Taps Coogan – August 18th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe

It is typical during recessions for official measures of inflation to drop as asset prices fall, bank lending tightens, and consumer spending slows. During the Global Financial crisis, official measures of inflation briefly turned negative, causing great alarm among inflation-obsessed central bankers, and providing further impetus for the quantitative easing programs first unveiled during that crisis.

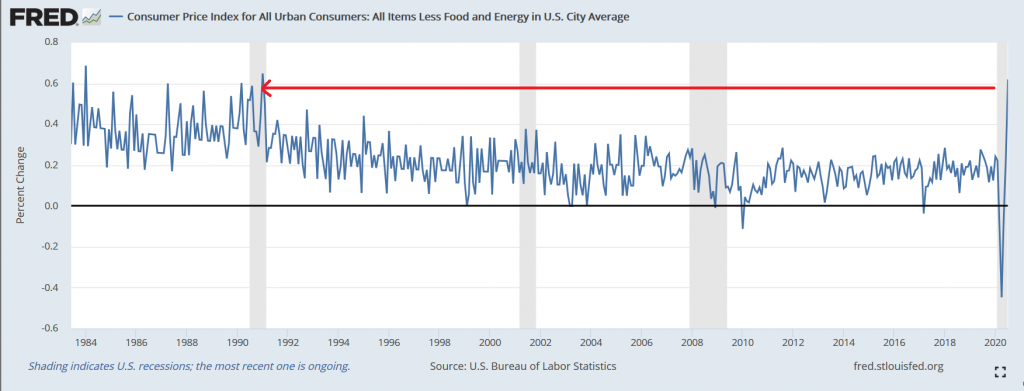

While official inflation measures slowed during the initial Covid lock-down, the sharp and enduring drop that many expected has already started to reverse, and shockingly quickly. In fact, Core CPI showed its fastest month-over-month increase in July since 1991.

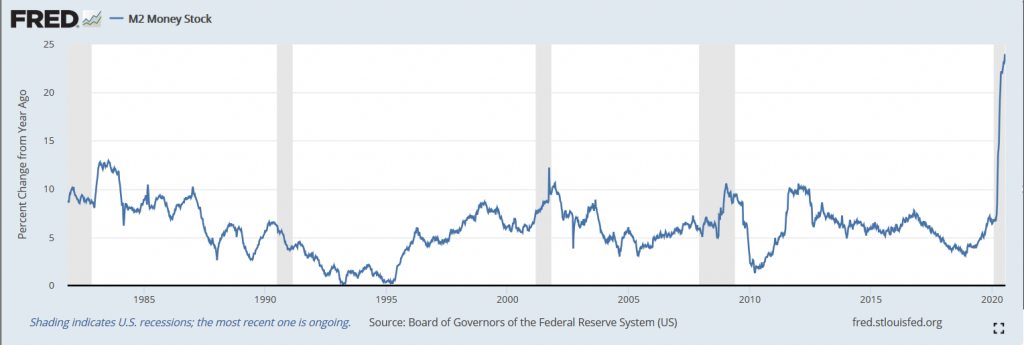

Not only has the Covid economic crisis caused price-hiking supply chain disruptions unseen in recent recessions, the overwhelming size and speed of stimulus measures unveiled, and the advent of ‘helicopter money’, but it has had profoundly different effects on the money supply growth rate, completely incomparable to past QE programs, as we have frequently discussed.

M2 Money Supply Growth Rate

Add to all of that the fact that official measures greatly understate the inflation experienced by middle and lower income households through a collection of statistical tricks like hedonic quality adjustments and the averaging of essential services (education, healthcare, etc…) with high inflation rates and non-essential consumer goods with low inflation rates (phones, flat-screen TVs, etc…), and one has to wonder how long we will be able to entertain the delusion that low inflation is our biggest monetary challenge.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Love the website. Yes, go price an oil filter, a 2×4, a box of deck screws, or a visit to the grocery store. You have to wonder who pays attention to any statistical propaganda anymore. Thanks.

Apologize, did not know your website comments required approval, but thanks anyway.

Mommicked, thanks for the interest in the site. Once I’ve have approved one comment, if you use the same email, you won’t need approval in the future