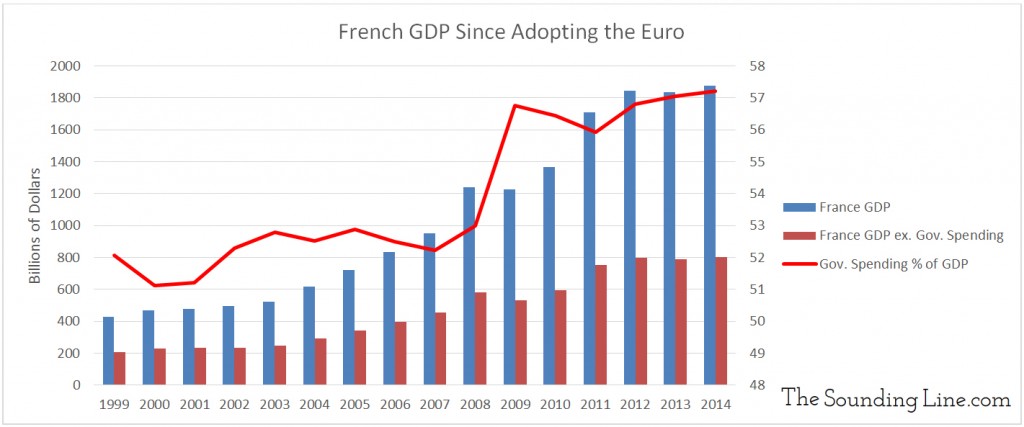

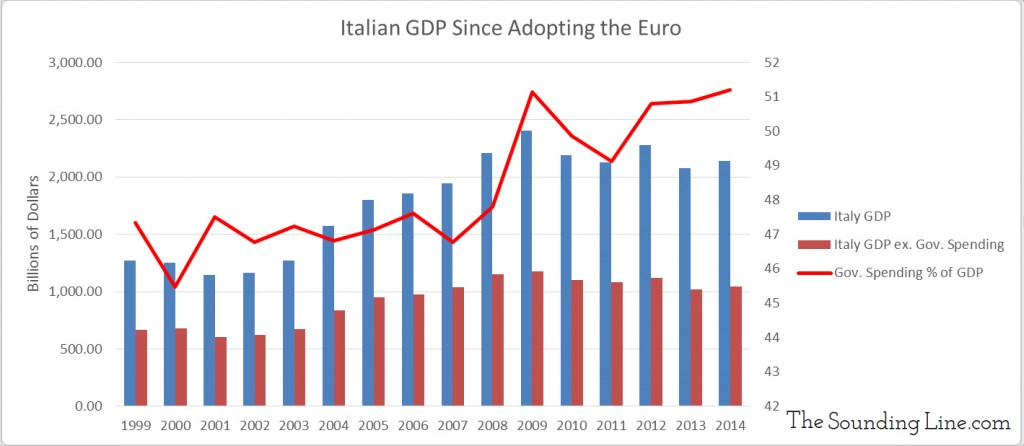

GDP:

At first glance, the national GDP figures for the targeted Eurozone countries paint a more positive picture. We can see that France and Italy have experienced significant GDP growth since joining the Eurozone in 1999. But when we delve deeper into those very same numbers something notable is revealed: a substantial rise in public spending. For both France and Italy, GDP growth has been accompanied by large growth in government spending (which is now above 50% of GDP for both countries).

Correcting for the increases in government spending, we can see that France’s private sector GDP growth plateaued around 2011.

Italy has not seen sustained GDP growth since 2009, though they too have seen an expansion of government spending.

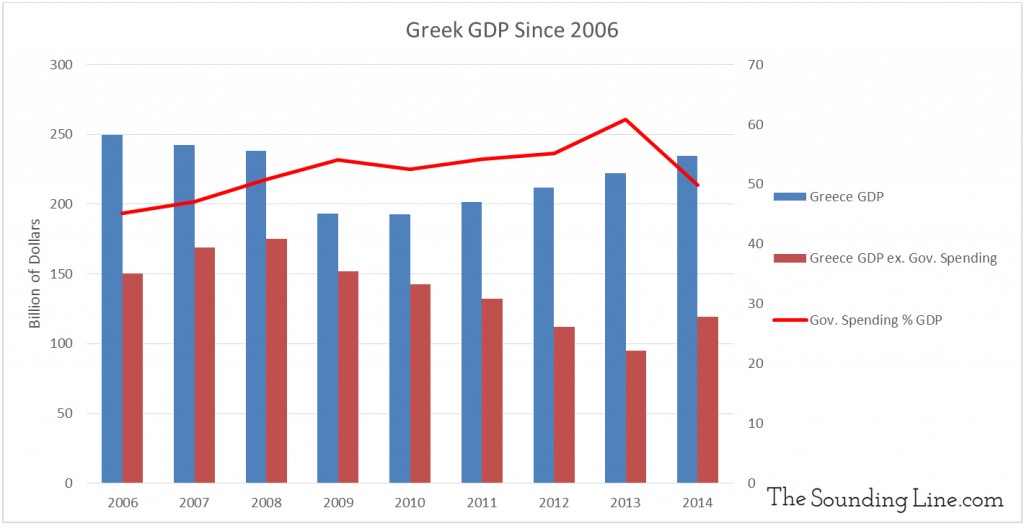

Greece’s experience has been disastrous with GDP still below 2006 levels even before correcting for government spending which peaked over 60% in 2013.

