Submitted by Taps Coogan on the 24th of April, 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

On many occasions in the ‘Top News Stories’ column here at The Sounding Line, we have featured articles about the emerging pension fund crises around the world (here).

The populations of developed countries, from Japan to the US, are aging and labor participation is flat or declining. As a result, more people are retiring (and collecting benefits) and fewer people are working (and paying into the system). Today, there are barely two workers per retiree in France, Greece, and Japan, yet it takes something like 10 workers to pay for one pension. As a result, many pension funds lack the money required to meet their obligations by tens or hundreds of thousands of dollars per household. Cities like Los Angeles are already spending 20% of tax revenues bailing out their municipal pension funds and that may quadruple for California alone. The pension fund problem is made much worse by the current era of low interest rates, which have dramatically lowered pension fund investment returns. Investments are a major way pension funds bridge the gap between falling worker contributions and rising payments to retirees.

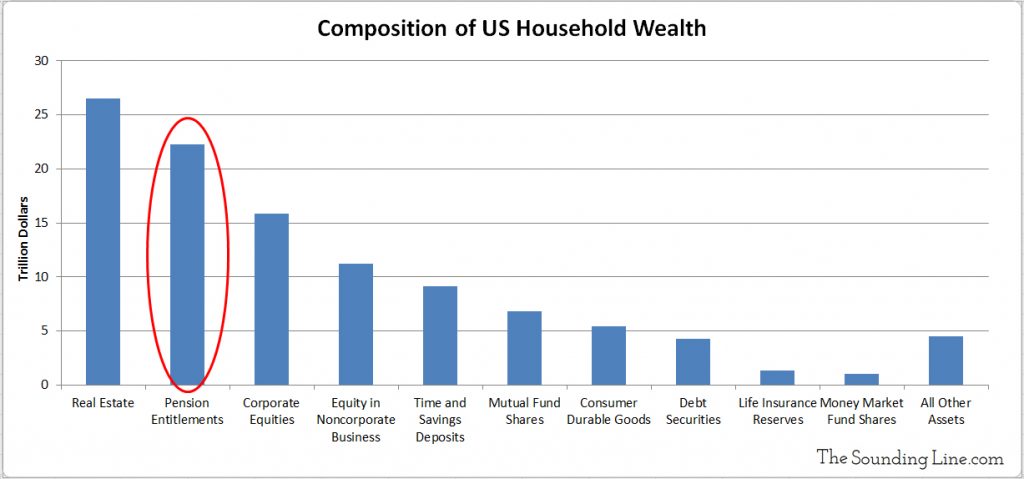

Given the precarious position of pension funds around the world, it is particularly concerning that pension fund entitlements now represent the second largest element of US household wealth after real-estate. As the following chart shows, nationwide, households hold $22 trillion in pension fund entitlements, just slightly less than $26 trillion in real-estate.

There is no easy solution to the demographic challenges facing pension funds. Even if birth rates increased dramatically, it would take 18 years before those new people would enter the workforce and many more before they would achieve the same productivity of retiring workers. In the meantime, the population of retirees will continue to grow and investment returns won’t improve barring a dramatic increase in interest rates. Given that pension funds represent such an important element of household wealth, there is a big risk for many people.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.