Submitted by Taps Coogan on the 17th of June 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

As the UK referendum on the EU approaches on June 23rd, polling data is increasingly pointing to a British exit from the EU, or ‘Brexit,’ as the most likely outcome. While this is undoubtedly a concerning development for the EU’s political class, the loss of the UK is only the start of the EU’s problems. Polls now show that a majority of the French citizenry not only want the British to leave the EU (here) but want their own referendum on the EU as well (here). Nearly half of Italians want to leave the EU (here) and polls have indicated that the majority of people in the Czech Republic, Austria, and Greece hold a negative impression of the EU as well. The same holds true for the Swedes, a majority of whom would support a Swedish exit in the event of a Brexit (here).

The dissatisfaction with the EU is widespread and for good reason. As we discussed on The Sounding Line here and here, countries in the Eurozone and/or EU have grown more slowly, accumulated more government debt, experienced greater unemployment, larger trade deficits, and greater inequity between countries than those European countries that have remained outside of the Eurozone and/or the EU. At its core, the EU is simply not structured in a sustainable way (see here).

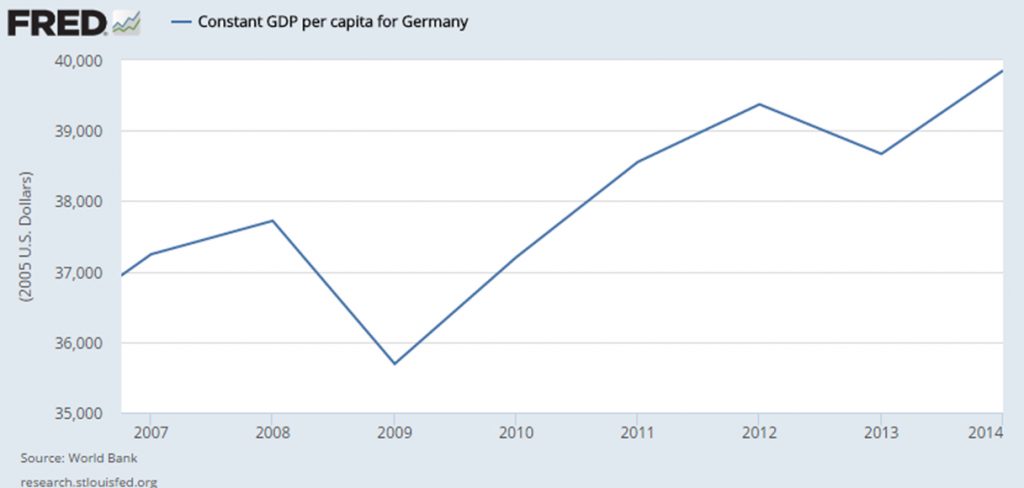

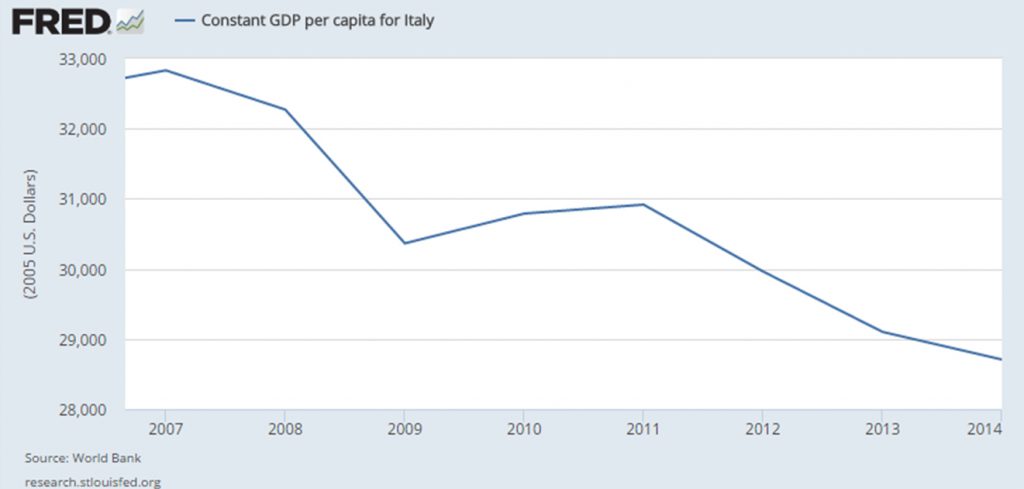

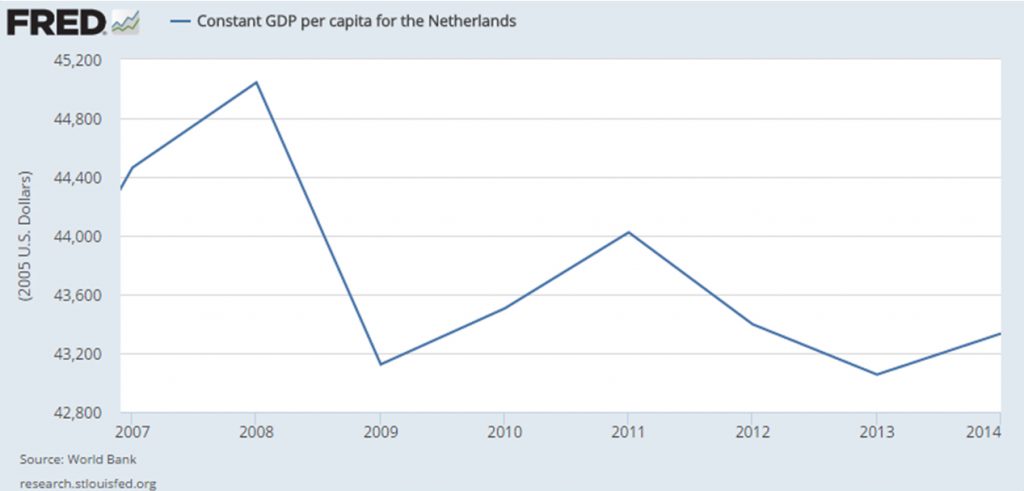

We submit another metric which further reveals the economic stagnation that has befallen the Eurozone. The charts below show the inflation adjusted GDP per capita for the five largest Eurozone economies: Germany, France, Italy, Spain and the Netherlands.

These charts reveal that, when accounting for inflation, the economic productivity of the average person in France, Italy, Spain and the Netherlands has been decreasing since 2007-2008, having never recovered from the global recession in 2008. For all but Germany, participation in the Eurozone is now being marked by the longest and largest decline in productivity going back to the start of record keeping in the 1960s.

When inflation adjusted per capital GDP declines, it means that these Eurozone economies are becoming fundamentally less efficient. The average person’s work effort is resulting in ever lessening value and, in turn, these very same people are bound to experience diminishing real economic prosperity and/or increasing indebtedness.

Despite the fear mongering coming out of the EU that insists that leaving the EU means certain economic decline, the anti EU mood is entirely understandable and grounded in factual economic statistics. Across Europe people are starting to recognize that there are a great number of non EU nations that enjoy all of the benefits of “free trade” and the convenient movement of people without having to give up their national sovereignty. The political and bureaucratic structure of the EU is entirely non-essential in permitting the very “free trade” it supposedly promotes. One only needs to remember that the US, Canada and Mexico enjoy the largest cross border trade in the world, all while having wholly independent and sovereign political structures.

Regardless of the outcome of the Brexit referendum, if the EU cannot radically reform its scope and practices, increasingly poor economic results will only continue to support a rush to the exits.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.