Submitted by Taps Coogan on the 16th of March 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

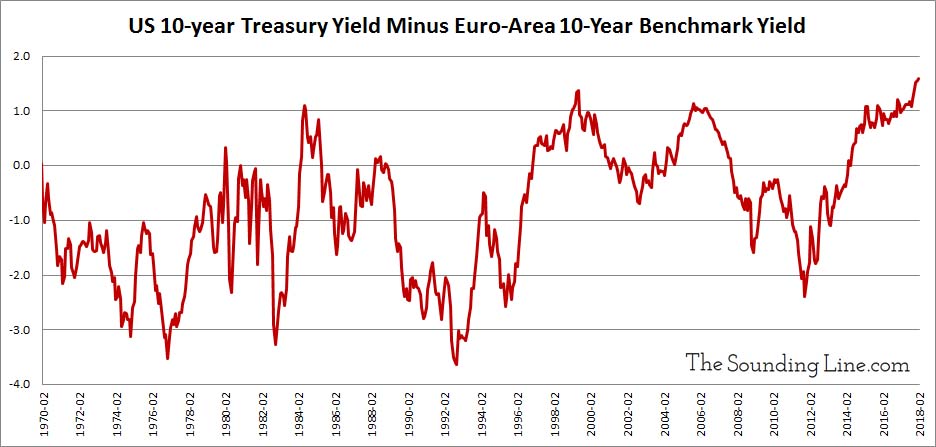

US 10-year treasury yields have never been higher relative to the Eurozone benchmark 10-year government bond yield. In other words, the borrowing cost for the US government (for 10 year bonds) has never been higher relative to the combined borrowing costs of the various countries that use the Euro currency such as Germany, France, Italy, Spain, and Greece. It follows that investors’ nominal returns have never been higher on US Treasuries relative to Eurozone government bonds.

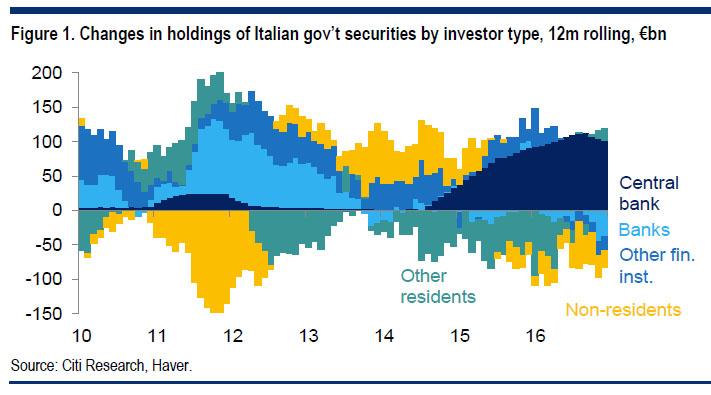

In late 2013, the US Federal Reserve began a slow process of reversing its extremely accommodative monetary response to the 2009 financial crisis. Four years later and the Fed’s balance sheet is finally beginning to shrink and interest rates are rising, albeit slowly. Despite improving economic conditions, the European Central Bank (ECB) has not meaningfully undertaken any such policy normalization. It is continuing to expand its balance sheet via an ongoing QE program that will last at least until the latter part of 2018 and it has kept its overnight interest rates at record negative lows. The result has been an increase in the yields on US Treasuries while Eurozone government bonds remain very near their all time record lows. As the following chart from Citi starkly points out, private investors and even European banks have largely unloaded Italian government bonds at these low rates, leaving the ECB as virtually the only buyer.  While the Fed has been slow to begin normalizing its policy, it is at least four years ahead of the ECB. As we first discussed here, the world has been experiencing one of the longest continuous economic expansions in history. If the US makes it another two years without recession it will be a record going back to the country’s founding. When the next recession eventually arrives, the ECB will have little room to accommodate markets further. With private investors largely displaced from government bond markets in countries like Italy, continued or accelerated QE will serve little additional stimulative purpose. It simply delays the calamity that will occur whenever QE ends and real price discovery is imposed on Eurozone bonds.

While the Fed has been slow to begin normalizing its policy, it is at least four years ahead of the ECB. As we first discussed here, the world has been experiencing one of the longest continuous economic expansions in history. If the US makes it another two years without recession it will be a record going back to the country’s founding. When the next recession eventually arrives, the ECB will have little room to accommodate markets further. With private investors largely displaced from government bond markets in countries like Italy, continued or accelerated QE will serve little additional stimulative purpose. It simply delays the calamity that will occur whenever QE ends and real price discovery is imposed on Eurozone bonds.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.