Submitted by Taps Coogan on the 22nd of July 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

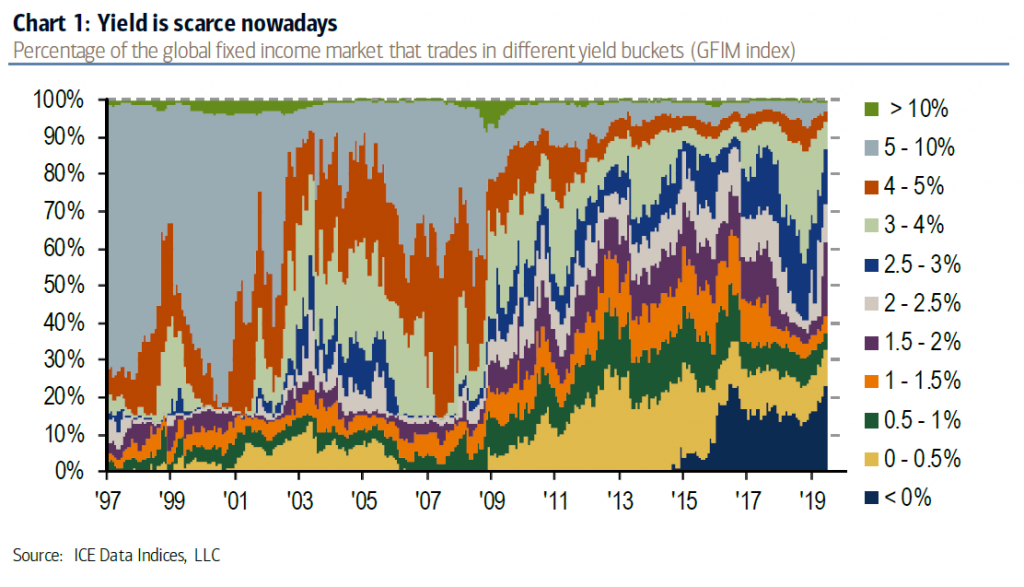

The following chart, from Bank of America, shows the distribution of yield in global fixed income markets since 1997.

In 1997, over 70% of the global fixed income market (bond market) yielded between 5% and 10%. As recently as 2008, over 40% of the global fixed income market yielded over 5%. Today, less than 5% of the global fixed income market yields more than 5% and 70% yields less than 2.5%.

Most public pension funds assume an anticipated return on their invested assets of around 7.5% to calculate their under-funding ratios. Historically, pension funds preferred fixed income investments over equities due to their more predictable returns and reputation for lower risk. However, as the chart above details, reaching a 7.5% return from fixed income today is essentially impossible without investing in the absolute worst quality debt in the entire world. Even then, there probably isn’t enough of it.

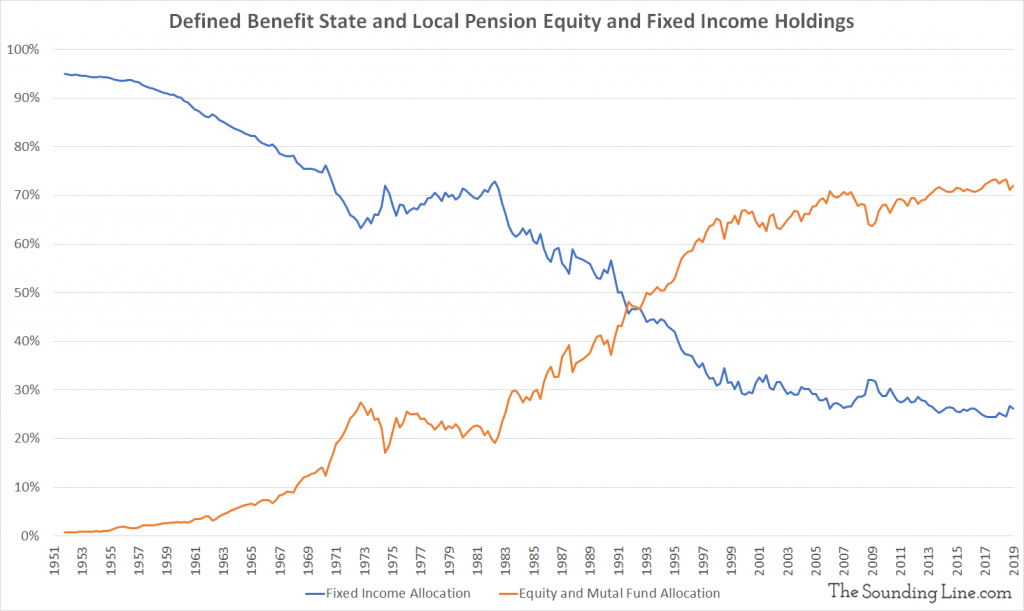

That leaves pension funds with few alternatives other than equities. Not surprisingly, pension funds have gone from nearly 100% invested in fixed income in the 1950s to roughly 70% invested in corporate equities and mutual funds today.

The average annualized return on the S&P 500 over the last 40 years has been roughly 9.4%, when reinvesting dividends. As such, pension funds can feasibly claim that they can meet their 7.5% return assumption by relying heavily on equity returns and re-investing dividends.

However, without reinvesting dividends, the average 40-year annualized return on the S&P 500 drops to just 4.5%, well below the 7.5% needed by pension funds.

Pension funds make distributions every year and, due to their underfunded nature, will soon be paying out more then they receive in. They will not be re-investing all of their dividends. Furthermore, every time equities have a negative year, and pension funds have to dip into their assets to make the year’s payments, they further detach from the 9.4% average annual return on the S&P 500.

The underfunded nature of pension funds mean that they are much more likely to get long-term equity returns closer to the 4.5% annualized rate of the S&P 500 than the 9.4% rate. That will become increasingly the case as the under-funding problem naturally evolves into a solvency problem in the coming decades.

Unless fixed income returns rise several percentage points higher, or state and local taxes are raised dramatically to plug the under-funding problem, fixed benefit public pension funds are destined for insolvency. As a reminder, household claims on pension funds are over $22 trillion, making them the second largest element of household wealth in the US after homes themselves.

Of course, if interest rates were to rise high enough to make the pension model workable again, it would make the other $22 trillion financial disaster-in-waiting in the US explode, the national debt.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Pensions in many ways are the biggest Ponzi Scheme of modern man. Pension payouts are often predicated on the idea the money invested in these funds will yield seven to eight percent a year and in today’s low-interest rate environment, this has forced funds into ever riskier investments. The PBGC America’s pension safety net is already under pressure and failing due to the inability of pension funds to meet their future obligations. The math alone is troubling but when coupled with the overwhelming possibility of a major financial dislocation looming in the future a nightmare scenario for pensions drastically increases.… Read more »

You wrote; “Of course, if interest rates were to rise high enough to make the pension model workable again, it would make the other $22 trillion financial disaster-in-waiting in the US explode, the national debt.”

It would be interesting if someone was able to run the numbers to see what would happen at an 8, 10 or 12% interest rate.