Taps Coogan – October 15th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

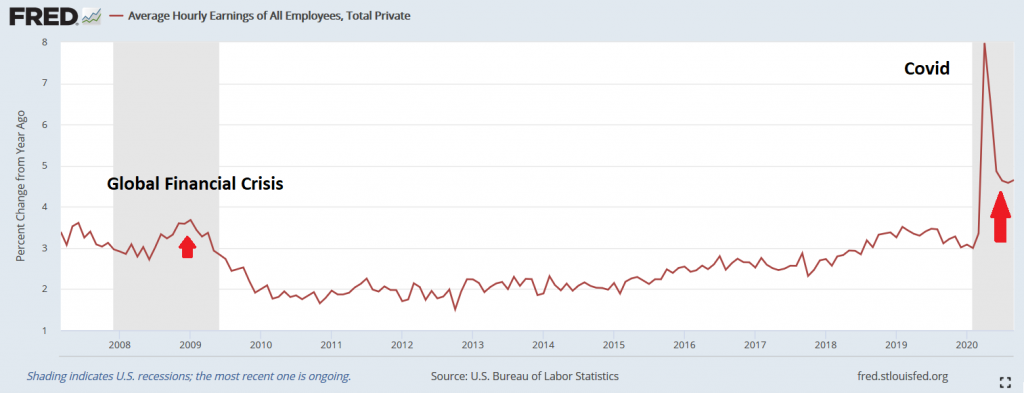

One of the unique features of the Covid Recession is that average hourly earnings in the private sector have risen dramatically since March.

The rise is primarily the result of low income workers being the first to get laid-off during recessions, leaving the remaining workforce disproportionately skewed towards higher earners. Simply put, when your income drops to zero, you’re no longer counted in the average.

A brief rise in average wages is a frequent feature of recessions, but the phenomenon has been much more severe for this recession, which has hit lower income service jobs exceptionally hard.

Average Private Sector Wages Year-over-Year

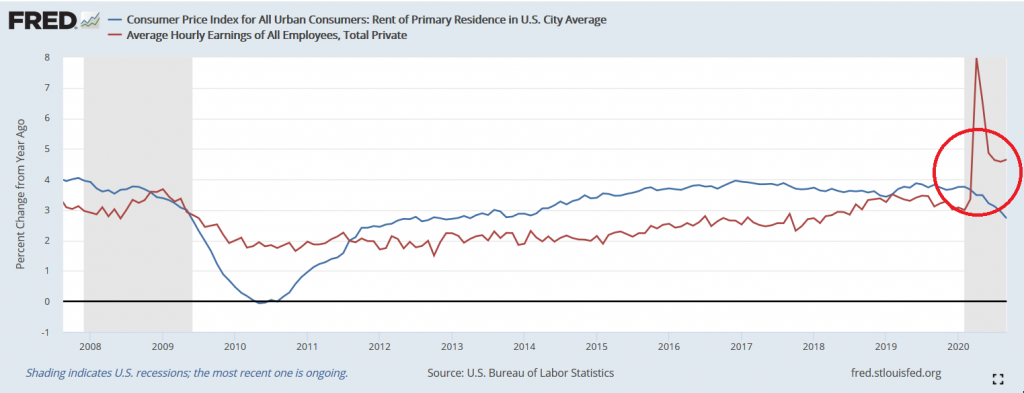

Meanwhile, rent inflation, which had been running at an annualized rate of roughly 3.7% for years, is falling as evictions, downsizing, and the migration out of urban areas pressures rents lower in key markets. Year-over-year rent inflation has fallen to a still-fairly-high 2.7%.

Average Wages vs Average Rent Inflation

That means that, for the first time since August 2011, average hourly wages are technically ‘rising’ faster than rent. Of course, it’s nothing to celebrate. Average hourly wages are not rising for the right reasons.

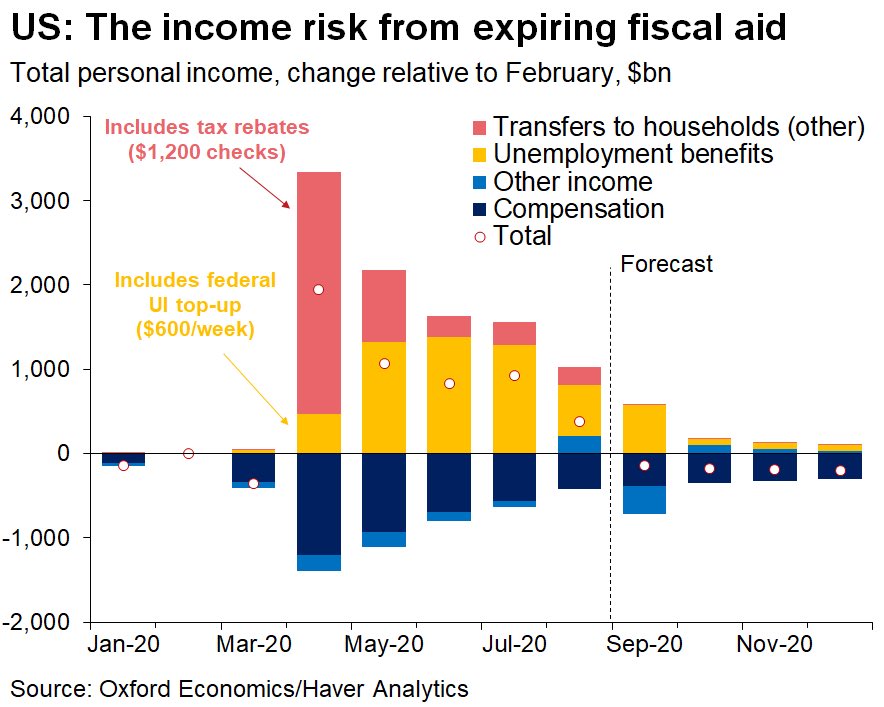

To add another wrinkle to the story, average total personal income, which looks at the population as a whole, including people on unemployment, has also risen strongly since March. That is because roughly two thirds of people on unemployment were making more on unemployment than at their prior job until August. Add to that the $1,200 stimulus checks. Those two factors have been so large that they have actually offset the decline in average income from all of the lay-offs.

Legions of people and business have been ruined and the stimulus has not made a difference for many of them, but when speaking strictly of averages, total personal income is actually up strongly so far this year.

With all of the talk of trillions of dollars of spending being thrown around in Washington these days, it’s easy to forget that the $2.2 trillion CARES act amounted to roughly $17,000 of stimulus spending per household in the US (there are about 129 million households in US). The proposed $1.8 trillion follow-up stimulus deal would be another roughly $14,000. Think about that for a second.

The fact that only now and for all the wrong reasons, incomes are rising faster than rent ought to be the ultimate condemnation of the Fed’s inflation targeting policies. Averaging high rates of inflation on essential goods and services like rent, which have run in excess of wage growth for nearly a decade, with cheap imports made by slaves in China produces garbage statistics that lead to nonsensical conclusions. Assuming that one accepts the concept of inflation targeting in the first place, why on Earth is the Fed still averaging the inflation rate on your home with the inflation rate on your iPad? For the vast majority of the country, the overwhelming determinant of quality of life is where you can afford to live. Changes in the cost of importing things from China are entirely at the margin.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Our $17000 must have got lost in the mail, but I will be on the lookout for that $14k.

You’ll have better luck with the tax bill