Taps Coogan – March 18th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

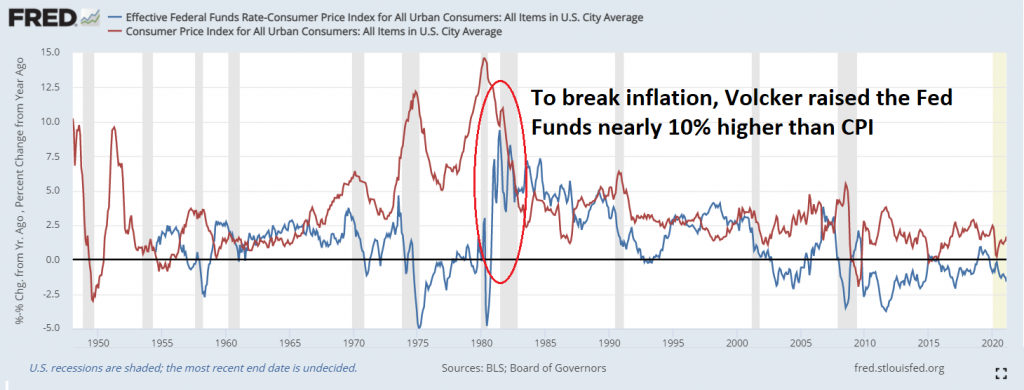

Here is a quick reminder of what it takes to stop a trend of rising inflation.

CPI (in Red) and the Fed Funds Rate Minus CPI (in Blue)

After years of the Fed dragging its feet with a on-and-off again negative real Fed Funds rate as inflation rose from the late 1960s through the 1980s, Fed Chairman Paul Volcker stepped in and did what needed to be done. He raised the Fed Funds rate to a whopping 10% higher than the CPI rate in 1981. Doing so immediately caused a deep recession. It also snapped the runaway inflation of the prior decade.

While that example represents an extreme, the chart above highlights a general rule of thumb. If you want to snap a rise in inflation, you need, at a minimum, to get the Fed Funds rate above the CPI rate.

The Fed often talks about having the tools to fight inflation. Those tools boil down to raising the Fed Funds above the CPI rate. That would work out to about six quarter-point rate hikes at today’s inflation rate and over 12 hikes if CPI got to 3%. Considering that the Fed intends to let inflation get to something like 3% and stay there, whenever they do decide to tighten policy, they are going to be badly behind the curve.

After a decade of dovish monetary policy, people have become conditioned to assume that the Fed will fix the problem of rising inflation with yet more stimulus via Yield Curve Curve or more QE. As we’ve noted repeatedly, there is certainly a need for more QE if the Fed wants to go down that route. Realistically however, those programs will just make the inflation problem worse and the Fed knows that. The Fed may do a relatively minor program like an Operation Twist. In fact, that seems likely. However, in the opinion of yours truly, the Fed’s next major policy change is likely to be an old fashioned rate hike. Presumably, it won’t be this year, but hikes are likely coming sooner than most realize. We doubt the markets would make it four months into 3%+ inflation before they realize how bad of an idea inflation overshoots actually are.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.