Submitted by Taps Coogan on the 30th of October 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

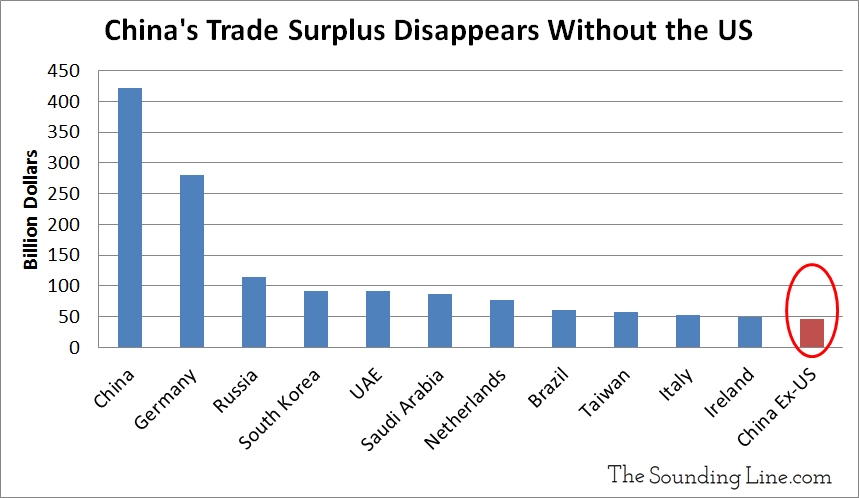

The popular image of China is of a massive export driven economy that runs trade surpluses around the world. In reality, China’s trade surplus is overwhelmingly the result of its trade with the US. In 2017, China’s total trade surplus with the US ($375 billion) accounted for 89% of its overall surplus ($421 billion). This year, it is on pace to account for over 90%. Nearly a quarter of China’s total global exports make their way to the US ($505 billion out of $2.26 trillion). That is not to say that China doesn’t run trade surpluses with countries other than the US. It is to say that, when excluding the anomalously large trade surplus with the US, China’s trading position in not of a massive exporter but of a closely balanced economy. Accordingly, if the US balanced its trade deficit with China, China would go from having the largest overall trade surplus in the world to having a trade surplus smaller than Ireland.

China is the only fast growing large economy in the world that operates with permanent capital controls, a pegged currency, and massive state intervention. Those attributes have stifled growth and scared off investors in every other large economy. China has been able to enjoy the authoritarian utopia of a fast growing closed economy with massive foreign investment in no small part because it accrues several hundred billion US dollars a year in trade with the US. That money enables China to perpetually maintain its currency peg at artificial levels, keep its extremely leveraged economy solvent, and perpetuate the narrative of economic growth that is needed to keep foreign investment flowing in.

As commodity prices rise and global growth slows, China’s current account surplus, which measures the balance of trade as well as financial flows, turned into a deficit earlier this year for the first time in 17 years. Simultaneously, the US has started putting meaningful pressure on China for its high tariffs and unfair trade practices for the first time in decades. China’s knee-jerk opposition to any reform of its trade relationship with the US is because it is China’s main source of US dollars. Without those dollars, it would simply not be possible to reconcile China’s capital controls and currency peg with its rapid economic growth and large foreign investment.

With more financial leverage than the US before the housing crises or the Eurozone before their sovereign debt crisis in 2011, what was once seen as a Chinese economic miracle is increasingly looking like a debt bubble. Decades of US ambivalence towards massive trade deficits with China has fostered within China an almost exclusive dependence on the US for the foreign currency it needs to keep its economic model solvent. While the US is unlikely to balance its trade deficit with China any time soon, its ambivalence is fading and the viability of China’s economic model is coming into doubt.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.