Submitted by Taps Coogan on the 29th of June 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

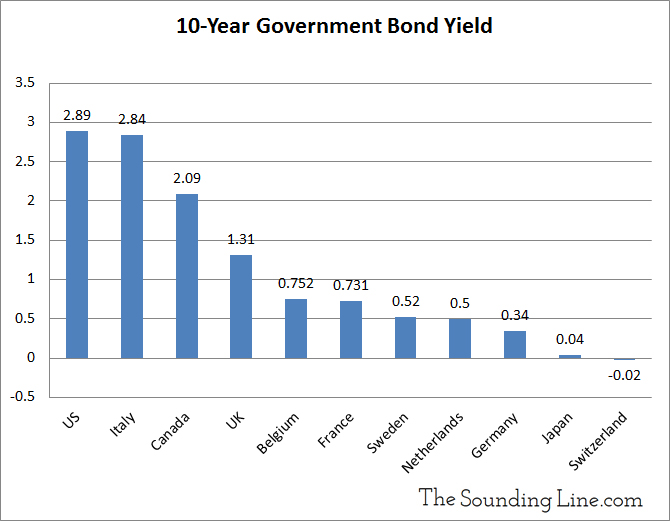

As the following chart shows, the US currently has the highest yield on its benchmark 10-year government bond of any country in the G10. Countries that currently have lower borrowing costs than the US include Japan which has dramatically higher debt levels (253% debt to GDP vs 105% in the US) and Italy which was higher debt levels (131%) and elevated geopolitical risk.

The fact that US interest rates are among the highest in the developed world is the result of a growing divergence in monetary policy that portends big problems down the road for Europe and Japan.

When the US Federal Reserve unveiled its quantitative easing and zero interest rate policies in the wake of the 2008 recession, many analysts feared that the easy money policies would cause a dramatic decline in the value of the dollar. Those fears never materialized for a simple reason: all other major central banks quickly adopted the same policies. So while currencies lost purchasing power relative to financial assets, synchronization between central banks prevented large cross-currency devaluations.

Fast forward to today and a substantial divide has developed between US monetary policy and the policy other major economies. Ten years into the economic recovery and the European Central Bank (ECB), the Swiss National Bank (SNB), and the Bank of Japan (BOJ) are maintaining monetary policy at or near its all time most accommodative levels. The ECB has signaled its intent to continue expanding its balance sheet until the end of 2018 and to keep interest rates at record negative lows until at least mid 2019. The BOJ and the SNB have not communicated any intent to tightening monetary policy for the foreseeable future. Meanwhile, the US Federal Reserve is reducing its balance sheet and raising interest rates seemingly as fast as it can without inverting the yield curve.

While the global economy is growing, markets are stable, and inflation is low, the impact of this monetary policy divergence is muted, though likely behind the US dollar’s recent strengthening. If the economy begins to slow, markets continue to weaken, or inflation picks up, the divergence may become much more important. That is why the ECB and BOJ are in a lose-lose-lose situation.

If the economy slows or markets sell off, the ECB and BOJ will not have any conventional policy tools to support markets and they may have to risk launching renewed QE without synchronization with the US Federal Reserve. That could create substantial currency risk and capital flight out of their economies. What’s more, the ECB and BOJ are already purchasing nearly all the qualified sovereign debt available in both markets making any re-acceleration of QE even more unconventional. On the other hand, if their economies strengthen and inflation picks up and the central banks leave interest rates at record negative lows, the effect will be even lower real rates and even wider divergence between the US, hitting their currencies and driving capital away. Yet, because the national debts of countries like Japan, Italy, and Greece are so high, if the ECB or BOJ allows rates to rise, those governments may quickly find themselves unable to service their debts. When you are borrowing at 0.04% like Japan, a half percent increase in interest rates equates to a more than a ten fold increase borrowing costs. Consider that Japan is already spending 37% of tax revenues servicing its national debt. The governments in Southern Europe and Japan simply cannot afford to let borrowing costs rise until their budgets are balanced, something which they have expressed no intention of ever doing.

Hence, the ECB and BOJ are in a lose-lose-lose situation from which there are essentially no plausible positive outcomes. For now they remain in a Goldilochs zone of slow but positive global growth. When growth either speeds up or slows down, the markets will realize that the policy mistakes have already been made and that no good options remain.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.