Taps Coogan – April 17th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

One of the maxims we’ve used since the early days here at The Sounding Line is: ‘never use the labor market for forward looking statements.’ That’s because trends in the labor market are among the more lagging economic/financial indicators. Indeed the unemployment rate typically hits its cycle lows just a few months before the formal onset of a recession and on a few occasions has bottomed after a recession had already been declared.

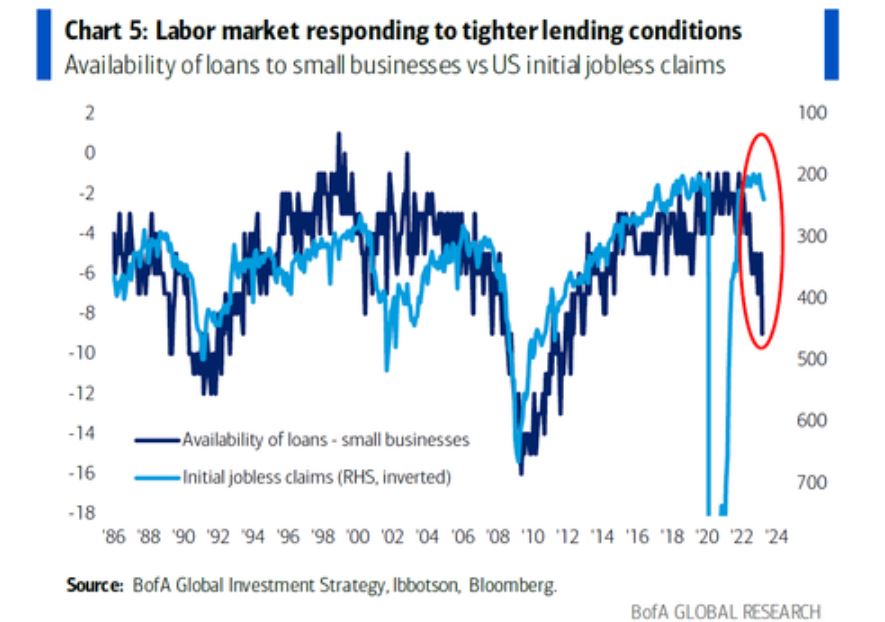

Along those lines, the following chart from Bank of America via Markets & Mayhem, highlights the relationship between credit availability to small businesses and changes in the labor market.

The banking business model, borrowing at the overnight rate and lending at long term rates, doesn’t work particularly well when the yield curve is inverted. Banks have gotten around that for the last year because they’ve refused to raise deposit rates inline with the Fed Funds rate. That game is now effectively over as savers have finally wised up to the existence of treasury money market funds yielding >4%.

As banks’ costs of funds rise towards the Fed Funds rate, they’re getting a lot more serious about who they’ll lend to. Historically, that sort of credit tightness, particularly on loans to small businesses (who employ most Americans), has led to labor recessions.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.