Taps Coogan – February 28th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

We’ve posted versions of the following chart before, so we’ll keep this short.

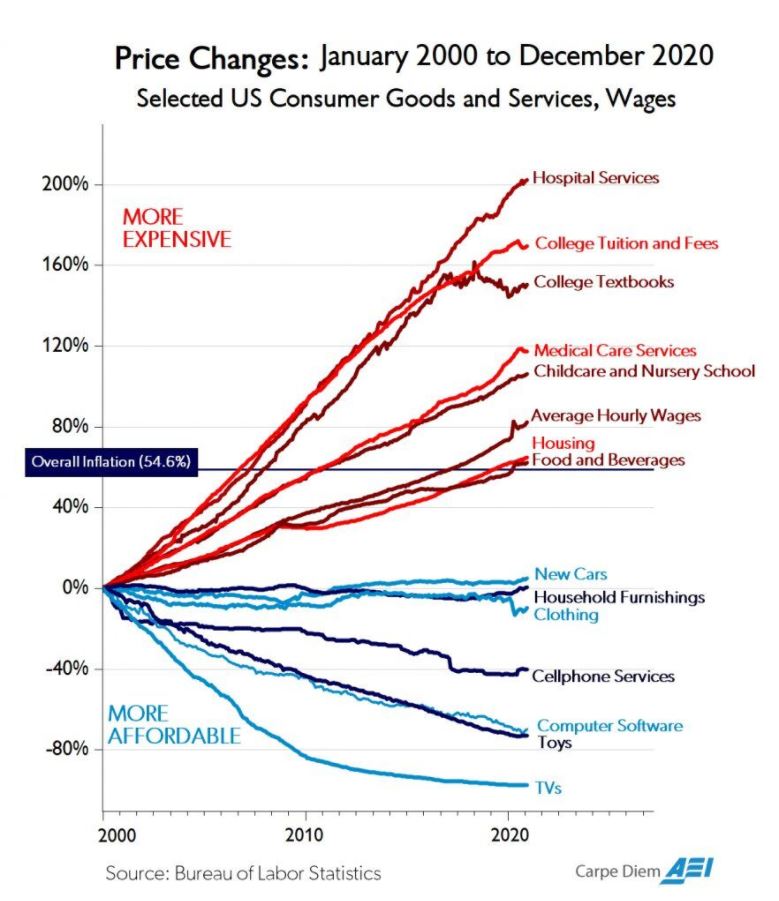

The point is this: CPI understates the pernicious effects of inflation because it effects essential goods and services, like medical care, education, childcare, and food, much more than non-essential and heavily hedonically adjusted items like TVs, toys, phones, and software.

From AEI via Beth Kindig:

Another way to look at this chart is that the only reason headline inflation hasn’t been about twice as high over the last twenty years is thanks to hedonically adjusted goods outsourced to sweatshops in far away lands.

As the Fed droned on for a decade about ‘low inflation’ and monetized trillions of dollars to try and push inflation up, what they were actually doing was pushing up the prices of essential goods and services – and the ladders of upward economic mobility like education – to offset the deflationary effect of farming out America’s industrial heart land to China.

All because of an arbitrary and self imposed 2% inflation target, as though condensing price changes across a complex $23 trillion economy into one number and then claiming that the resulting statistical artifact should always be ‘2’ was a good idea.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Come on. That chart is beyond bunk. Housing inflation is LESS THAN WAGE INFLATION? What planet is that author on? I don’t know a single person who’s wages have tripled since 2000 AND I’m not full of S. I just looked up my old house that I bought in 1991. I was upside down on that house for 9 years. I got my property taxes lowered to it’s “current value” during that time period AND in 2000 I got a letter from the county telling me that my property was now valued at my bought at price. $174,000. AND I… Read more »

That’s the Housing component of CPI which does badly under represent actual housing costs, as I’ve written about a lot. So you are completely right. I should have noted it in the article