Submitted by Taps Coogan on the 30th of June 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Throughout the 2008 financial crisis, the financial and political establishment were adamant that the largest banks and financial institutions had become so consolidated, so few in number, so large, and so interconnected that the failure of any one (except Lehman Brothers apparently) would lead to the collapse of the entire global financial system. So the phrase ‘too big to fail’ entered into the average American’s lexicon.

The argument was made that the largest banks and institutions absolutely had to be bailed out by the American taxpayer. A preposterously long list of 734 banks were eventually deemed ‘too big to fail’ and the American taxpayer, already spinning from loses, ended up bailing out the very banks that helped create the disaster, all to the astonishing tune of $204 billion just to the banks (see here).

It would seem logical that if the banks were so large that they poised a systemic risk to the global economy requiring hundreds of billions of taxpayer dollars to cover their loses, the bailouts should have come with some stipulation that the banks be broken up into ‘small enough to fail’ organizations after the crisis was resolved. Alas, this was not the case; it appears that the ‘people’s’ representatives in Washington overlooked that important detail.

Fast forward to today, with markets in the midst of a global industrial and trade recession (see here, here, here) and one might wonder whether America’s financial system is still dominated by ‘too big to fail’ banks.

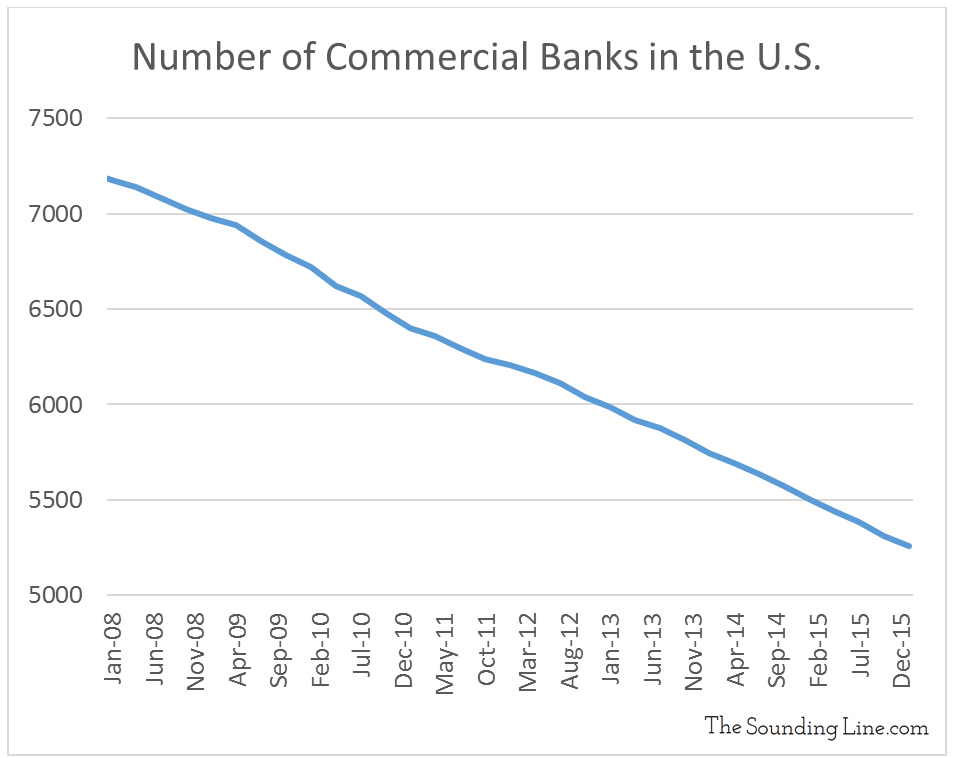

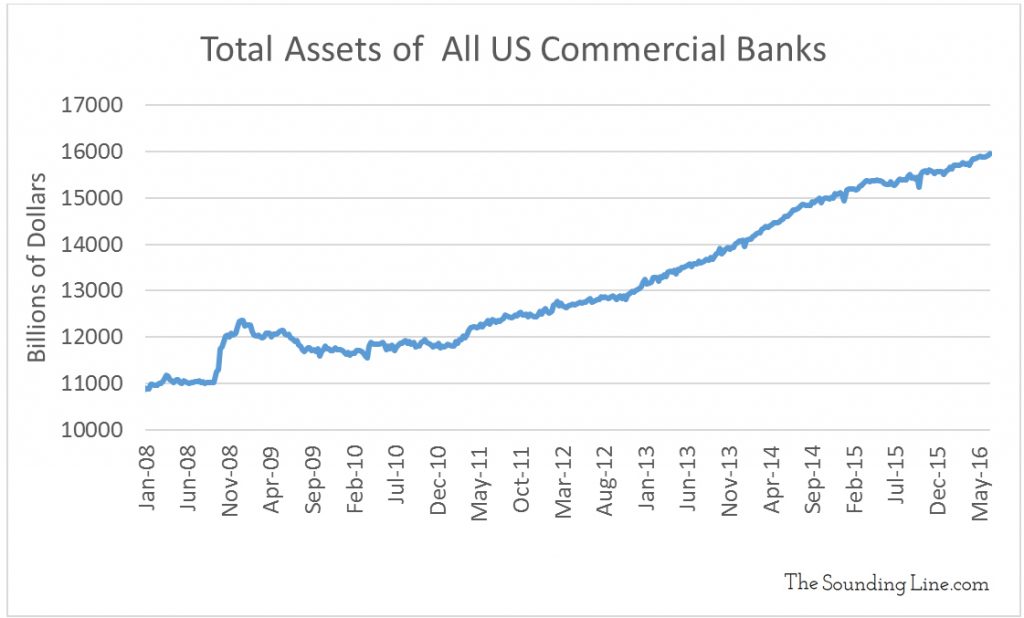

Quite remarkably, in the face of increasing global risk, there are 25% fewer commercial banks in the US today than in January 2008 and those remaining banks hold nearly 50% more assets as shown in the charts below.

