Submitted by Taps Coogan on the 20th of June 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

One of the primary beliefs underpinning the Federal Reserve’s monetary policy response to the 2008 financial crisis was the idea that rising equity prices would create wealth and confidence in the broader population and that that would boost the underlying US economy. This so called ‘wealth effect’ is a large reason why the Fed initially reduced, and has maintained for so long, interest rates near historic lows and why they have purchased trillions of dollars of US treasuries and mortgage backed securities since 2008. These Fed actions have injected trillions of dollars of new money into financial markets and displaced private sector investors and capital out of low yielding/low risk securities and into higher risk securities and stocks for almost a decade. Every treasury or mortgage backed security purchased by the Fed through its QE programs is one that might otherwise have been purchased by private capital. The result thus far has been one of the longest bull markets in history.

However, these actions have failed to boost the broader US economy, which has objectively failed to keep pace with financial asset price gains, particularly equity markets. Labor participation, industrial production, capital formation, the velocity of money, home ownership rates, capacity utilization, and a host of other measures of the broader economy have shown little or no recovery since the financial crisis of 2008. Objectively, the wealth effect has failed to lead to a proportional increase in wealth and confidence outside of the financial economy. Instead, the gap between those who have benefited from the stock market’s rise and those who have not participated has never been greater.

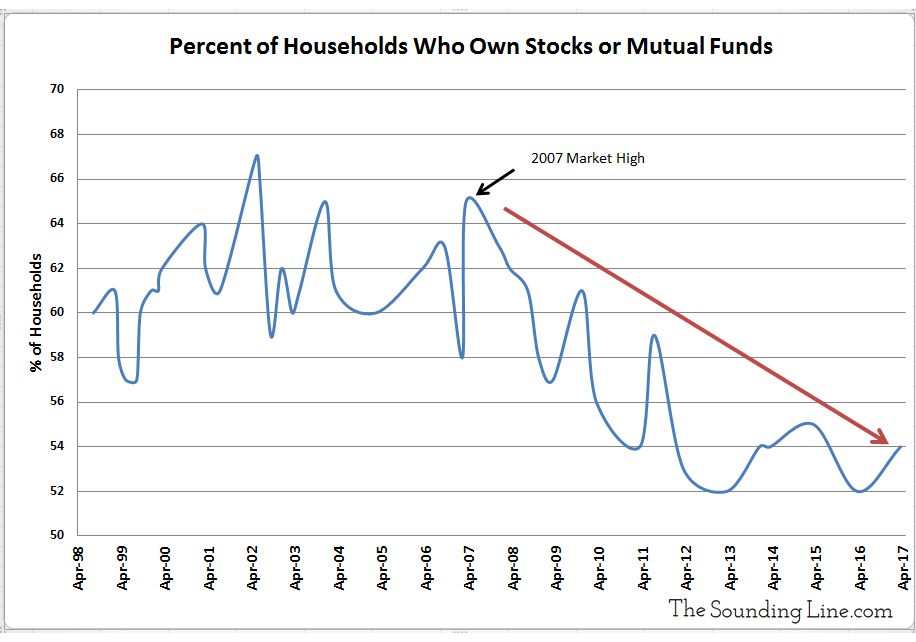

Back in early 2016 we described reasons why the wealth effect failed. One of these reasons, which remains true today, is that the wealth created by rising financial asset prices has been enjoyed overwhelmingly by the wealthy, and at the expense of everyone else. To illustrate this point further, the following graph shows that the percentage of US households who claim to own stocks or mutual fund shares has plunged from 65% at the peak of the market in 2007 to just 54% today, nearly the lowest level on record.

Fewer and fewer Americans benefit from the Fed’s so called wealth effect. Far from creating broad based wealth and economic growth, the Fed’s policies have contributed to a widening wealth divide in the US. Rising asset prices have made the wealthy wealthier while the rest of the country, people who have little or no financial assets, have seen their wages stagnate. While most Americans own few or no stocks, nearly all Americans have at least some modest savings at the bank. The Fed’s low interest rate policies have reduced interest income on bank savings for average Americans, who spend nearly all of that income, in order to increase stock returns for wealthy Americans who spend a far lower portion of their income. Such a program of reducing interest income for the vast majority of Americans in order to increase stock returns for the wealthy, can never succeed in creating broad based wealth. The events of the last number of years have gone a long way to prove this point.

It is also worth noting that while stock prices are very high by a range of metrics, the fact that household participation in the stock market is near record lows likely contributes to the low volatility and high resilience of the market. There are fewer so called ‘weak hands’ and they have fewer means to participate in markets than at any point in memory.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

How can people buy into the stock market with declining incomes? And, how do they compete with The Swiss National Bank (printing money and then buying stocks)?