Taps Coogan – November 10th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

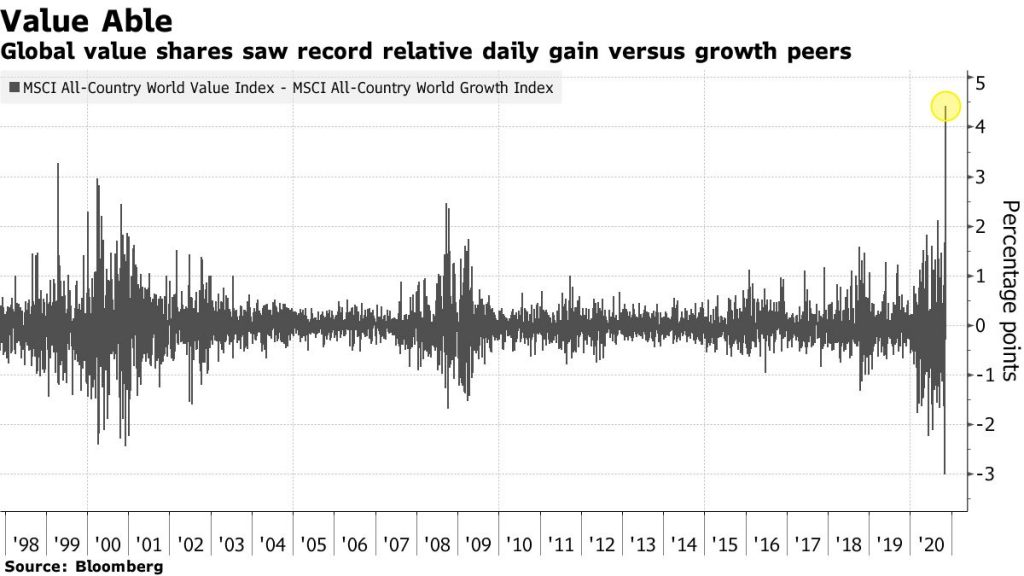

Yesterday witnessed the largest value out-performance relative to growth in the US in at least 22 years. At times yesterday, the Dow Jones was up well over 1,000 points and the NASDAQ was negative, an unprecedented divergence.

Radical changes in relative performance between value and growth have been a pretty good indicator of major market transitions, as the following chart from Bloomberg (via Holger Zschaepitz) details. It looks like we have been in such a transition for at least a year. Yesterday was further evidence of that transition.

To explore what this means, let’s make one distinction. ‘Value’ is simply a euphemism for ‘non-growth.’ After all, the defining quality of ‘value’ companies are their lower valuation multiples, lower multiples that usually result from lacking the premium that the market places on predictable, secular ‘growth.’

In certain ways, the anomalously strong out-performance of tech and ‘story’ stocks over the past decade has been a bearish commentary on the rarity of growth during a historically weak post Financial Crisis landscape dominated by ZIRP and QE fueled winner-takes-all effects, aging demographics, and rising taxes and regulations (until quite recently, i.e. 2018). The premium that the market has placed on secular growth is so high because it has been so rare. Seemingly, the only companies that could generate predictable, secular growth were the ones that were non-correlated to the economy. People used Facebook, Google, Netflix, Amazon, etc… regardless of whether or not the economy was booming or in lockdown.

In many ways, 2020 has been a highly concentrated and exaggerated metaphor for the post-Financial Crisis era: unconstrained QE, ZIRP, political gridlock, economic heartache, massive budget deficits, and a booming stock market riding on a handful of monopolistic tech companies. Was it the last hoorah of a dying era?

The wild swings in the relative performance of ‘growth’ and ‘non-growth’ suggest that the market is re-evaluating the rarity of growth and which companies will enjoy it moving forward. While the winds seem to be pointing to an exaggerated ‘back to the future’ redux of 2010 to 2016 (ZIRP, QE, too much debt, political gridlock, taxes and regulations, low labor participation, etc…), yesterday was a warning that it won’t be that simple.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.