Taps Coogan – March 25th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

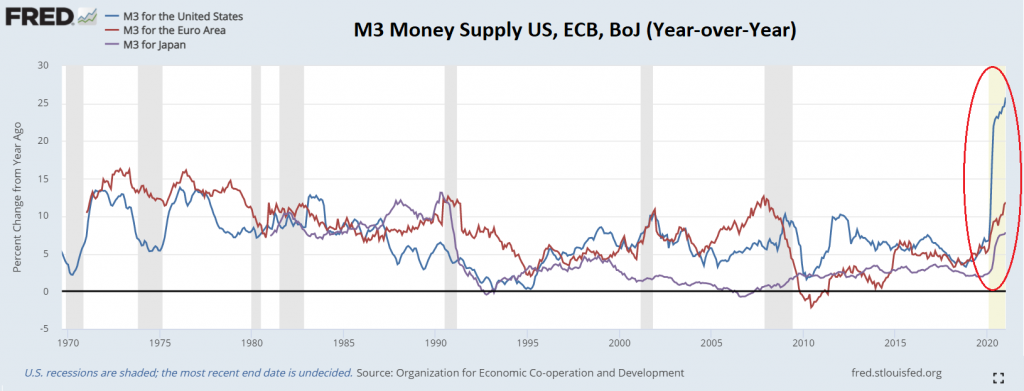

The following chart shows the year-over-year broad money supply growth of the US, Eurozone (ECB), and Japan (BoJ).

The increase in M3 money supply in the US is not only unprecedented in the US, it is running at more than twice the pace in the Eurozone and over three times the pace in Japan. Expect the US M3 supply to spike further in the coming month as the latest round of stimulus checks get deposited in people’s accounts.

A lot of attention has gotten focused on the potential inflationary impacts of this massive increase in the money supply, including here at The Sounding Line. Everyone, including the Fed, is now expecting an inflation overshoot in the coming months.

However, sustaining high inflation in an massively overindebted economy with excess capacity, low labor participation, and perilously overvalued financial assets is not a naturally occurring phenomenon. It will take further intervention from the Fed, probably something like Yield Curve Control, and the Fed is unlikely to do that without a crisis that forces them to.

The threat of inflation, as it pertains to over-valued & over-indebted markets, is not inflation itself but a rise in interest rates that inflation causes, a rise which leads, not to more inflation but, to default and deflation.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.