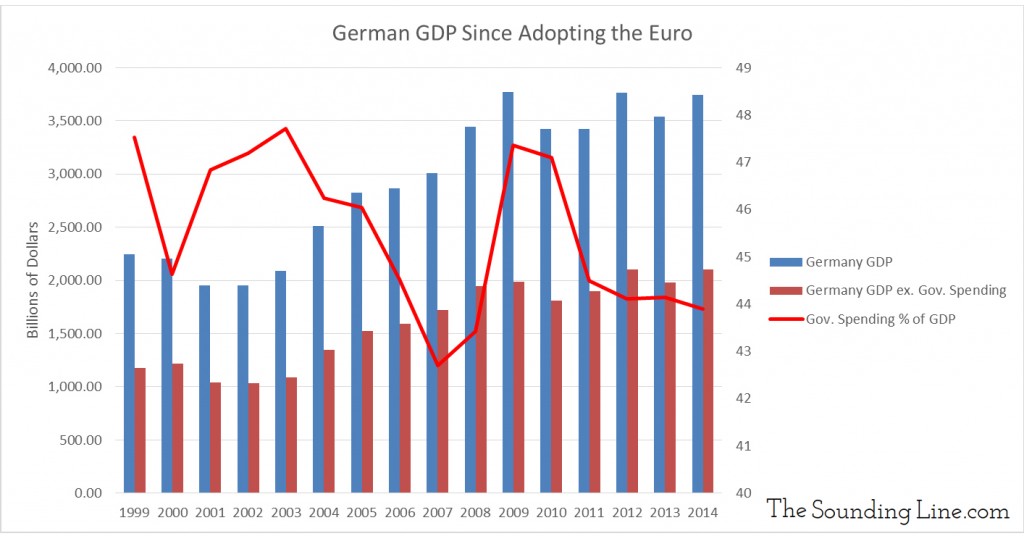

At the other end of the spectrum, Germany has experienced a reduction in government spending as a percent of GDP simultaneously with GDP growth, an indication of real economic growth. However, even that growth has now started to plateau.

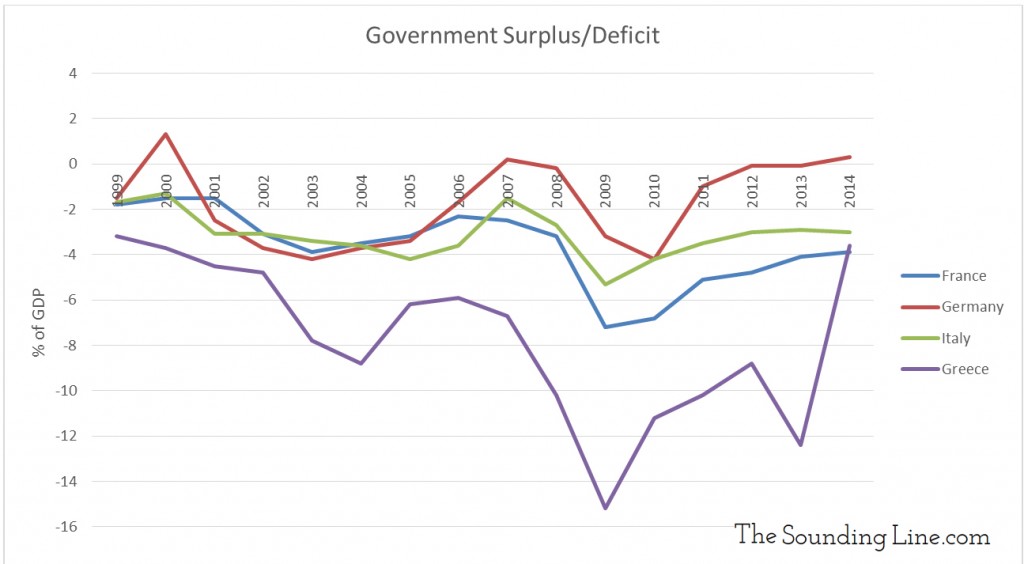

Deficit spending:

It comes as little surprise that, in the case of France, Italy, and Greece, the government spending which is so important in supporting GDP, has been deficit spending. This has very real consequences as deficit spending that doesn’t produce growth is simply not sustainable. For France, Italy, and Greece the predominant trend since joining the Euro has been growing deficits. It should be noted that Greece made significant reductions to their deficit in 2014. Germany, once again, seems to be best off with the occasional government surpluses and some moderate deficits.

In summary:

When we return to our question “Has the adoption of the Euro actually benefited members of the Eurozone economically?” by these metrics there is little indication that the Euro has benefited France, Italy, or Greece. As pointed out in each example above, Germany remains the major beneficiary of participation in the Euro.

While most certainly not an exhaustive economic analysis of these countries or the Eurozone, France, Italy, and Greece have all witnessed a persistent deterioration in key economic factors over the last 17 years. Perhaps the most politically consequential indicator will end up being the downward trend in employment. Furthermore, GDP growth has stagnated with increasing government deficit spending accounting for a large part of any growth trend. Such is also the case with the current account balance with only Italy seeing a recent positive development and France going from a net exporter to a net importer.

In the upcoming article ‘The Eurozone – Help or Hindrance Part II’ we will compare the GDP growth of the early Euro adopters to the rest of the E.U.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I enjoyed that very much, glad that you are back in business!

Thanks! Glad to be up and running. Stay tuned for Part II

[…] Part I of the ‘The Euro – Help or Hindrance’ (link here), we contrasted the trends in a few key economic indicators for Germany as compared to France, […]

[…] First, there has been a clear divergence between Germany and other members of the Eurozone (Part I here). […]