Taps Coogan – April 19th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

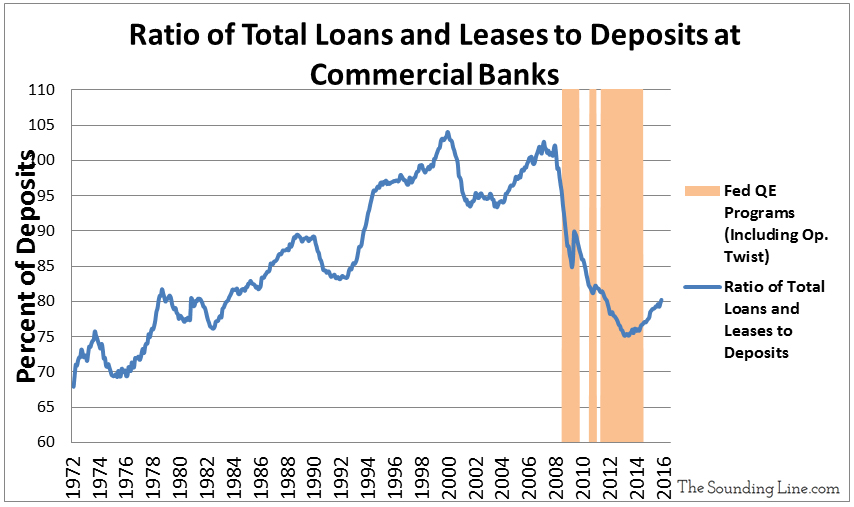

Since the earliest days here at The Sounding Line, we’ve been discussing the failure of ultra-lose monetary policy to spur bank lending growth in the US.

Back in 2016 we noted:

The failure of the programs (QE and ZIRP) occurred, at least in a proximate sense, because while the Fed injected commercial banks with literally trillions of dollars via its various QE programs, they simultaneously implemented a policy of paying banks interest on reserves kept at the Fed. As a result, the banks chose to park the Fed’s newly created QE money right back at the Fed to collect interest without any of the risk and overhead associated with actual banking. Money that was ostensibly created to facilitate affordable bank lending to would be homeowners, consumers, and businesses never left the financial system, serving as little more than welfare for banks.

Enough time has now passed since the Fed began tapering its QE3 program (December 2013) and eventually, modestly raised the Fed funds rate (December 2015) that it warrants taking a fresh look at bank lending behavior.

Confirming our suspicions, the charts below show that once the Fed began to normalize its policy so did the banks. Banks are just now starting to lend out more of their deposits and remove some of their excess reserves from the Fed. The Fed’s policy of paying interest on excess reserves remains in effect, and nearly $2 trillion of excess reserves remain at the Fed. Yet, that amount of excess reserves peaked in September 2014 nearly simultaneously with the Fed ending its QE3 program.

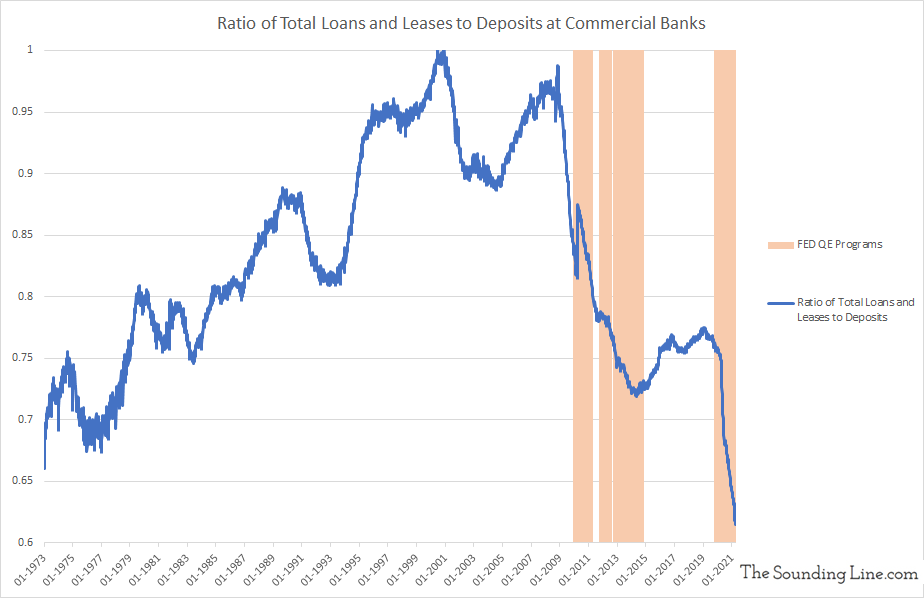

Here is the same chart updated for today:

In the simplest sense, banks borrow money from depositors and/or the repo market and lend it businesses, consumers, and prospective homeowners. In other words, they borrow overnight at the Fed Funds Rate (which is a rough proxy for the deposit and the repo rate) and lend it at long term rates (mortgages, business loans, etc…).

In pre-Financial Crisis times, a bank had no incentive to take deposits if it wasn’t going to lend against them because they had to pay a non-trivial deposit rate or a non-trivial repo rate.

When the deposit rate and repo rate are close to zero, and the Fed is paying interest on excess reserves, banks can accumulate as many reserves and deposits as they want without any urgency to lend them out. Sitting on deposits costs them essentially nothing.

Of course, by sitting on deposits the banks miss out on the opportunity to make a bigger return by lending. However, the limiting factor for lending growth stopped being lending capacity from banks nearly a decade ago, as the charts above reveal. The limiting factor has long been borrowers’ credit worthiness and willingness to take on more debt. That is a function of long term interest rates, inflation, household income, corporate profits, and economic growth. Those are domains over which pro-growth economic policy reform dominate and monetary policy has only weak influence.

Continuing to push ever more QE and Zero Interest Rate Policy in an environment in which there is essentially no supply constraint on bank lending is not just pushing on a rope, it’s a multi-trillion dollar exercise in capital misallocation.

To avoid the mistakes of the past, if the Fed were instead to intrepidly raise the Fed Funds rate as we emerge from this recession, the excess deposits at banks would turn into an expensive liability. They would be incentivized to lend against those liabilities or shed them.

The end results may not lead to more bank lending, but it would force the trillions of dollars deposits and reserves trapped idly in banks out into the economy via some other channel. That would almost certainly be more simulative than letting trillions of dollars sit idly at the banks, as we did for a decade after the Global Financial Crisis.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. Also, please consider sharing this article so that we can grow The Sounding Line!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.