Taps Coogan – June 2nd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

The following chart from Statista shows the largest importers of Russian crude oil based on data from 2020.

While China remains the largest buyer of Russian crude, EU countries buy roughly 40% of Russian exports, collectively more than China.

The EU’s recently announced ban on Russian seaborne oil, combined with Germany and Poland’s previously announced decisions to end pipeline imports by the end of the year, should in theory reduce Russian oil exports to the EU by roughly 90%. That means that Russia needs to find new markets for over a third of its total oil exports.

Many people have argued whether or not Russian can turn around and sell that crude to India and China and whether or not the EU can source enough oil from elsewhere. Allowing for some time to adjust, the answer to both questions is ‘yes.’

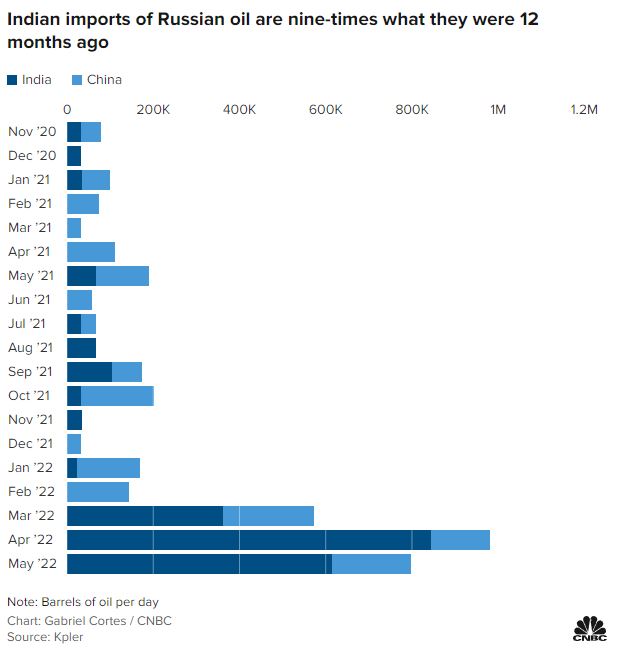

As the following chart highlights, Russia has already radically increased the oil it ships to India, though less so to China.

Russia has already rerouted nearly one million barrels-a-day to India and China, more-or-less fully offsetting the current reduction of exports to Europe.

Russia may ultimately need to find buyers for another 500,000 to one million barrels of oil that was going to the US, Southern Europe, Japan, South Korea, etc…

That next million barrels may be more difficult to reroute as the longer sailing time from Russia to India will eventually require building more ships and port infrastructure in Russia.

Of course, India and other buyers will also only go through the hassle of buying Russian crude if it’s offered at substantial discounts. So yes, Russia will find buyers for nearly all of the crude that Europe is blocking, though it will be at a discount to market prices and require infrastructure investments that will make the remaining transition somewhat bumpy.

On the flip side, the EU will not struggle all that badly to replace Russian crude, at least not at these high prices. The countries that were selling to India now need new buyers and more-or-less every remotely productive oil project is going to make financial sense at $115-a-barrel. Don’t underestimate how much oil can come online after a year or two of $100-a-barrel oil.

All in all, Russia may lose some overall market share and be forced to sell at below benchmark prices, while the EU will have to endure high prices (along with the rest of the world) and perhaps some passing shortages this summer. While a setback of sorts for Russia, this will not end the War in Ukraine.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

What a joke.Nothing that affects the profits of the world top 10 will be allowed to interfere with shareholder returns!!