Submitted by Taps Coogan on the 15th of June 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

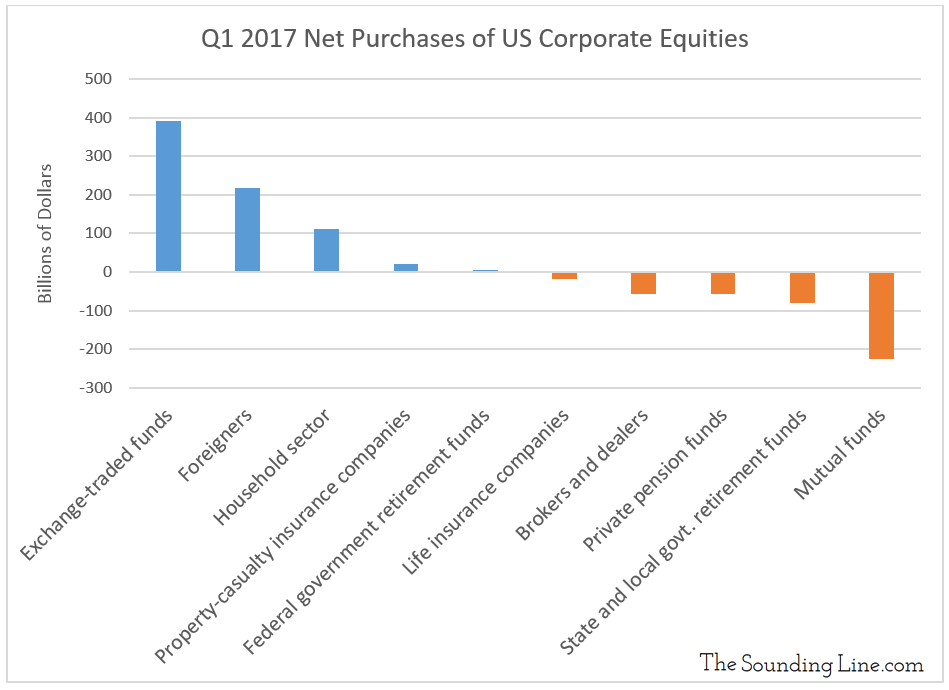

Despite domestic political controversy and weakening economic fundamentals, the Dow Jones Industrial Average appreciated an impressive 5.3% in the first quarter of 2017, the largest quarterly increase in three years (since the fourth quarter of 2013). A net total of just over $306 billion of corporate equities were bought in the US in the first quarter, the most since the fourth quarter of 2014. As the following chart shows, the largest net purchasers were exchange-traded funds (ETFs), foreigners, and US households. In contrast, the largest net sellers were mutual funds, state and local retirement funds, and private pension funds, all further reinforcing concerns, discussed frequently here on The Sounding Line, that pension and retirement funds are becoming dangerously depleted.

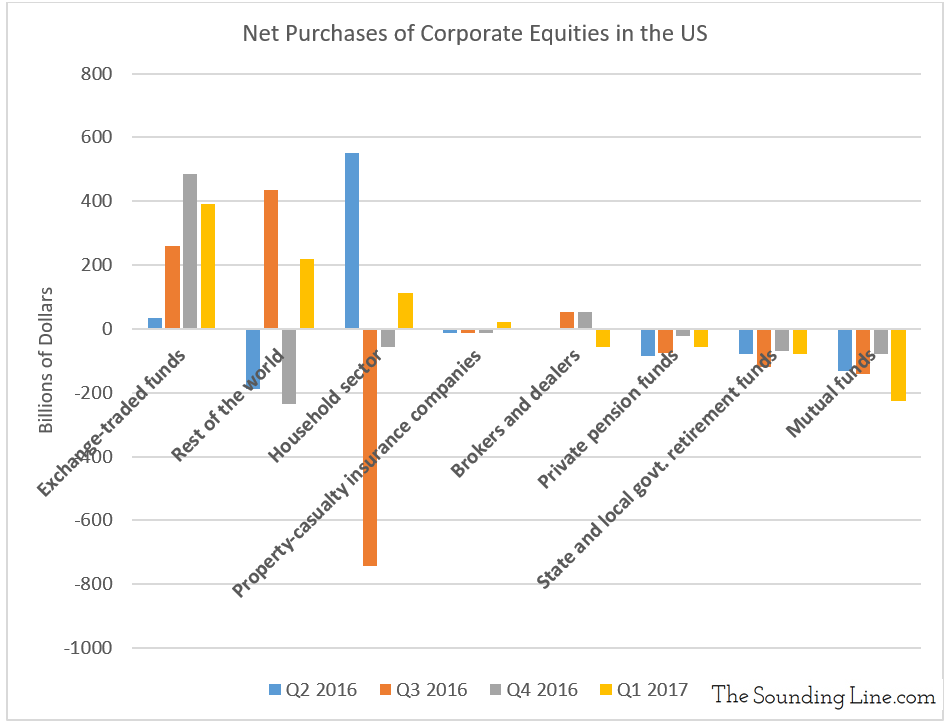

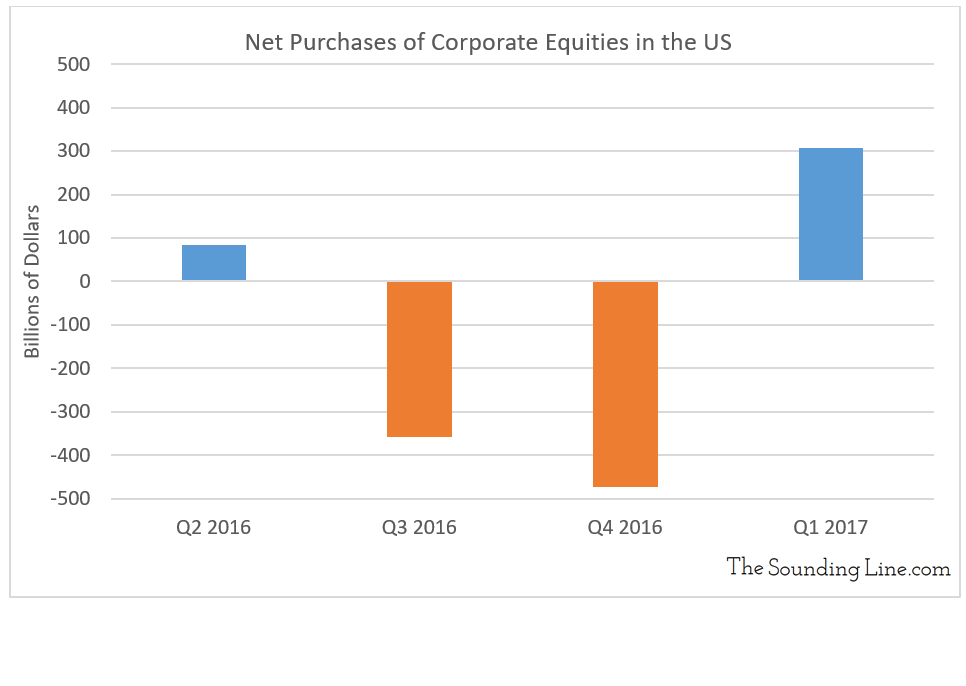

As the following two charts shows, ETFs have been the only consistent large net purchasers of corporate equities in past last year. While ETFs are in turn purchased by a host of other parties, one must wonder how long ETFs can remain consistent net purchasers when the broader market has been much less consistent.

It is worth noting that these figures will most likely be revised in future releases by the Federal Reserve and should thus be treated as approximations.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.