Taps Coogan – December 17th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

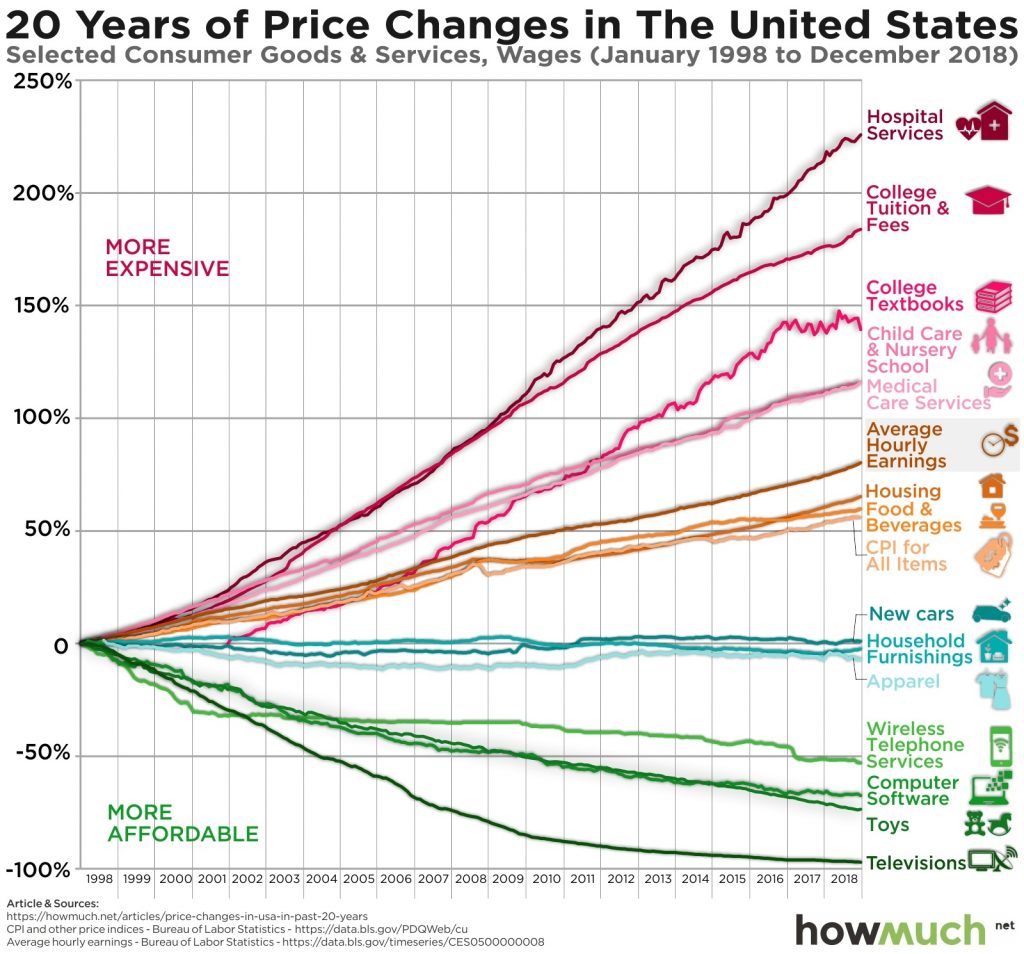

Last year, we wrote the article ‘Why Inflation Is Worse than the Headline Numbers Suggest‘ in which we shared the following chart. It shows the price changes for the goods and services that go into the Fed’s official inflation calculations.

When determining the official CPI and PCE inflation metrics, the Fed weights and averages the categories above.

The result is that ‘deflation’ in phones, computers, toys, and electronics counterbalances high inflation in healthcare, education, child care, housing, etc… and keeps the Fed’s official inflation metrics lower than they otherwise would be. ‘Low inflation‘ is something that the Fed frequently laments as the greatest monetary challenge of our time.

The problem with this premise is that the official metrics are the result of averaging diametrically different categories of goods and services, producing an inflation number which is not symmetrically responsive to monetary policy.

The categories of items with inflation above the official CPI and PCE rates are, for the most part, domestically produced essential services: healthcare, education, housing, and childcare. The categories of items with deflation (after hedonic adjustments) are, for the most part, manufactured goods imported from low wage producers, particularly China.

The Fed does not control labor costs in China and it’s all too easy to forget that the Chinese Yuan is pegged to a narrow range versus the US dollar (a currency basket dominated by the US dollar), negating the currency exchange effects of monetary policy on imports from China. A dozen other countries also formally peg to the dollar and dozens more unofficially maintain pegs, trading bands, and capital controls aimed at managing dollar exchange rates.

The result is that the ‘deflationary’ effect of manufactured imports is unresponsive to the Fed’s monetary stimulus.

Endless monetary stimulus can, however, create housing bubbles, commercial real-estate bubbles, stock bubbles, M&A bubbles, etc… that drive up the costs of services and assets that can’t be outsourced to China.

The economic benefit of getting inflation higher on the back of healthcare, education, and housing while the goods side of the economy remains uncorrelated to monetary policy is dubious at best. One inevitable side-effect is that wage ‘inflation’, which tends to follow CPI, will lag essential service inflation almost by definition.

Axiomatically, the lower your income, the greater the portion of your income that is consumed by essentials: housing, healthcare, etc… It follows that the poorer you are, the more CPI or PCE will understate your experienced inflation or overstate your wage gains. Hence, we have legions of normal, rational people, probably the majority of the country, complaining about the cost of living while the Fed drones on about dis-inflation.

To be fair to the Fed, it is a common misnomer that the Fed even argues that 2% inflation is optimal for the economy. Instead, they argue that having inflation in the ballpark of 2% gives them the space to provide negative real rates without having negative nominal interest rates (and likely wage deflation) during recessions. While that is true by definition, to make achieving 2% inflation the objective of monetary policy because 2% inflation makes monetary policy easier creates a self-referential loop. It leads to targeting nonsensical statistical artifacts with limited real-world relevance. It is to confuse inputs with outputs. It is to co-opt the most important price signals and capital allocation mechanisms in a free market towards these ends.

Nonetheless, that has been the Fed’s official policy for the last 13 years. The results speak for themselves.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. Also, please consider sharing this article so that we can grow The Sounding Line!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Experienced inflation varies hugely by social class (and income level, as explained). Targetting this, and accepting the consequences for the weakest members of society is damaging to the social fabric, not only of the USA, but also of the UK and the EU where similar forces are at work. A far better solution would be to target a nominal wage level, or nominal GDP. To understand why nominal GDP level targetting is such a great idea, just look for something written by David Beckworth of the Mercatus Center. This alternative to inflation targetting is not a panacea, but is much… Read more »

Thanks for the interesting comment.

IMO… Whatever alternative one prefers, we need to let go of the idea that the Fed is a vehicle for perpetual economic stimulus. They can be a lender of last resort during a genuine financial panic. As for how to manage the size of their balance sheet, any target that implies that the balance sheet is an ongoing driver of growth as opposed to a result of growth should be avoided.

The purpose of the consumer price index (CPI) is to reflect just how much inflation is eating into both our incomes and our savings. The aggregate impact of the reporting changes since 1980 has been to reduce the reported level of annual CPI inflation by roughly seven percentage points meaning there is no question as to the understatement of inflation. If the methodological changes did not reduce CPI inflation reporting significantly, the politicians would not have pushed the changes through. The important issue is that without these changes, Social Security checks would be more than double what they are today.… Read more »