Taps Coogan – July 13th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

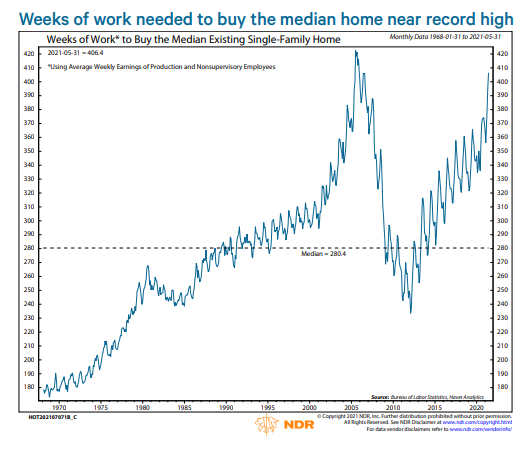

The following chart, via the always interesting Daniel Lacalle, shows the number of weeks of income the average hourly worker would need to save to afford the median home in the US without a mortgage. That number has skyrocketed to nearly 410 weeks (nearly eight years), just shy of the Housing Bubble peak and rising just as fast.

In the aftermath of the last Housing Bubble, there was a brief moment of widespread recognition that a rapid increase in home prices, well in excess of wage growth and enabled by unsustainably low borrowing costs, was a bad thing.

Those days are long past.

The current rapid increase in home prices, yet again well in excess of wages and yet again predicated on low interest rates, is yet again the official policy of the Federal Reserve which is busily buying a whopping $40 billion of mortgage backed securities every month, equating to roughly a quarter of all home sales in the US.

Lending standards are theoretically better this time around, the banking system is theoretically better capitalized, and things like teaser rate mortgages are no longer common. So, theoretically, this bubble shouldn’t create a global financial crisis when it inevitably pops. We’ll see…

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.