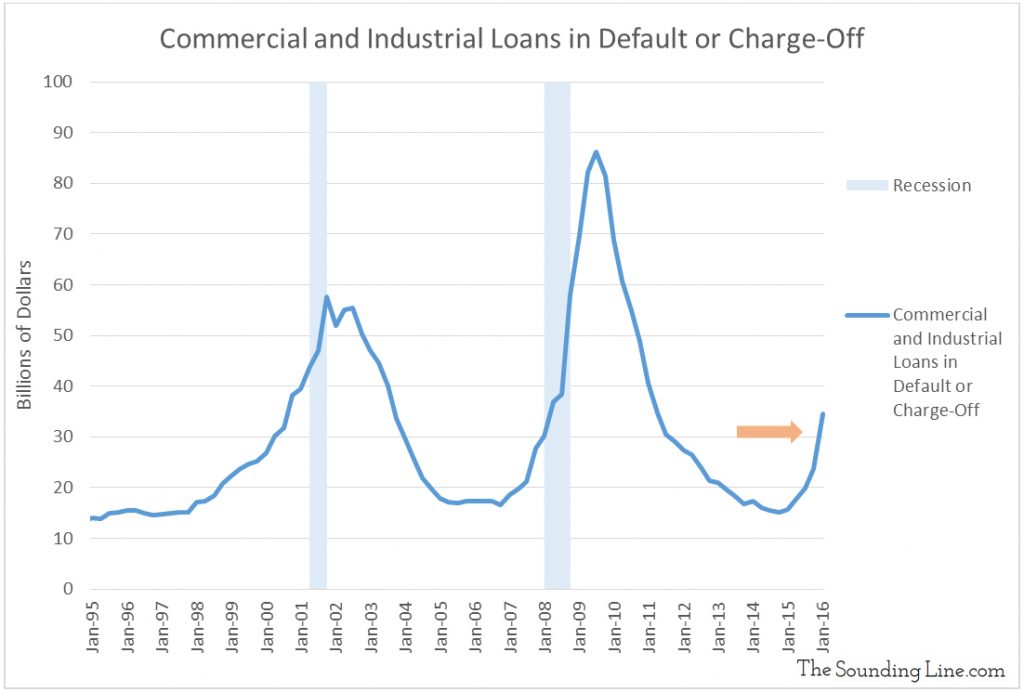

If that was not concerning enough, the total amount of debt held by commercial banks, in delinquency or ‘charge-off’ (declaration of severe delinquency), is once again spiking higher: a tell-tale indicator that a financial crisis is imminent.

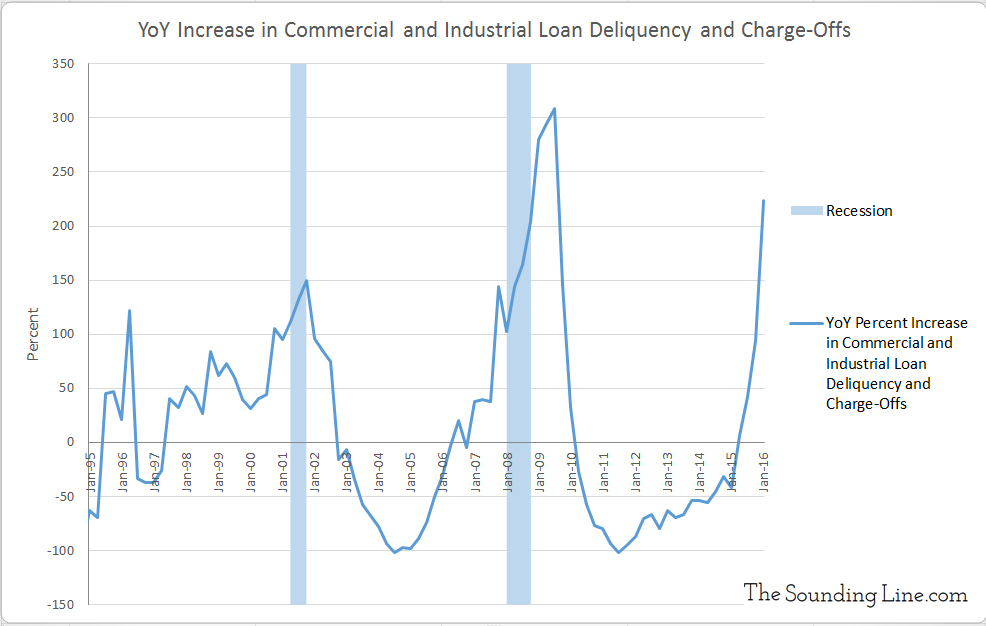

The chart below provides a sense of how quickly the delinquency problem is accelerating. The year-over-year (YoY) rate of increase in the delinquencies is over 200% and higher than when the 2008 or 2001 recessions started.

When the next financial crisis arrives, and it looks to be arriving soon, we can expect, once again, to be presented with the same false choice: bailing out ‘too big to fail’ banks or financial armageddon. Banks will never be immune to failing, including big banks. Providing taxpayer funded bailouts to big banks subsidizes risk taking, funnels resources into dysfunctional organizations, and guarantees that the financial system continues to be dominated by the same big banks ad infinitum. Instead of trying forever to keep big banks from failing, perhaps we should focus on preventing financial institutions from being ‘too big to fail’ in the first place.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.