Submitted by Taps Coogan on the 3rd of April 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

It’s hardly news, but the 2009 to 2020 economic cycle, the so-called ‘Everything Bubble,’ is over.

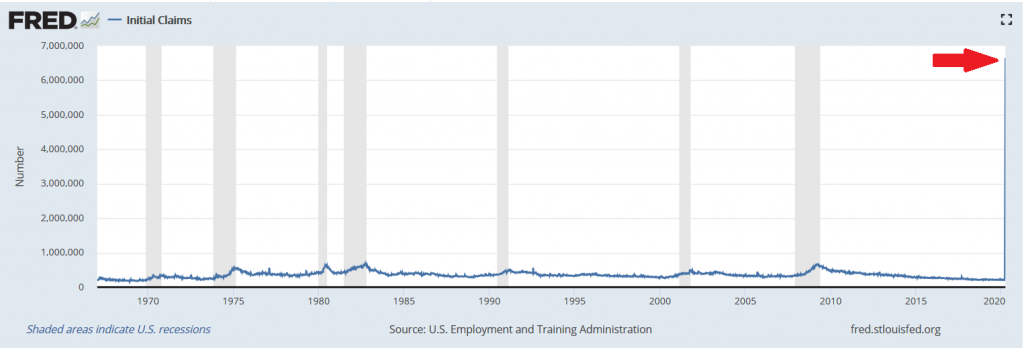

Initial jobless claims have posted their largest surge on record, an increase of nearly 7 million people. The technical definition of a recession, two quarters of negative GDP growth, is now all but guaranteed to be satisfied. Our record long bull market ended unambiguously two weeks ago when the major indices closed down roughly 35% from their prior highs and below the lows from late 2018.

Initial Jobless Claims

Markets and the economy have never endured a shock of this magnitude without it demarcating a major turning point for both. Just as the last ten years of expansion represented a sharp break with prior precedent, so will whatever comes next.

Some of the changes are already clear for those willing to look. The Federal Reserve and the federal government have, for all intents and purposes, launched MMT and ‘helicopter money.’ Despite already running massive deficits, and despite the looming contraction in tax revenues and explosion in unemployment claims, the federal government is spending trillions of dollars on direct cash payments and bailouts, with trillions of dollars of more spending in the pipeline. Meanwhile, the Fed is monetizing the national debt faster than the Treasury can borrow and buying every manner of financial asset. The Fed’s PDCF Special Purpose Vehicle is even taking equities as collateral.

The federal deficit is likely to reach levels only seen briefly during World War II and the national debt-to-GDP is likely to surge to its highest level in American history.

Just as the Fed failed to normalize policy after the Global Financial Crisis, they will fail to normalize policy after this crisis. Even in the optimistic scenario that the market has already made its lows, and that the Coronavirus outbreak peaks in the next few weeks, the economic, fiscal, and monetary landscape has already been radically transformed. It is high time to unlearn the bad habits that the last ten years have engendered upon investors and search for clues as to what the new rules will be.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.